IBM 2003 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2003 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

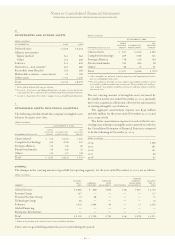

Areconciliation of the company’s continuing operations

effective tax rate to the statutory U.S. federal tax rate is as

follows:

FOR THE YEAR ENDED DECEMBER 31: 2003 2002 2001

Statutory rate 35% 35% 35%

Foreign tax differential (5) (7) (6)

State and local 111

Other (1) —(1)

Effective rate 30% 29% 29%

The effect of tax law changes on deferred tax assets and lia-

bilities did not have a significant effect on the company’s

effective tax rate.

The significant components of activities that gave rise to

deferred tax assets and liabilities that are recorded in the

Consolidated Statement of Financial Position were as follows:

DEFERRED TAX ASSETS

(dollars in millions)

AT D ECEMBER 31: 2003 2002*

Retirement benefits $«««3,566 $«««3,587

Capitalized research and development 1,907 2,251

Alternative minimum tax credits 1,344 1,316

Bad debt, inventory and

warranty reserves 1,092 992

Employee benefits 1,021 1,069

General business credits 884 798

Deferred income 598 733

Infrastructure reduction charges 440 560

Foreign tax loss carryforwards 311 304

State and local tax loss carryforwards 205 239

Capital loss carryforwards 195 —

Other 2,253 2,474

Gross deferred tax assets 13,816 14,323

Less: Valuation allowance 722 628

Net deferred tax assets $«13,094 $«13,695

*Reclassified to conform with 2003 presentation.

DEFERRED TAX LIABILITIES

(dollars in millions)

AT D ECEMBER 31: 2003 2002*

Retirement benefits $«6,644 $«5,904

Leases 693 1,088

Software development costs 285 219

Other 1,188 1,308

Gross deferred tax liabilities $«8,810 $«8,519

*Reclassified to conform with 2003 presentation.

The valuation allowance at December 31, 2003, principally

applies to certain foreign, state and local, and capital loss

carryforwards that, in the opinion of management, are more

likely than not to expire before the company can use them.

For tax return purposes, the company has available tax

credit carryforwards of approximately $2,228 million, of which

$1,344 million have an indefinite carryforward period and

the remainder begin to expire in 2005. The company also has

foreign, state and local, and capital loss carryforwards, the

tax effect of which is $711 million. Most of these carry-

forwards are available for five years or have an indefinite

carryforward period.

During 2003, the Internal Revenue Service (IRS) com-

menced an examination of the years 1998 through 2000.

Although the outcome of tax audits is always uncertain, the

company believes that adequate amounts of tax have been

provided for any adjustments that are expected to result for

these years. The resolution of this audit will likely result in

the reduction of existing tax credit carryforwards rather

than a significant cash payment.

Undistributed earnings of non-U. S. subsidiaries included in

consolidated retained earnings were $18,120 million at

December 31, 2003, and $16,631 million at December 31, 2002.

These earnings, which reflect full provision for non-U.S.

income taxes, are indefinitely reinvested in non-U.S. opera-

tions or will be remitted substantially free of additional tax.

Q

advertising and promotional expense

Advertising and promotional expense, which includes

media, agency and promotional expense, was $1,406 million,

$1,427 million and $1,615 million in 2003, 2002 and 2001,

respectively, and is recorded in SG&A expense.

R

research, development and engineering

RD&E expense was $5,077 million in 2003, $4,750 million in

2002 and $4,986 million in 2001.

The company incurred expense of $4,609 million in 2003,

$4,247 million in 2002 and $4,321 million in 2001 for

scientific research and the application of scientific advances

to the development of new and improved products and their

uses as well as services and their application. Of these

amounts, software-related expense was $2,300 million, $1,974

million and $1,926 million in 2003, 2002 and 2001, respec-

tively. Included in the expense was a charge of $9 million and

$4 million in 2003 and 2002, respectively, for acquired in-

process R&D. There was no in-process R&D expense

recorded in 2001.

Expense for product-related engineering was $468 mil-

lion, $503 million and $665 million in 2003, 2002 and 2001,

respectively.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

104