IBM 2003 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2003 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

106

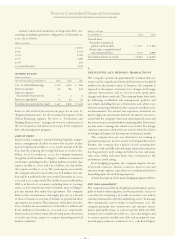

(a) This amount was recorded in SG&A expense in 2002 and

primarily represents the abandonment and loss on sale of

certain capital assets during the second quarter of 2002.

(b) This amount comprises costs incurred to remove abandoned

capital assets and the remaining lease payments for leased

equipment that was abandoned in the second quarter of

2002. The liability at December 31, 2003 relates to the

remaining lease payments, which will continue through

2005. These amounts were recorded in SG&A expense

in 2002.

(c) The company is subject to certain noncancelable purchase

commitments. As a result of the decision to significantly

reduce aluminum capacity, the company no longer has a

need for certain materials subject to these agreements.

The required future payments for materials no longer

needed under these contracts are expected to be paid

through June 30, 2004. This amount was recorded in

SG&A expense in 2002.

(d) The workforce reductions represent 1,400 people, all of

whom left the company as of June 30, 2003. This amount

was recorded in SG&A expense in 2002. The remaining

liability relates to terminated employees who were granted

annual payments to supplement their income in certain

countries. Depending on individual country legal require-

ments, these required payments will continue until the

former employee begins receiving pension benefits or dies.

(e) The space accruals are for ongoing obligations to pay rent

for vacant space that could not be sublet or space that was

sublet at rates lower than the committed lease arrange-

ments. The length of these obligations varies by lease with

the longest extending through 2006. These amounts were

recorded in Other (income) and expense in 2002.

(f ) As part of the company’s strategic realignment of its

Microelectronics business to exit the manufacture and

sale of certain products and component technologies, the

company signed an agreement in the second quarter of

2002 to sell its interconnect products operations in

Endicott to Endicott Interconnect Technologies, Inc.

(EIT). As a result of this transaction, the company

incurred a $223 million loss on sale, primarily relating to

land, buildings, machinery and equipment. This loss was

recorded in Other (income) and expense in 2002. This

transaction closed in the fourth quarter of 2002. The

company entered into a limited supply agreement with

EIT for future products, and it will also lease back, at fair

market value rental rates, approximately one-third of the

Endicott campus’ square footage for operations outside

the interconnect OEM business.

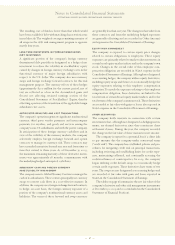

(g) As part of the strategic realignment of the company’s

Microelectronics business, the company agreed to sell

certain assets and liabilities comprising its Mylex business

to LSI Logic Corporation and the company sold part of its

wireless phone chipset operations to TriQuint Semi-

conductor, Inc. in June 2002. The Mylex transaction was

completed in August 2002. The loss of $74 million for the

Mylex transaction and the realized gain of $11 million for

the chipset sale were recorded in Other (income) and

expense in 2002.

(h) The majority of the workforce reductions relate to the

company’s Global Services business. The workforce

reductions represent 14,213 people, all of whom left the

company as of June 30, 2003. See (c) above for information

on the remaining liability. These charges were recorded in

SG&A expense in 2002.

(i) The space accruals are for ongoing obligations to pay rent

for vacant space that could not be sublet or space that was

sublet at rates lower than the committed lease arrange-

ments. This space relates primarily to workforce dynamics

in the Global Services business and the downturn in

corporate technology spending on services. The length of

these obligations varies by lease with the longest extending

through 2016. These amounts were recorded in Other

(income) and expense in 2002.