IBM 2003 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2003 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

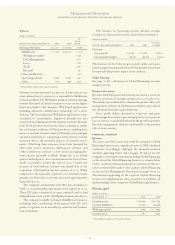

(dollars in millions)

AT DECEMBER 31: 2003 2002

Total company debt $«23,632 $«26,017

Non-Global Financing debt*««««««368 «««2,189

Non-Global Financing debt/

capitalization 1.5% 10.2%

*Non-Global Financing debt is the company’s total external debt less the Global Financing

debt described in the Global Financing balance sheet on pages 70, 72 and 73.

During the fourth quarter of 2002, the company increased

its non-Global Financing debt to position itself for potential

year-end pension funding levels and the possible acquisition

of Rational, especially given the cash paid for PwCC during

the 2002 fourth quarter. Based upon the strong cash flows

from operations in 2003, the company reduced non-Global

Financing debt.

Equity

(dollars in millions)

YR. TO YR.

AT DECEMBER 31: 2003 2002 CHANGE

Stockholders’ equity:

Total $«27,864 $«22,782 22.3%

The company’s total consolidated Stockholders’ equity

increased $5,082 million during 2003 primarily due to an

increase in the company’s retained earnings partially offset

by the company’s ongoing stock repurchase program and

higher dividend payments.

Off-Balance Sheet Arrangements

The company, in the ordinary course of business, entered

into off-balance sheet arrangements as defined by the SEC

Final Rule 67 (FR-67), “Disclosure in Management’s

Discussion and Analysis about Off-Balance Sheet

Arrangements and Aggregate Contractual Obligations,”

including: certain guarantees, indemnifications and retained

interests in assets transferred to an unconsolidated entity for

securitization purposes.

None of these off-balance sheet arrangements either has,

or is reasonably likely to have, a material current or future

effect on financial condition, changes in financial condition,

revenues or expenses, results of operations, liquidity, capital

expenditures or capital resources. See pages 65 and 66 for the

company’s contractual obligations.

See note O, “Contingencies and Commitments,” on pages

102 and 103, for detailed information about the company’s

guarantees on certain loans and financial commitments,

indemnification arrangements and loans receivable securiti-

zation program.

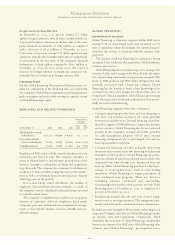

CONSOLIDATED FOURTH QUARTER RESULTS

(dollars and shares in millions except per share amounts)

YR. TO YR.

FOR FOURTH QUARTER: 2003 2002 CHANGE

Revenue $«25,913 $«23,684 9.4% *

Gross profit margin 38.4% 38.8% (0.4) pts.

Total expense and

other income $«««6,097 $«««6,479 (5.9) %

Total expense and other

income-to-revenue ratio 23.5% 27.4% (3.9) pts.

Provision for

income taxes $«««1,162 $««««««801 45.0%

Income from continuing

operations $«««2,716 $«««1,911 42.2%

Earnings per share from

continuing operations:

Assuming dilution $«««««1.56 $«««««1.11 40.5%

Basic $«««««1.59 $«««««1.12 42.0%

Weighted-average shares

outstanding:

Assuming dilution 1,745.7 1,728.7 1.0%

Basic 1,708.5 1,699.1 0.6%

*0.8 percent increase at constant currency

Continuing Operations

The increase in IBM’s fourth quarter 2003 Income from

continuing operations and diluted earnings per share from

continuing operations as compared to the fourth quarter of

2002 was due to:

•The increased demand for the company’s offerings as a

result of the reviving economy as well as the company’s

market share gains

•The charges recorded in the fourth quarter of 2002 asso-

ciated with the acquisition of PwCC (approximately half

of the increase)

•Favorable impact of currency translation partly offset by

related hedging activity

The following is an analysis of external segment results.

The company achieved Global Services signings of over $17

billion, including three over $1 billion, and additionally, 18

over $100 million. Included were several key signings for the

company’s relatively new BTO business, which totaled nearly

$3 billion in signings. Global Services revenue increased 8.3

percent (1 percent decrease at constant currency). The

decline at constant currency was mainly due to lower BCS

revenue as the positive impact of the economy had not yet

driven increased corporate spending in this area by year-end.

Although 2003 fourth quarter BCS revenue declined year-to-

year, its BTO signings are a positive sign for the unit’s future

prospects as well as the fact that revenue for the unit

increased sequentially from third quarter to fourth quarter.

Management Discussion

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

59