IBM 2003 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2003 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The primary items that generated goodwill are the value

of the acquired assembled workforce and the synergies

between Informix and the company created by the combina-

tion. Goodwill of $591 million has been assigned to the

Software segment. Almost all of the goodwill is deductible

for tax purposes. This transaction occurred after June 30,

2001, and therefore, the acquired goodwill is not subject to

amortization. The overall weighted-average life of intangible

assets purchased from Informix is 4.2 years. The results of

operations of Informix were included in the company’s

Consolidated Financial Statements as of July 2, 2001.

Other Acquisition – The primary items that generated good-

will are the synergies between the acquired business and the

company and the premium paid by the company for the

right to control the business acquired. Goodwill of $25 mil-

lion has been assigned to the Global Services segment. The

goodwill is not deductible for tax purposes. The results of

operations of the acquired business were included in the

company’s Consolidated Financial Statements from the

date of acquisition.

Overall

The company’s acquisitions were accounted for as purchase

transactions, and accordingly, the assets and liabilities of the

acquired entities were recorded at their estimated fair values

at the date of acquisition.

The acquired tangible net assets comprise primarily cash,

accounts receivable, land, buildings and leasehold improve-

ments. The acquired identifiable intangible assets comprise

primarily completed technology, trademarks, client lists,

employee agreements and leasehold interests. The identifiable

intangible assets are amortized on a straight-line basis,

generally not to exceed seven years. Goodwill from acqui-

sitions that were consummated prior to July 1, 2001, was

amortized over five years. The company adopted SFAS No. 142

on January 1, 2002, and ceased amortizing goodwill as of that

date. The results of operations of all acquired businesses

were included in the company’s Consolidated Financial

Statements from the respective dates of acquisition.

DIVESTITURES

2002

On December 31, 2002, the company sold its HDD business

to Hitachi. The total gross proceeds of the sale were $2 billion

(excluding purchase price adjustments), of which $1,414 mil-

lion was received by IBM at closing. According to the terms

of the agreement, the remaining proceeds will be received

one and three years after closing. The remaining proceeds

are fixed and are not dependent or variable based upon the

sold business’ earnings or performance. The company trans-

ferred approximately $244 million of cash as part of the

HDD business, resulting in a net cash inflow in 2002 related

to the HDD transaction of $1,170 million. The company

received approximately $156 million from Hitachi on

December 31, 2003 for the payment due one year after closing

and paid approximately $59 million to Hitachi for certain

contractual items resulting in a net cash inflow in 2003 of

$97 million.

IBM has entered into an arms-length five-year supply

agreement with Hitachi, effective January 1, 2003, designed to

provide the company with a majority of its ongoing internal

disk drive requirements for the company’s Server, Storage

and Personal Systems products.

The loss on disposal recorded in 2002 was approximately

$382 million, net of tax, and was recorded in Loss from discon-

tinued operations in the Consolidated Statement of Earnings.

See note A, “Significant Accounting Policies,” on page 80

for the “Basis of Presentation” for the discontinued operations.

In the second and fourth quarters of 2002, the company

announced certain asset and workforce reduction actions,

and excess leased space charges related to its discontinued

HDD business. The company recorded a charge of approxi-

mately $508 million, net of tax, in discontinued operations

associated with these announced actions.

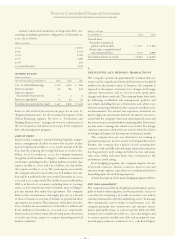

Summarized selected financial information for the dis-

continued operations is as follows:

(dollars in millions)

FOR THE YEAR ENDED DECEMBER 31: 2003 2002*2001

Revenue $«— $«1,946 $«2,799

Loss before

income taxes $«29 $«2,037 $««««497

Income tax expense/(benefit) 1(282) (74))

Loss from

discontinued operations $«30 $«1,755 $««««423

*At closing, the company incurred a significant U.S. tax charge of approximately

$248 million related to the repatriation of divestiture proceeds from certain countries

with low tax rates. This amount was included in the Income tax expense/(benefit) line

item of discontinued operations.

D

financial instruments

(excluding derivatives)

FAIR VALUE OF FINANCIAL INSTRUMENTS

Cash and cash equivalents, marketable securities, notes and

other accounts receivable and other investments are financial

assets with carrying values that approximate fair value.

Accounts payable, other accrued expenses and liabilities,

and short-term and long-term debt are financial liabilities

with carrying values that approximate fair value.

MARKETABLE SECURITIES*

The following table summarizes the company’s marketable

securities, all of which are considered available for sale, and

alliance investments.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

92