IBM 2003 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2003 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

arrangement, the product has been shipped or the services

have been provided to the client, the sales price is fixed or

determinable, and collectibility is reasonably assured. The

company reduces revenue for estimated client returns and

other allowances. In addition to the aforementioned general

policy, the following are the specific revenue recognition poli-

cies for multiple-element arrangements and for each major

category of revenue.

Multiple-Element Arrangements

The company enters into transactions that represent multiple-

element arrangements, which may include any combination

of services, software, hardware and financing. Multiple-

element arrangements are assessed to determine whether

they can be separated into more than one unit of accounting.

Amultiple-element arrangement is separated into more than

one unit of accounting if all of the following criteria are met.

•The delivered item(s) has value to the client on a stand-

alone basis.

•There is objective and reliable evidence of the fair value of

the undelivered item(s).

•If the arrangement includes a general right of return relative

to the delivered item(s), delivery or performance of the

undelivered item(s) is considered probable and substan-

tially in the control of the company.

If these criteria are not met, then revenue is deferred until

such criteria are met or until the period(s) over which the

last undelivered element is delivered. If there is objective

and reliable evidence of fair value for all units of accounting

in an arrangement, the arrangement consideration is allo-

cated to the separate units of accounting based on each unit’s

relative fair value. There may be cases, however, in which

there is objective and reliable evidence of fair value of the

undelivered item(s) but no such evidence for the delivered

item(s). In those cases, the residual method is used to allocate

the arrangement consideration. Under the residual method,

the amount of consideration allocated to the delivered item(s)

equals the total arrangement consideration less the aggregate

fair value of the undelivered item(s). The revenue policies

described below are then applied to each unit of accounting.

For any non-software products that are in a multiple-

element arrangement whereby the software products in the

arrangement are not essential to the functionality of the

non-software items, the guidance for multiple-element

arrangements described above apply to the non-software

items. If, however, the software products are essential to the

functionality of the non-software items, then the guidance

described in Software on page 81 should be applied for

purposes of separating and allocating consideration to the

software and non-software items.

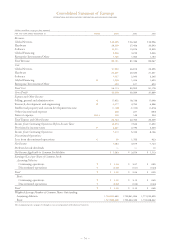

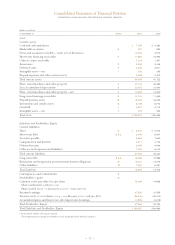

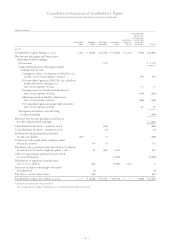

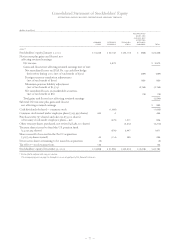

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

80

A

significant accounting policies

BASIS OF PRESENTATION

On December 31, 2002, the company sold its hard disk drive

(HDD) business to Hitachi, Ltd. (Hitachi). See note C,

“A cquisitions/Divestitures,” on pages 89 to 92. The HDD

business was part of the company’s Technology Group

reporting segment. The HDD business was accounted for as

a discontinued operation under generally accepted account-

ing principles (GAAP) and therefore, the HDD results of

operations and cash flows have been removed from the

company’s results of continuing operations and cash flows

for all periods presented in this document. The financial

results reported as discontinued operations include the

external original equipment manufacturer (OEM) HDD

business and charges related to HDDs used in the company’s

eServer and Storage products that were reported in the

Technology Group segment. The discontinued operations

results do not reflect HDD shipments to the company’s

internal customers.

PRINCIPLES OF CONSOLIDATION

The Consolidated Financial Statements include the accounts

of International Business Machines Corporation (IBM) and

its controlled subsidiary companies, which in general are

majority owned. The accounts of variable interest entities

(VIEs) as defined by the Financial Accounting Standards

Board’s (FASB) Interpretation No. 46 (FIN 46) and related

interpretations (see note B, “Accounting Changes,” on page

86), created after January 31, 2003, are included in the

Consolidated Financial Statements. Investments in business

entities in which the company does not have control, but has

the ability to exercise significant influence over operating

and financial policies (generally 20-50 percent ownership),

are accounted for by the equity method. Other investments

are accounted for by the cost method. The accounting policy

for other investments in securities is described on page 85

within “Marketable Securities.”

USE OF ESTIMATES

The preparation of Consolidated Financial Statements in

conformity with GAAP requires management to make

estimates and assumptions that affect the amounts that are

reported in the Consolidated Financial Statements and

accompanying disclosures. Although these estimates are

based on management’s best knowledge of current events

and actions that the company may undertake in the future,

actual results may be different from the estimates.

REVENUE

The company recognizes revenue when it is realized or realiz-

able and earned. The company considers revenue realized or

realizable and earned when it has persuasive evidence of an