IBM 2003 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2003 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ment, software and services to meet IBM clients’ total solu-

tions requirements. Customer financing assets are primarily

sales-type, direct financing and operating leases for equip-

ment as well as loans for software and services with terms

generally for two to five years. Customer financing also

includes internal activity as described on page 69.

Commercial financing originations arise primarily from

inventory and accounts receivable financing for dealers and

remarketers of IBM and non-IBM products. Payment terms

for inventory financing generally range from 30 to 75 days.

Payment terms for accounts receivable financing generally

range from 30 to 90 days. Syndicated loans are also included

in commercial financing assets. See page 69 for discussion on

syndicated loans.

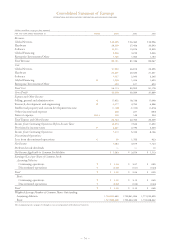

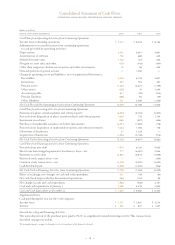

Originations

The following are total external and internal financing

originations.

(dollars in millions)

FOR THE YEAR ENDED DECEMBER 31: 2003 2002 2001

Customer finance:

External $«13,279 $«12,845 $«15,620

Internal 1,150 1,061 931

Commercial finance 24,291 22,546 25,071

Total $«38,720 $«36,452 $«41,622

New financing originations of customer and commercial

financing assets exceeded cash collections in 2003, which

resulted in a net increase in financing assets at December 31,

2003, as compared to December 31, 2002. The increase in

originations was due to favorable currency movements offset

by a decline in participation rates. The decline in participa-

tion rates is in line with industry trends. Originations

decreased in 2002 from 2001 due to lower demand for the

company’s IT equipment. Cash collections in 2003, 2002 and

2001 included $105 million, $218 million and zero, respec-

tively, generated through sales of portions of Global

Financing’s syndicated loan portfolio. These sales transac-

tions did not have a material impact on the company’s

Consolidated Statement of Earnings. Additionally, funds

were generated through the sale and lease of used equipment

sourced primarily from prior years’ lease originations.

Cash generated by Global Financing was deployed to pay

dividends to IBM and to reduce debt.

Financing Assets by Sector

The following are the percentage of external financing assets

by industry sector.

AT DECEMBER 31: 2003 2002

Financial Services 28% 31%

Business Partners*18 14

Industrial 17 18

Communications 11 12

Distribution 10 11

Public 10 10

Other 64

Total 100% 100%

*Business Partners financing assets represent a portion of commercial financing inventory

and accounts receivable financing for terms generally less than 90 days.

Financing Receivables and Allowances

The following table presents external financing receivables,

excluding residual values, and the allowance for doubtful

accounts.

(dollars in millions)

AT DECEMBER 31: 2003 2002

Financing receivables $«28,451 $«28,007

Specific allowance for

doubtful accounts 666 787

Unallocated allowance for

doubtful accounts 199 184

Total allowance for

doubtful accounts 865 971

Net financing receivables $«27,586 $«27,036

Allowance for doubtful

accounts coverage 3.0% 3.5%

Roll-Forward of Financing Receivables Allowance

for Doubtful Accounts

(dollars in millions)

ADDITIONS:

JAN. 1, RESERVE BAD DEBT DEC. 31,

2003 USED*EXPENSE OTHER** 2003

$«971 $«(417) $«206 $«105 $«865

*Represents reserved receivables, net of recoveries, that were disposed of during the period.

** Primarily represents translation adjustments.

The percentage of financing receivables reserved decreased

from 3.5 percent at December 31, 2002, to 3.0 percent at

December 31, 2003, primarily due to the write-off of receiv-

ables covered by specific reserves. Unallocated reserves

increased 8.2 percent from $184 million at December 31,

2002 to $199 million at December 31, 2003, and the receiv-

ables balance increased 1.6 percent over the same period.

The unallocated reserve coverage increased slightly during

the same period. While the overall credit quality of the portfo-

lio remains stable, the increased unallocated reserve primarily

reflects loss history. Specific reserves decreased 15.4 percent

from $787 million at December 31, 2002 to $666 million at

Management Discussion

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

71