IBM 2003 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2003 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

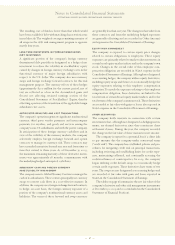

breach of contract with regard to the company’s contribution

of unspecified code to Linux. The company has asserted

counterclaims, including breach of contract, violation of the

Lanham Act, unfair competition, intentional torts, unfair

and deceptive trade practices, breach of the General Public

License that governs open source distributions, patent

infringement, promissory estoppel and copyright infringe-

ment. Trial is scheduled for April 2005.

On June 2, 2003 the company announced that it received

notice of a formal, nonpublic investigation by the Securities

and Exchange Commission (SEC). The SEC is seeking infor-

mation relating to revenue recognition in 2000 and 2001

primarily concerning certain types of client transactions.

IBM believes that the investigation arises from a separate

investigation by the SEC of Dollar General Corporation, a

client of IBM’s Retail Stores Solutions unit, which markets

and sells point of sale products.

On January 8, 2004, IBM announced that it received a

“Wells Notice” from the staff of the SEC in connection with

the staff’s investigation of Dollar General Corporation, which

as noted above, is a client of IBM’s Retail Stores Solutions unit.

It is IBM’s understanding that an employee in IBM’s Sales &

Distribution unit also received a Wells Notice from the SEC in

connection with this matter. The Wells Notice notifies IBM

that the SEC staff is considering recommending that the SEC

bring a civil action against IBM for possible violations of the

U.S. securities laws relating to Dollar General’s accounting

for a specific transaction, by participating in and aiding and

abetting Dollar General’s misstatement of its 2000 results.

In that transaction, IBM paid Dollar General $11 million for

certain used equipment as part of a sale of IBM replacement

equipment in Dollar General’s 2000 fourth fiscal quarter.

Under the SEC’s procedures, IBM responded to the SEC

staff regarding whether any action should be brought against

IBM by the SEC. The separate SEC investigation noted

above, relating to the recognition of revenue by IBM in 2000

and 2001 primarily concerning certain types of client trans-

actions, is not the subject of this Wells Notice.

In January 2004, the Seoul District Prosecutors Office in

South Korea announced it had brought criminal bid rigging

charges against several companies, including IBM Korea and

LG IBM (a joint venture between IBM Korea and LG Elec-

tronics) and had also charged employees of some of those

entities with, among other things, bribery of certain officials

of government-controlled entities in Korea, and bid rigging.

In addition, the U. S. Department of Justice and the SEC have

both contacted the company in connection with this matter.

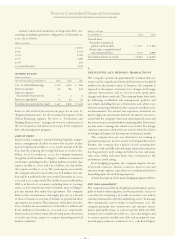

In accordance with SFAS No.5, the company records a

provision with respect to a claim, suit, investigation or pro-

ceeding when it is probable that a liability has been incurred

and the amount of the loss can reasonably be estimated. Any

provisions are reviewed at least quarterly and are adjusted to

reflect the impact and status of settlements, rulings, advice

of counsel and other information pertinent to a particular

matter. Any recorded liabilities for the above items, including

any changes to such liabilities during each of the three years

in the period ended December 31, 2003, were not material to

the Consolidated Financial Statements. Based on its experi-

ence, the company believes that the damage amounts

claimed in the matters referred to above are not a meaningful

indicator of the company’s potential liability.

Litigation is inherently uncertain and it is not possible to

predict the ultimate outcome of the matters discussed

above. While the company will continue to defend itself

vigorously in all such matters, it is possible that the company’s

business, financial condition, results of operations or cash

flows, could be affected in any particular period by the resolu-

tion of one or more of these matters. Whether any losses,

damages or remedies finally determined in any such claim,

suit, investigation or proceeding could reasonably have a

material effect on the company’s business, financial condition,

results of operations or cash flows will depend on a number

of variables, including the timing and amount of such losses

or damages, the structure and type of any such remedies, the

significance of the impact any such losses, damages or remedies

may have on IBM’s Consolidated Financial Statements, and

the unique facts and circumstances of the particular matter

which may give rise to additional factors, such as, among

other things, in the Cooper case referred to on page 101, the

amount of any additional obligations that may be imposed

on the pension plan by the remedies finally determined,

whether such additional obligations would require addi-

tional contributions by the company and the size of any such

additional contributions.

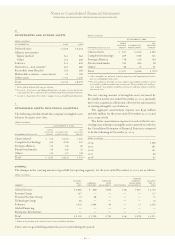

COMMITMENTS

The company’s extended lines of credit include unused

amounts of $2,208 million and $3,482 million at December 31,

2003 and 2002, respectively. A portion of these amounts was

available to the company’s business partners to support their

working capital needs. In addition, the company committed

to provide future financing to its clients in connection with

client purchase agreements for approximately $263 million

and $288 million at December 31, 2003 and 2002, respectively.

The company has applied the disclosure provisions of

FIN 45, “Guarantor’s Accounting and Disclosure Require-

ments for Guarantees, Including Indirect Guarantees of

Indebtedness of Others,” to its agreements that contain guar-

antee or indemnification clauses. These disclosure provisions

expand those required by SFAS No. 5, by requiring a guarantor

to disclose certain types of guarantees, even if the likelihood of

requiring the guarantor’s performance is remote. The follow-

ing is a description of arrangements in which the company

is the guarantor.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

102