IBM 2003 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2003 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

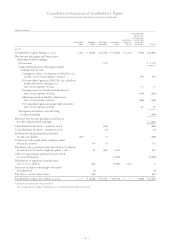

Accumulated gains and (losses) not affecting retained earnings

within Stockholders’ equity.

Inventories, Plant, rental machines and other property-

net, and other non-monetary assets and liabilities of non-U. S.

subsidiaries and branches that operate in U.S. dollars, or

whose economic environment is highly inflationary, are

translated at approximate exchange rates prevailing when

the company acquired the assets or liabilities. All other assets

and liabilities are translated at year-end exchange rates. Cost

of sales and depreciation are translated at historical

exchange rates. All other income and expense items are

translated at the weighted-average rates of exchange pre-

vailing during the year. Gains and losses that result from

translation are included in net income.

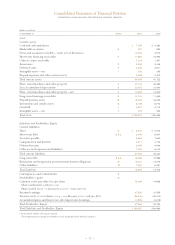

DERIVATIVES

All derivatives are recognized in the Consolidated Statement

of Financial Position at fair value and are reported in Prepaid

expenses and other current assets, Investments and sundry

assets, Other accrued expenses and liabilities or Other lia-

bilities in the Consolidated Statement of Financial Position.

Classification of each derivative as current or non-current is

based upon whether the maturity of each instrument is less

than or greater than 12 months. To qualify for hedge account-

ing in accordance with SFAS No. 133, “Accounting for

Derivative Instruments and Hedging Activities,” as amended

by SFAS No. 138, “Accounting for Certain Derivative Instru-

ments and Certain Hedging Activities,” and SFAS No. 149,

“Amendment of Statement 133 on Derivative Instruments

and Hedging Activities,” (SFAS No. 133), the company requires

that the instruments are effective in reducing the risk

exposure that they are designated to hedge. For instruments

that are associated with the hedge of cash flows, hedge effec-

tiveness criteria also require that it be probable that the

underlying transaction will occur. Instruments that meet

established accounting criteria are formally designated as

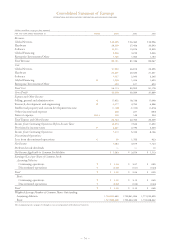

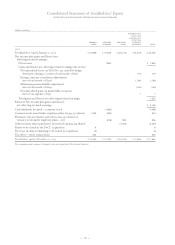

(dollars in millions except per share amounts)

FOR THE YEAR ENDED DECEMBER 31: 2003 2002 2001

Net income applicable to common stockholders, as reported $«7,583 $«3,579 $«7,713

Add: Stock-based employee compensation expense included in

reported net income, net of related tax effects 76 112 104

Deduct: Total stock-based employee compensation expense determined

under fair value method for all awards, net of related tax effects 1,101 1,315 1,343

Pro forma net income applicable to common stockholders $«6,558 $«2,376 $«6,474

Earnings per share of common stock:

Basic—as reported $«««4.40 $«««2.10 $«««4.45

Basic—pro forma $«««3.81 $«««1.40 $«««3.74

Assuming dilution—as reported $«««4.32 $«««2.06 $«««4.35

Assuming dilution—pro forma $«««3.74 $«««1.39 $«««3.69

The pro forma amounts that are disclosed in accordance with SFAS No. 123 reflect the portion of the estimated fair value of

awards that was earned for the years ended December 31, 2003, 2002 and 2001.

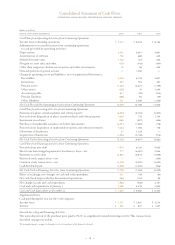

The fair value of stock option grants is estimated using

the Black-Scholes option-pricing model with the following

assumptions:

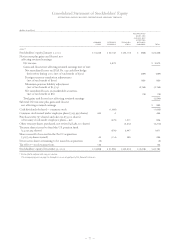

FOR THE YEAR ENDED DECEMBER 31: 2003 2002 2001

Option term (years)*554/5

Volatility** 39.9% 40.4% 37.7%

Risk-free interest rate

(zero coupon

U.S. treasury note) 2.9% 2.8% 4.4%

Dividend yield 0.7% 0.7% 0.5%

Weighted-average fair value

per option $«««30 $«««28 $«««42

*The Option term is the number of years that the company estimates, based upon history,

that options will be outstanding prior to exercise or forfeiture. The Option term is 5

years for non-tax incentive options granted in 2001 through 2003. The Option term is

4 years for tax incentive options granted in 2001. There were no tax incentive options

granted in 2003 or 2002.

** To determine volatility, the company measured the daily price changes of the stock

over the respective term for tax incentive options and non-tax incentive options.

INCOME TAXES

Income tax expense is based on reported income before

income taxes. Deferred income taxes reflect the effect of

temporary differences between asset and liability amounts

that are recognized for financial reporting purposes and the

amounts that are recognized for income tax purposes. These

deferred taxes are measured by applying currently enacted

tax laws. Valuation allowances are recognized to reduce the

deferred tax assets to the amount that is more likely than not

to be realized. In assessing the likelihood of realization,

management considers estimates of future taxable income.

TRANSLATION OF NON-U.S. CURRENCY AMOUNTS

Assets and liabilities of non-U.S. subsidiaries that operate in

a local currency environment are translated to U. S. dollars at

year-end exchange rates. Income and expense items are

translated at weighted-average rates of exchange prevailing

during the year. Translation adjustments are recorded in

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

83