IBM 2003 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2003 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

105

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

S

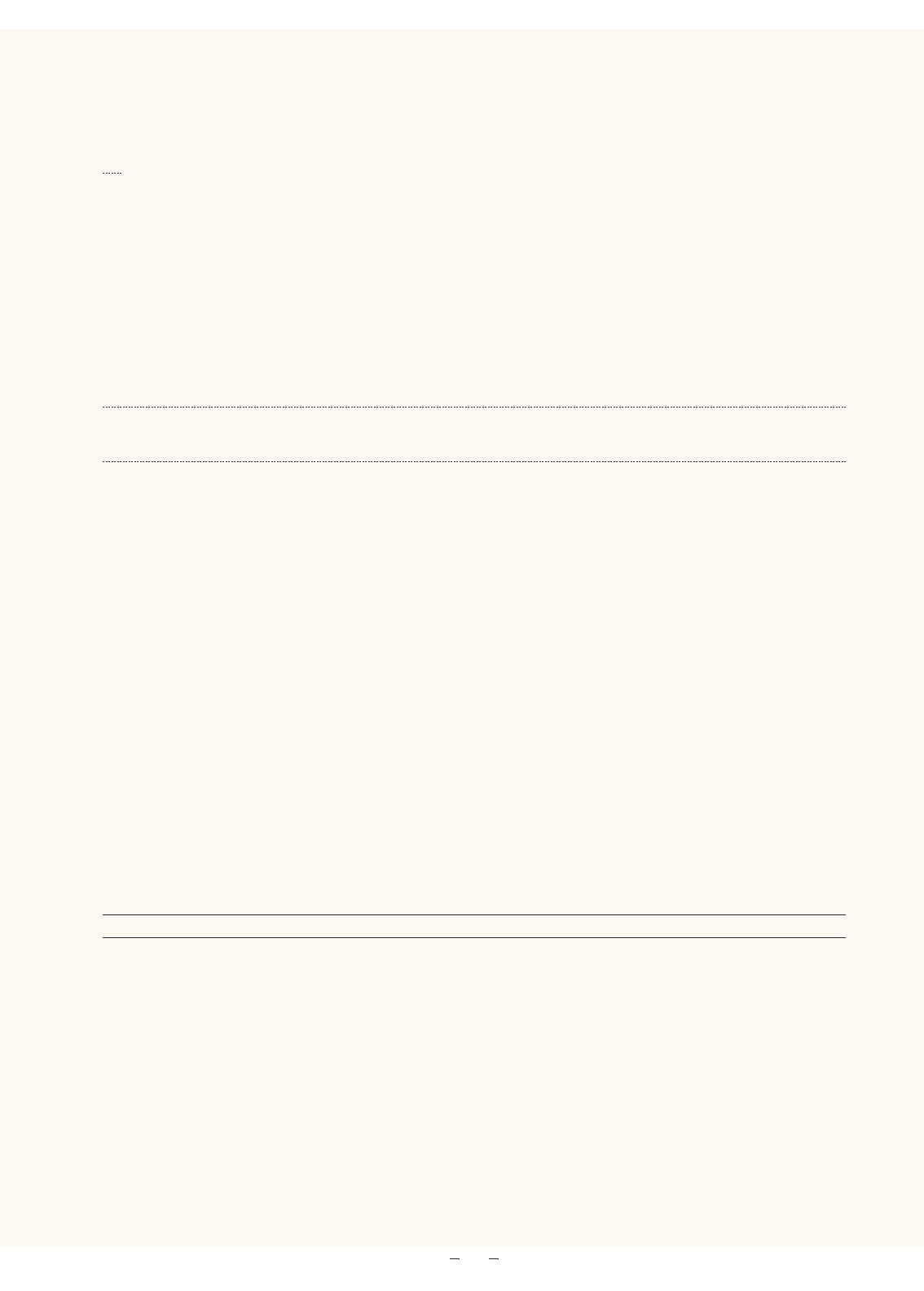

2002 actions

SECOND QUARTER ACTIONS

During the second quarter of 2002, the company executed several actions in its Microelectronics Division. The Microelectronics

Division is within the company’s Technology Group segment. These actions were the result of the company’s announced

intentions to refocus and direct its Microelectronics business to the high-end foundry, Application Specific Integrated

Circuits (ASICs) and standard products, while creating a technology services business. A major part of the actions related to a

significant reduction in the company’s manufacturing capacity for aluminum technology.

In addition, the company rebalanced both its workforce and its leased space resources primarily in response to the decline

in corporate spending on technology services in 2001 and 2002.

The following table summarizes the significant components of these actions.

(dollars in millions)

LIABILITY LIABILITY LIABILITY

RECORDED IN OTHER AS OF OTHER AS OF

PRE-TAX WRITE-OFF 2ND QTR. ADJUST- DEC. 31, ADJUST- DEC. 31,

CHARGES OF ASSETS 2002 PAYMENTS MENTS+2002 PAYMENTS MENTS++ 2003

Microelectronics:

Machinery/equipment: $««««423 $«323 (a)

Current*$«««««67 (b) $«««38 $«13 $«««42 $«««39 $««13 $«««16

Non-current** 33 (b) —(16) 17 — «(15) 2

Noncancelable

purchase commitments: 60

Current*35 (c) 15 4 24 241515

Non-current** 25 (c) —(12) 13 — (13) —

Employee terminations: 45

Current*44 (d) 35 (8) 1 1 — —

Non-current** 1(d) —— 1—— 1

Vacant space: 11

Current*5(e) 115533

Non-current** 6(e) —(1) 5 — (2) 3

Sale of Endicott facility*223 221 (f ) 2(f ) 311106(3) 1

Sale of certain operations*63 53 (g) 10 (g) 9— 1 1——

Global Services and other:

Employee terminations: 722

Current*671 (h) 505 (23) 143 109 (2) 32

Non-current** 51 (h) —2778— (3)75

Vacant space: 180 29 (i)

Current*57 (i) 29 16 44 72 71 43

Non-current** 94 (i) —(8) 86 — (55) 31

Total $«1,727 $«626 $«1,101 $«635 $«««4 $«470 $«257 $««««9 $«222

*Recorded in Accounts payable and accruals in the Consolidated Statement of Financial

Position.

** Recorded in Other liabilities in the Consolidated Statement of Financial Position.

+Principally represents currency translation adjustments and reclassification of non-

current to current. In addition, net adjustments of $(40) million were recorded in

SG&A expense in the fourth quarter of 2002 to reduce previously recorded liabilities

and $10 million was recorded in Other (income) and expense to increase previously

recorded liabilities in the fourth quarter of 2002. These adjustments, along with

adjustments of $(19) million were recorded in SG&A expense and $9 million were

recorded in Other (income) and expense for assets previously written off, were for

differences between the estimated and actual proceeds on the disposition of certain

assets and changes in the estimated cost of employee terminations.

++ Principally represents currency translation adjustments and reclassification of non-

current to current. In addition, adjustments of $(26) million were recorded in SG&A

expense in 2003 to reduce previously recorded liabilities and $4 million was recorded

in Other (income) and expense to increase previously recorded liabilities. These adjust-

ments, along with adjustments of $(7) million were recorded in SG&A expense and

$(2) million were recorded in Other (income) and expense for assets previously written

off, were primarily for differences between the estimated and actual proceeds on the

disposition of certain assets as well as changes in the estimated cost of employee termina-

tions and in vacant space accrual estimates.