IBM 2003 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2003 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Impairment of Long-Lived Assets and for Long-Lived Assets

to Be Disposed Of,” and develops a single accounting model,

based on the framework established in SFAS No. 121 for

long-lived assets to be disposed of by sale, whether such

assets are or are not deemed to be a business. SFAS No. 144

also modifies the accounting and disclosure rules for discon-

tinued operations. The standard was adopted on January 1,

2002, and did not have a material impact on the company’s

Consolidated Financial Statements. The discontinued HDD

operations are presented in the Consolidated Financial

Statements in accordance with SFAS No. 144.

In November 2001, the FASB issued EITF Issue No. 01-14,

“Income Statement Characterization of Reimbursements

Received for ‘Out of Pocket’ Expenses Incurred.” This

guidance requires companies to recognize the recovery of

reimbursable expenses such as travel costs on services con-

tracts as revenue. These costs are not to be netted as a

reduction of cost. This guidance was effective January 1,

2002. This guidance did not have a material effect on the

company’s Consolidated Financial Statements due to the

company’s billing practices. For instance, outside the U. S.,

almost all of the company’s contracts involve fixed billings

that are designed to recover all costs, including out-of-

pocket costs. Therefore, the “reimbursement” of these costs

is already recorded in revenue.

In July 2001, the FASB issued SFAS No. 141, “Business

Combinations,” and SFAS No. 142, “Goodwill and Other

Intangible Assets.” SFAS No. 141 requires the use of the pur-

chase method of accounting for business combinations and

prohibits the use of the pooling of interests method. Under

the previous rules, the company used the purchase method

of accounting. SFAS No. 141 also refines the definition of

intangible assets acquired in a purchase business combina-

tion. As a result, the purchase price allocation of current

business combinations may be different than the allocation

that would have resulted under the old rules. Business combi-

nations must be accounted for using SFAS No. 141 effective

July 1, 2001.

SFAS No. 142 eliminates the amortization of goodwill,

requires annual impairment testing of goodwill and intro-

duces the concept of indefinite life intangible assets. The

company adopted SFAS No. 142 on January 1, 2002. The new

rules also prohibit the amortization of goodwill associated

with business combinations that closed after June 30, 2001.

In accordance with SFAS No. 141, the unamortized bal-

ance for acquired assembled workforce of $33 million, which

had been recognized as an intangible asset separate from

goodwill, has been reclassified to goodwill effective January 1,

2002. In addition, an initial goodwill impairment test was

required to be performed in 2002 as of January 1, 2002. This

initial test and the company’s first annual goodwill impairment

test, performed as of October 1, 2002, resulted in no goodwill

impairment charges. See note I, “Intangible Assets Including

Goodwill,” on page 94 for current year changes in the

amount of recorded goodwill.

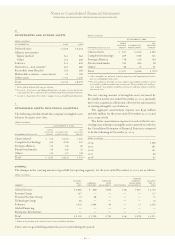

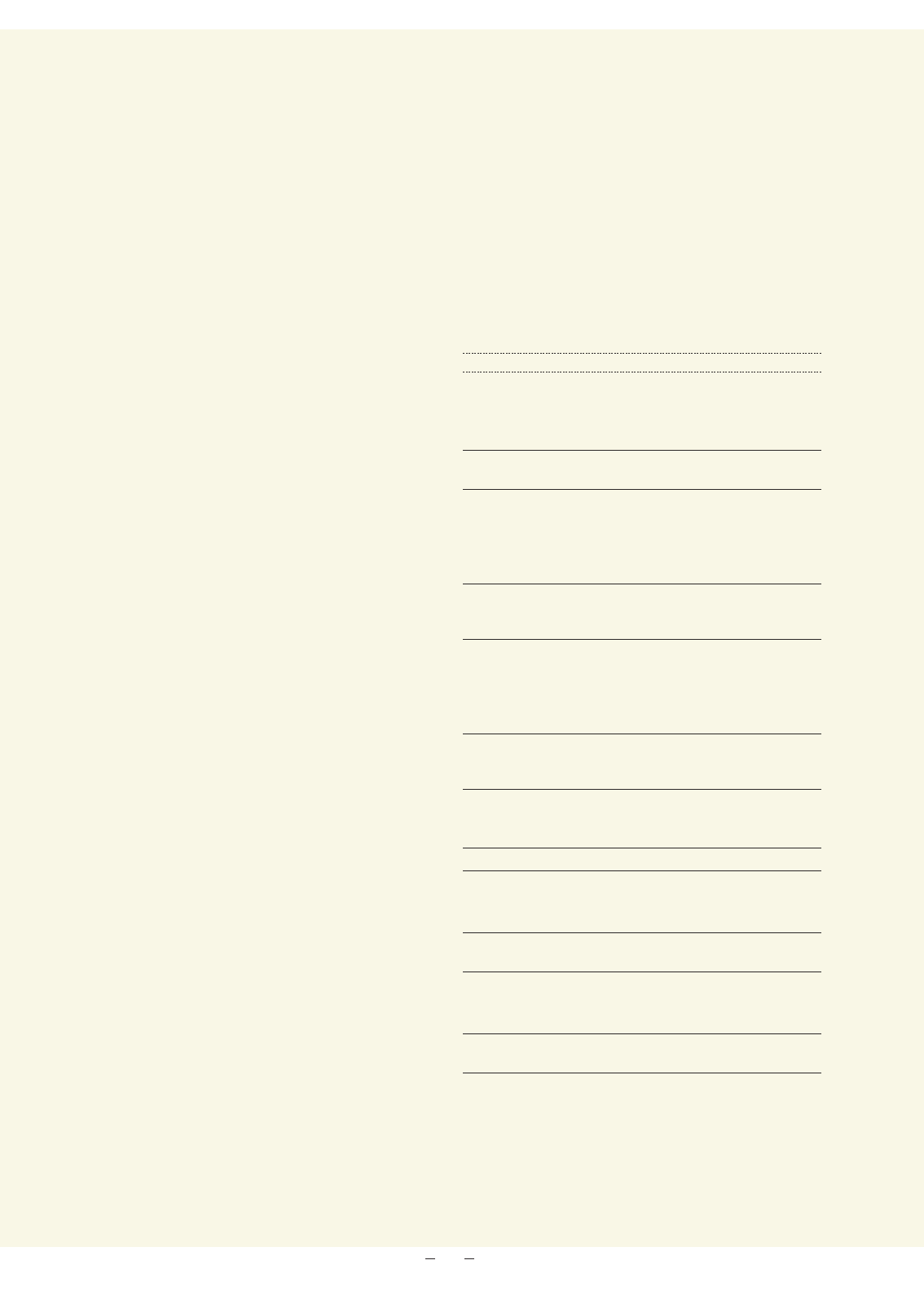

The following table presents Reported income from

continuing operations and net income adjusted to exclude

goodwill amortization, which is no longer recorded under

SFAS No. 142 effective January 1, 2002.

(dollars in millions except per share amounts)

FOR THE YEAR ENDED DECEMBER 31: 2003 2002 2001

Reported income from

continuing operations $«7,613 $«5,334 $«8,146

Add: Goodwill amortization,

net of tax effects ——262

Adjusted income from

continuing operations $«7,613 $«5,334 $«8,408

Basic earnings per share from

continuing operations:

Reported income from

continuing operations $«««4.42 $«««3.13 $«««4.69

Goodwill amortization ——0.15

Adjusted basic earnings

per share from

continuing operations $«««4.42 $«««3.13 $«««4.85*

Diluted earnings per share

from continuing operations:

Reported income from

continuing operations $«««4.34 $«««3.07 $«««4.59

Goodwill amortization ——0.15

Adjusted diluted earnings

per share from

continuing operations $«««4.34 $«««3.07 $«««4.74

Reported net income $«7,583 $«3,579 $«7,723

Add: Goodwill amortization,

net of tax effects ——262

Adjusted net income $«7,583 $«3,579 $«7,985

Basic earnings per share:

Reported net income $«««4.40 $«««2.10 $«««4.45

Goodwill amortization ——0.15

Adjusted basic earnings

per share $«««4.40 $«««2.10 $«««4.60

Diluted earnings per share:

Reported net income $«««4.32 $«««2.06 $«««4.35

Goodwill amortization ——0.15

Adjusted diluted earnings

per share $«««4.32 $«««2.06 $«««4.50

*Does not total due to rounding.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

88