IBM 2003 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2003 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

or anticipated insurance recoveries, were $243 million and

$247 million at December 31, 2003 and 2002, respectively.

Estimated environmental costs are not expected to materi-

ally affect the consolidated financial position or consolidated

results of the company’s operations in future periods.

However, estimates of future costs are subject to change due

to protracted cleanup periods and changing environmental

remediation regulations.

N

stockholders’equity activity

In the fourth quarter of 2002, in connection with the PwCC

acquisition, IBM issued 3,677,213 shares of restricted stock

valued at approximately $254 million and recorded an addi-

tional $30 million for stock to be issued in future periods as

part of the purchase price consideration paid to the PwCC

partners. See note C, “Acquisitions/Divestitures,” on pages

89 to 92, for further information regarding this acquisition

and related payments made by the company. Additionally, in

the fourth quarter of 2002, in conjunction with the funding

of the company’s U.S. pension plan, the company issued an

additional 24,037,354 shares of common stock from treasury

shares valued at $1,871 million.

STOCK REPURCHASES

From time to time, the Board of Directors authorizes the

company to repurchase IBM common stock. The company

repurchased 49,994,514 common shares at a cost of $4,403

million and 48,481,100 common shares at a cost of $4,212

million in 2003 and 2002, respectively. In 2003 and 2002, the

company issued 2,120,293 and 979,246 treasury shares,

respectively, as a result of exercises of stock options by

employees of certain recently acquired businesses and by

non-U.S. employees. At December 31, 2003, $2,961 million of

Board-authorized repurchases remained. The company plans

to purchase shares on the open market from time to time,

depending on market conditions. The company also repur-

chased 291,921 common shares at a cost of $24 million and

189,797 common shares at a cost of $18 million in 2003 and

2002, respectively, as part of other stock compensation plans.

100

In 1995, the Board of Directors authorized the company

to repurchase all of its outstanding Series A 7-1/2 percent

callable preferred stock. On May 18, 2001, the company

announced it would redeem all outstanding shares of its

Series A 7-1/2 percent callable preferred stock, represented

by the outstanding depositary shares (10,184,043 shares).

The depositary shares represent ownership of one-fourth of

a share of preferred stock. Depositary shares were redeemed

as of July 3, 2001, the redemption date, for cash at a redemp-

tion price of $25 plus accrued and unpaid dividends to the

redemption date for each depositary share. Accordingly,

these shares are no longer outstanding. Dividends on pre-

ferred stock, represented by the depositary shares, ceased to

accrue on the redemption date.

EMPLOYEE BENEFITS TRUST

In 1997, the company created an employee benefits trust to

which the company contributed 10 million shares of treasury

stock. The company was authorized to instruct the trustee

to sell such shares from time to time and to use the proceeds

from such sales, and any dividends paid or earnings received

on such stock, toward the partial payment of the company’s

obligations under certain of its compensation and benefit

plans. The shares held in trust were not considered out-

standing for earnings per share purposes until they were

committed to be released. The company did not commit any

shares for release from the trust during its existence nor

were any shares sold from the trust. The trust would have

expired in 2007. Due to the fact that the company had not

used the trust, nor was it expected to need the trust prior to

its expiration, the company dissolved the trust, effective

May 31, 2001, and all of the shares (20 million on a split-

adjusted basis) were returned to the company as treasury

shares. Dissolution of the trust did not affect the company’s

obligations related to any of its compensation and employee

benefit plans or its ability to settle the obligations. In addi-

tion, the dissolution is not expected to have any impact on

net income. At this time, the company plans to fully meet its

obligations for the compensation and benefit plans in the

same manner as it does today, using cash from operations.

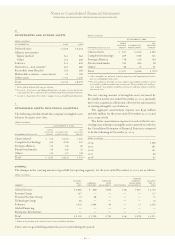

ACCUMULATED GAINS AND (LOSSES) NOT AFFECTING RETAINED EARNINGS*

(dollars in millions)

NET NET ACCUMULATED

UNREALIZED FOREIGN MINIMUM UNREALIZED GAINS/(LOSSES)

GAINS/(LOSSES) CURRENCY PENSION GAINS/(LOSSES) NOT AFFECTING

ON CASH FLOW TRANSLATION LIABILITY ON MARKETABLE RETAINED

HEDGE DERIVATIVES ADJUSTMENTS ADJUSTMENT SECURITIES EARNINGS

December 31, 2001 $««296 $«««(612) $««««(526) $«14 $««««(828)

Change for period (659) 850 (2,765) (16) (2,590)

December 31, 2002 (363) 238 (3,291) (2) (3,418)

Change for period (91) 1,768 (162) 7 1,522

December 31, 2003 $«(454) $«2,006 $«(3,453) $«««5 $«(1,896)

*net of tax