IBM 2003 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2003 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The acquisition was accounted for as a purchase transac-

tion, and accordingly, the assets and liabilities of the acquired

entity were recorded at their estimated fair values at the date

of the acquisition. The primary items that generated the

goodwill are the value of the synergies between Rational and

IBM and the acquired assembled workforce, neither of

which qualify as an amortizable intangible asset. None of

the goodwill is deductible for tax purposes. The overall

weighted-average life of the identified intangible assets

acquired in the purchase of Rational that are subject to

amortization is 4.7 years. With the exception of goodwill, these

identified intangible assets will be amortized on a straight-

line basis over their useful lives. Goodwill of $1,405 million

has been assigned to the Software segment. The company

recorded a pre-tax charge of $9 million for in-process R&D.

C

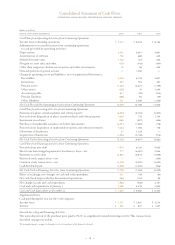

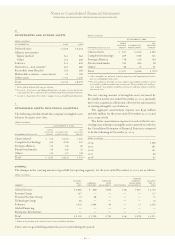

acquisitions/divestitures

ACQUISITIONS

2003

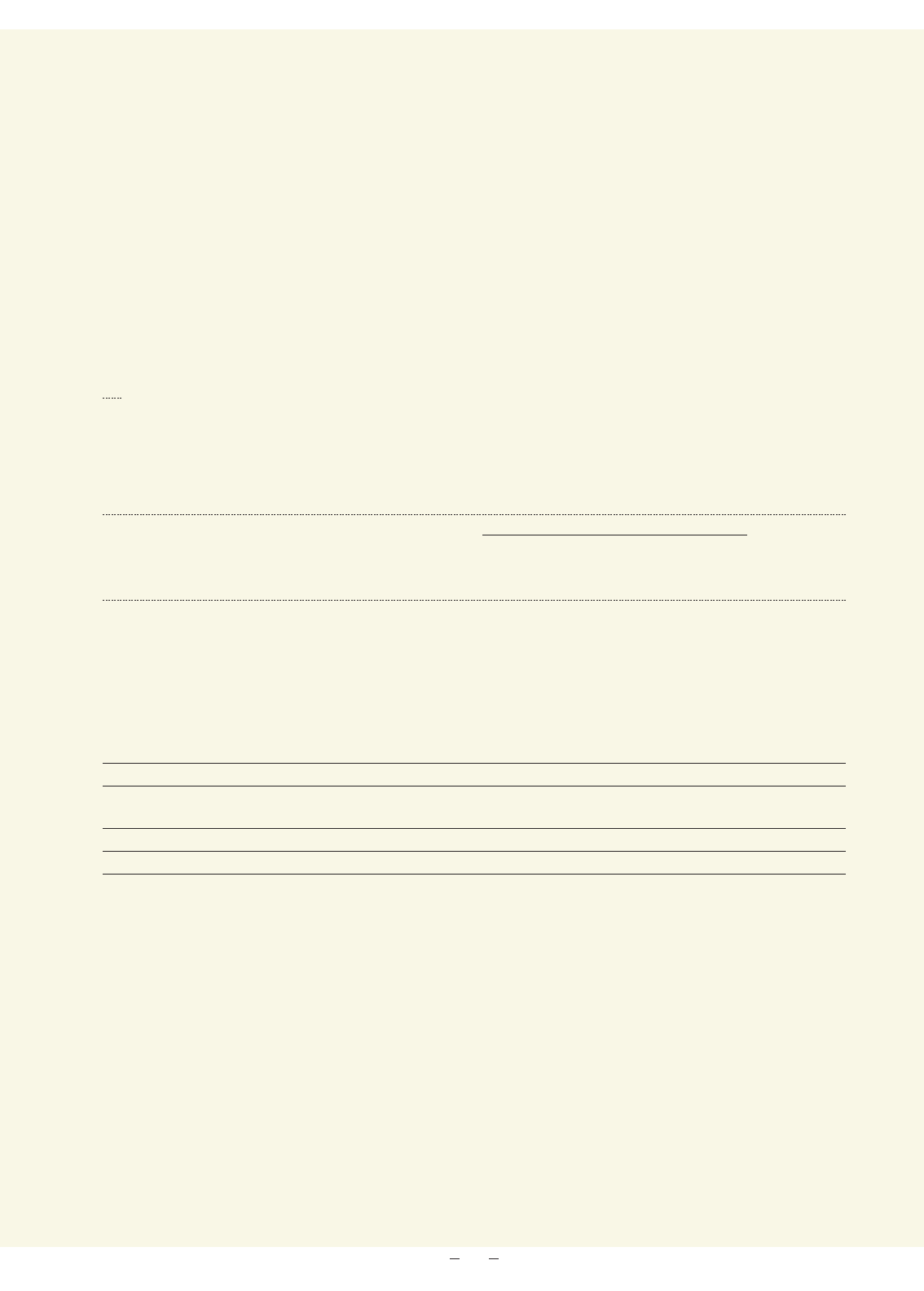

In 2003, the company completed nine acquisitions at an aggregate cost of $2,536 million.

(dollars in millions)

RATIONAL

ORIGINAL

AMOUNT

DISCLOSED IN

AMORTIZATION FIRST QUARTER PURCHASE TOTAL OTHER

LIFE (IN YEARS) 2003 ADJUSTMENTS*ALLOCATION ACQUISITIONS

Current assets $«1,179 $««51 $«1,230 $«««19

Fixed assets/non-current 83 28 111 2

Intangible assets:

Goodwill NA 1,365 40 1,405 335

Completed technology 3229 — 229 12

Client relationships 7180 — 180 1

Other identifiable intangible assets 2–5 32 — 32 21

In-process R&D 9— 9—

Total assets acquired 3,077 119 3,196 390

Current liabilities (347) (81) (428) (28)

Non-current liabilities (638) 33 (605) 11

Total liabilities assumed (985) (48) (1,033) (17)

To tal purchase price $«2,092 $««71 $«2,163 $«373

*Adjustments primarily relate to acquisition costs, deferred taxes and other accruals.

Rational Software Corporation (Rational) – The largest acquisi-

tion in 2003 was that of Rational. The company purchased

the outstanding stock of Rational for $2,095 million in

cash. In addition, the company issued replacement stock

options with an estimated fair value of $68 million to Rational

employees. Rational provides open, industry standard tools,

and best practices and services for developing business

applications and building software products and systems. The

Rational acquisition provides the company with the ability to

offer a complete development environment for clients. The

transaction was completed on February 21, 2003, from which

time the results of this acquisition were included in the

company’s Consolidated Financial Statements. The company

merged Rational’s business operations and employees into

the company’s Software segment as a new division and brand.

On January 1, 2001, the company adopted SFAS No. 133,

as amended. SFAS No. 133 establishes accounting and report-

ing standards for derivative instruments. As of January 1,

2001, the adoption of the new standard resulted in a cumulative

effect, net-of-tax increase of $219 million to Accumulated

gains and (losses) not affecting retained earnings in the

Stockholders’ equity section of the Consolidated Statement

of Financial Position and a cumulative effect net-of-tax

charge of $6 million included in Other (income) and expense

in the Consolidated Statement of Earnings.

Effective January 1, 2001, the company adopted SFAS No.

140, “Accounting for Transfers and Servicing of Financial

Assets and Extinguishments of Liabilities—a replacement

of SFAS No. 125.” This statement provides accounting and

reporting standards for transfers and servicing of financial

assets and extinguishments of liabilities. It also revises the

accounting standards for securitizations and transfers of

financial assets and collateral. The adoption did not have a

material effect on the company’s Consolidated Financial

Statements. The standard also requires new disclosures that

are not applicable to the company.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

89