IBM 2003 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2003 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

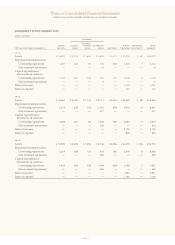

The changes in the Expected long-term return on plan assets

in 2003 and 2002 for the PPP decreased net periodic pension

income by approximately $715 million and $224 million,

respectively, for the year ended December 31, 2003 as com-

pared to the year ended December 31, 2002 and for the year

ended December 31, 2002 as compared to the year ended

December 31, 2001, respectively. The change in the Rate of

compensation increase assumption for the PPP increased

net periodic pension income by approximately $145 million

for the year ended December 31, 2003 as compared to the

year ended December 31, 2002. The changes in the Discount

rate assumption since 2001 for the PPP did not have a mate-

rial impact on net periodic pension income for the years

ended December 31, 2003, 2002, and 2001.

Net changes in assumptions for the material non-U. S. plans

had the net impact of decreasing net periodic pension income

by approximately $225 million and $200 million for the year

ended December 31, 2003 as compared to the year ended

December 31, 2002 and for the year ended December 31, 2002

as compared to the year ended December 31, 2001, respectively.

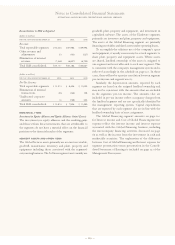

Funded Status for Defined Benefit Pension Plans

It is the company’s general practice to fund amounts for pen-

sions sufficient to meet the minimum requirements set forth

in applicable employee benefits laws and local tax laws, gen-

erally up to the ABO level. From time to time, the company

contributes additional amounts as it deems appropriate.

In the fourth quarter of 2002, the company voluntarily

fully funded the qualilfied portion of the PPP, as measured

by its ABO, through a total contribution of $3,963 million.

The contribution comprised $2,092 million in cash and

$1,871 million, or 24,037,354 shares, of IBM common stock.

This contribution increased net periodic pension income by

approximately $375 million during the year ended December 31,

2003 as compared to the year ended December 31, 2002.

There was no contribution to the PPP during the year ended

December 31, 2003.

There were contributions of $542 million and $225 mil-

lion for the material non-U.S. plans during the year ended

December 31, 2003 and December 31, 2002, respectively.

The company, however, decided not to fund certain of the

company’s non-U.S. plans that had unfunded positions to the

ABO level. As a result and consistent with the accounting

rules required by SFAS No. 87 for these “unfunded” positions

as described on page 111, the company recorded an additional

minimum liability of $560 million and a reduction to stock-

holders’ equity of $72 million as of December 31, 2003. The

differences between these amounts and the amounts

included in the Consolidated Statement of Financial Position

and Consolidated Statement of Stockholders’ Equity relate to

the non-material plans. This accounting transaction did not

impact 2003 retirement-related plans cost/(income).

The company’s Benefit Obligation (BO) for its material

plans is disclosed at the top of page 113. BO is calculated simi-

larly to ABO except for the fact that BO includes an estimate

for future salary increases. SFAS No. 132 (revised 2003),

“Employers’ Disclosures about Pensions and Other Post-

retirement Benefits—an amendment of FASB Statements No.

87, 88 and 106,” requires that companies disclose the aggregate

BO and plan assets of all plans in which the BO exceeds plan

assets. Similar disclosure is required for all plans in which the

ABO exceeds plan assets. The aggregate BO and plan assets are

also disclosed for plans in which the plan assets exceed the BO.

The following table excludes the U. S. plans due to the fact

that these plans’ BO and plan assets, if any, appear either in

the narrative on pages 111 and 112 or the table on page 113.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

114

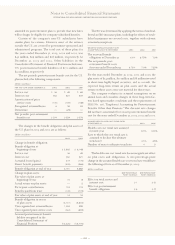

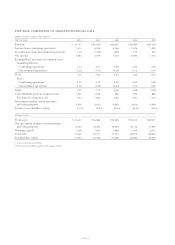

Assumptions used to determine the year-end benefit obligations for principal pension plans follow:

U.S. PLANS NON-U.S. PLANS

WEIGHTED-AVERAGE ASSUMPTIONS AT DECEMBER 31: 2003 2002 2001 2003 2002 2001

Discount rate 6.0% 6.75% 7.0% 3.0–6.0% 4.25–6.5% 4.5–7.1%

Rate of compensation increase 4.0% 4.0% 6.0% 1.5–5.0% 2.2–5.0% 2.0–6.1%

Assumptions used to determine the net periodic pension cost/(income) for principal pension plans during the year follow:

U.S. PLANS NON-U.S. PLANS

WEIGHTED-AVERAGE ASSUMPTIONS FOR YEARS ENDED DECEMBER 31: 2003 2002 2001 2003 2002 2001

Discount rate 6.75% 7.0% 7.25% 4.25–6.5% 4.5–7.1% 4.5–7.1%

Expected long-term return on plan assets 8.0% 9.50% 10.0% 5.0–8.0% 5.0–9.25% 5.0–10.0%

Rate of compensation increase 4.0% 6.0% 6.0% 2.2–5.0% 2.0–6.1% 2.6–6.1%

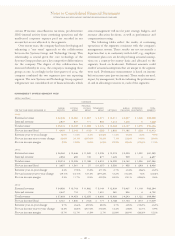

(dollars in millions)

2003 2002

BENEFIT PLAN BENEFIT PLAN

AT DECEMBER 31: OBLIGATION ASSETS OBLIGATION ASSETS

Plans with BO in excess of plan assets $«21,101 $«12,985 $«20,212 $«13,132

Plans with ABO in excess of plan assets $«19,902 $«12,985 $«15,978 $«10,086

Plans with assets in excess of BO $«10,774 $«13,561 $«««5,487 $«««7,505