IBM 2003 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2003 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

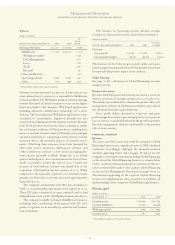

prior year in review

(dollars and shares in millions except per share amounts)

YR. TO YR.

FOR THE YEAR DECEMBER 31: 2002 2001 CHANGE

Revenue $«81,186 $«83,067 (2.3) % *

Gross profit margin 37.3% 38.4% (1.1) pts.

Total expense and

other income $«22,760 $«20,439 11.4%

Total expense and other

income-to-revenue ratio 28.0% 24.6% 3.4 pts.

Provision for

income taxes $«««2,190 $«««3,304 (33.7) %

Income from

continuing operations $«««5,334 $«««8,146 (34.5) %

Earnings per share from

continuing operations:

Assuming dilution $«««««3.07 $«««««4.59 (33.1) %

Basic $«««««3.13 $«««««4.69 (33.3) %

Discontinued operations:

Loss $«««1,755 $««««««423 NM NM

Diluted earnings

per share $««««(1.01) $««««(0.24) NM NM

Basic earnings

per share $««««(1.03) $««««(0.24) NM NM

Weighted-average

shares outstanding:

Assuming dilution 1,730.9 1,771.2 (2.3) %

Basic 1,703.2 1,733.3 (1.7) %

Assets** $«96,484 $«90,303 6.8%

Liabilities** $«73,702 $«66,855 10.2%

Equity** $«22,782 $«23,448 (2.8) %

*2.9 percent decrease at constant currency

** at December 31

NM—not meaningful

CONTINUING OPERATIONS

Income from continuing operations and diluted earnings

per share from continuing operations each declined over 30

percent in 2002 as compared to 2001. Over half of the

decline was attributable to after-tax charges of $1.2 billion

and $433 million associated with the 2002 second quarter

Microelectronics and productivity actions and the charges

related to the 2002 fourth quarter acquisition of PwCC,

respectively. The remainder of the decline was primarily due

to lower corporate spending on IT. Sector revenue in 2002

declined across all client sectors compared to 2001 with the

exception of the Public sector, which had strong growth in a

continuing tough economic climate. The Small & Medium

Business sector gained traction despite the economy, reflect-

ing the company’s increased focus on this client sector.

Geographic revenue declines were due to lower corpo-

rate spending on IT given the economic trends prevalent

from 2001 to 2002. Such declines were experienced in the

Americas compared with 2001, whereas Asia Pacific revenue

was essentially the same in 2002 as compared to 2001. Asia

Pacific’s revenue performance was slowed by a weak economy

in Japan (over 60 percent of Asia Pacific revenue), although

revenue growth was achieved in the ASEAN region.

Europe/Middle East/Africa’s revenue increased 1.1 percent,

although it declined 4 percent at constant currency, primarily

due to weakness in the U.K ., France and Germany, offset by

good performance in Italy.

The following is an analysis of external segment results.

Global Services

Revenue increased 4.0 percent (3 percent at constant cur-

rency) to $36,360 million as a result of the fourth quarter

2002 acquisition of PwCC into the company’s BCS business.

SO revenue increased despite the economic downturn given

its annuity-like characteristics. ITS revenue also increased

due to increased deployment of network hardware and

connectivity services, business continuity services and

OEM alliances. The PwCC acquisition accounted for all of

BCS’s revenue increase. The company signed $53 billion of

services contracts in 2002, an increase of $2 billion versus

2001. The estimated services backlog at December 31, 2002,

was $112 billion.

Hardware Segments

Revenue declined 10.5 percent (11 percent at constant cur-

rency) to $27,630 million and is more sensitive to changes in

the economy and corporate IT spending levels relative to

Global Services. Systems Group revenue declined 8.0 per-

cent (10 percent at constant currency) across zSeries, iSeries,

pSeries and storage, although zSeries MIPS deliveries

increased 6 percent compared to 2001. xSeries also increased

as the company launched its blade offerings. Personal

Systems Group revenue declined 7.8 percent (9 percent at

constant currency) for the same reasons cited above.

Technology Group revenue declined 23.6 percent (23 percent

at constant currency) primarily due to divestiture of multi-

ple, non-core businesses during the year, including display

and card manufacturing.

Software Group

Revenue increased 1.0 percent (flat at constant currency) to

$13,074 million. The company noted two trends in 2002.

First, clients were spending more time on the selection

process for software solutions and second, clients were more

inclined to negotiate smaller software arrangements, which

are perceived to provide a faster return on investment. The

company’s focus on client base expansion offset these two

trends. Modest growth in middleware products, particularly

in Data Management, WebSphere and Tivoli, offset declines

in operating system revenue, which is somewhat dependent

on hardware volumes.

Management Discussion

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

61