IBM 2003 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2003 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

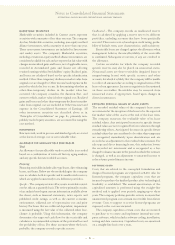

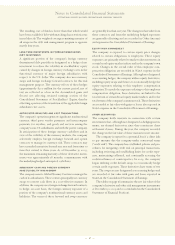

In April 2003, the FASB issued SFAS No. 149, “Amendment

of Statement 133 on Derivative Instruments and Hedging

Activities.” SFAS No. 149 clarifies under what circumstances

a contract with an initial net investment meets the character-

istics of a derivative as discussed in SFAS No. 133. It also

specifies when a derivative contains a financing component

that requires special reporting in the Consolidated Statement

of Cash Flows. SFAS No. 149 amends certain other existing

pronouncements in order to improve consistency in report-

ing these types of transactions. The new guidance is effective

for contracts entered into or modified after June 30, 2003,

and for hedging relationships designated after June 30, 2003.

SFAS No. 149 did not have a material effect on the Consoli-

dated Financial Statements.

In May 2003, the FASB issued SFAS No. 150, “Accounting

for Certain Financial Instruments with Characteristics of both

Liabilities and Equity.” It establishes classification and meas-

urement standards for three types of freestanding financial

instruments that have characteristics of both liabilities and

equity. Instruments within the scope of SFAS No. 150 must

be classified as liabilities within the company’s Consolidated

Financial Statements and be reported at settlement date

value. The provisions of SFAS No. 150 are effective for (1)

instruments entered into or modified after May 31, 2003, and

(2) pre-existing instruments as of July 1, 2003. In November

2003, through the issuance of FSP 150-3, the FASB

indefinitely deferred the effective date of certain provisions

of SFAS No. 150, including mandatorily redeemable instru-

ments as they relate to minority interests in consolidated

finite-lived entities. The adoption of SFAS No. 150, as

modified by FSP 150-3, did not have a material effect on the

Consolidated Financial Statements.

In November 2002, the FASB issued Interpretation No.

45 (FIN 45), “Guarantor’s Accounting and Disclosure

Requirements for Guarantees, Including Indirect Guarantees

of Indebtedness of Others,” which addresses the disclosures

to be made by a guarantor in its interim and annual financial

statements about its obligations under guarantees. FIN 45

also requires the recognition of a liability by a guarantor at

the inception of certain guarantees that are entered into or

modified after December 31, 2002. The company has adopted

the disclosure requirements of FIN 45 (see note A, “Significant

Accounting Policies,” on page 86 under “Product Warranties,”

in note O, “Contingencies and Commitments,” on pages 101

to 103) and applied the recognition and measurement provi-

sions for all material guarantees entered into or modified in

periods beginning January 1, 2003. The initial adoption of

the recognition and measurement provisions of FIN 45 did

not have a material impact on the Consolidated Financial

Statements. The impact of FIN 45 on the company’s future

Consolidated Financial Statements will depend upon

whether the company enters into or modifies any material

guarantee arrangements.

In July 2002, the FASB issued SFAS No. 146, “Accounting

for Costs Associated with Exit or Disposal Activities.” SFAS

No. 146 supersedes EITF No. 94-3, “Liability Recognition

for Certain Employee Termination Benefits and Other Costs

to Exit an Activity (Including Certain Costs Incurred in a

Restructuring),” and requires that a liability for a cost associ-

ated with an exit or disposal activity be recognized when the

liability is incurred. Such liabilities should be recorded at fair

value and updated for any changes in the fair value each

period. The company adopted this statement effective

January 1, 2003, and its adoption did not have a material effect

on the Consolidated Financial Statements. Going forward,

the impact of SFAS No. 146 on the company’s Consolidated

Financial Statements will depend upon the timing of and

facts underlying any future exit or disposal activity.

On January 1, 2003, the company adopted SFAS No. 143,

“A ccounting for Asset Retirement Obligations.” SFAS No. 143

provides accounting and reporting guidance for legal obliga-

tions associated with the retirement of long-lived assets that

result from the acquisition, construction or normal operation

of a long-lived asset. SFAS No. 143 requires the recording of

an asset and a liability equal to the present value of the esti-

mated costs associated with the retirement of long-lived

assets for which a legal or contractual obligation exists. The

asset is required to be depreciated over the life of the related

equipment or facility, and the liability is required to be

accreted each year based on a present value interest rate. The

adoption of the standard did not have a material effect on

the company’s Consolidated Financial Statements.

In April 2002, the FASB issued SFAS No. 145, “Rescission

of FASB Statements No. 4, 44 and 64, Amendment of FASB

Statement No. 13, and Technical Corrections,” effective

May 15, 2002. SFAS No. 145 eliminates the requirement that

gains and losses from the extinguishment of debt be aggre-

gated and classified as an extraordinary item, net of tax, and

makes certain other technical corrections. SFAS No. 145 did

not have a material effect on the company’s Consolidated

Financial Statements.

Effective January 1, 2002, the company adopted SOP 01-6,

“A ccounting by Certain Entities (including entities with

Trade Receivables) That Lend to or Finance the Activities of

Others.” With limited exception, SOP 01-6 applies to any

entity that lends to, or finances the activities of, others and

provides specialized guidance for certain transactions specific

to financial institutions. This SOP reconciles and conforms,

as appropriate, the accounting and financial reporting guid-

ance established by the American Institute of Certified

Public Accountants. The adoption did not have a material

effect on the company’s Consolidated Financial Statements.

In October 2001, the FASB issued SFAS No. 144,

“A ccounting for the Impairment or Disposal of Long-Lived

Assets.” SFAS No. 144 addresses significant issues relating to

the implementation of SFAS No. 121, “Accounting for the

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

87