IBM 2003 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2003 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

111

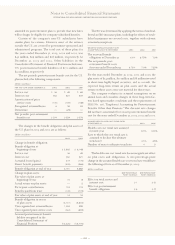

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

ACCOUNTING POLICY

Defined Benefit Pension and

Nonpension Postretirement Benefit Plans

The company accounts for its defined benefit pension plans

and its nonpension postretirement benefit plans using actuarial

models required by SFAS No. 87, “Employers’ Accounting

for Pensions,” and SFAS No. 106, “Employers’ Accounting for

Postretirement Benefits Other Than Pensions,” respectively.

These models use an attribution approach that generally

spreads individual events over the average service lives of the

employees in the plan. Examples of “events” are plan amend-

ments and changes in actuarial assumptions such as discount

rate, rate of compensation increases and mortality. The

principle underlying the required attribution approach is

that employees render service over their service lives on a

relatively smooth basis and therefore, the income statement

effects of pensions or nonpension postretirement benefit

plans are earned in, and should follow, the same pattern.

One of the principal components of the net periodic

pension cost/(income) calculation is the expected long-term

rates of return on plan assets. The required use of expected

long-term rate of return on plan assets may result in recog-

nized pension income that is greater or less than the actual

returns of those plan assets in any given year. Over time,

however, the expected long-term returns are designed to

approximate the actual long-term returns and therefore

result in a pattern of income and expense recognition that

more closely matches the pattern of the services provided by

the employees. Differences between actual and expected

returns are recognized in the calculation of net periodic

pension cost/(income) over five years as provided for in the

accounting rules.

These expected returns on plan assets are developed in

conjunction with external advisors, and take into account

long-term expectations for future returns and investment

strategy. Amounts are tested for reasonableness against their

historical averages, usually over a ten year period.

The discount rate assumptions used for pension and non-

pension postretirement benefit plan accounting reflect the

prevailing rates available on high-quality, fixed-income debt

instruments. The rate of compensation increase is another

significant assumption used in the actuarial model for pen-

sion accounting and is determined by the company, based

upon its long-term plans for such increases. For retiree med-

ical plan accounting, the company reviews external data and

its own historical trends for health care costs to determine

the health care cost trend rates.

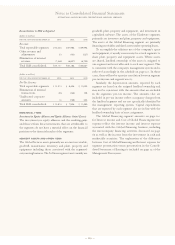

As required by SFAS No. 87, for instances in which pension

plan assets are less than the accumulated benefit obligation

(ABO) as of the end of the reporting period (defined as an

unfunded ABO position), a minimum liability equal to this

difference is established in the Consolidated Statement of

Financial Position. The ABO is the present value of the

actuarially determined company obligation for pension pay-

ments assuming no further salary increases for the employees.

The offset to the minimum liability is a charge to equity, net

of tax. In addition, any prepaid pension asset in excess of

unrecognized prior service cost must be reversed through a

net-of-tax charge to equity. The charge to equity is included

in the Accumulated gains and (losses) not affecting retained

earnings section of Stockholders’ equity in the Consolidated

Statement of Financial Position.

The company uses a December 31 measurement date for

the majority of its pension plans.

Defined Contribution Pension Plans

The company records pension expense for defined contri-

bution plans when the employee renders service to the

company, essentially coinciding with the cash contributions

to the plans.

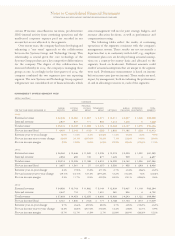

DEFINED BENEFIT AND DEFINED CONTRIBUTION PLANS

The company and its subsidiaries have defined benefit and

defined contribution pension plans that cover substantially

all regular employees, and supplemental retirement plans

that cover certain executives.

U.S. Plans

IBM Personal Pension Plan (PPP) – IBM provides U.S. regular,

full-time and part-time employees with noncontributory

defined benefit pension benefits (PPP). The PPP comprises

a tax qualified plan and a non-qualified plan. The qualified

plan is funded by company contributions to an irrevocable

trust fund, which is held for the sole benefit of participants.

The non-qualified plan, which provides benefits in excess of

IRS limitations for qualified plans, is unfunded.

The number of individuals receiving benefits from the

PPP at December 31, 2003 and 2002, was 136,302 and 136,365,

respectively. The pre-tax net periodic pension income for

the qualified plan for the years ended December 31, 2003,

2002 and 2001, was $(692) million, $(917) million and

$(1,086) million, respectively. The pre-tax net periodic pension

cost for the non-qualified plan was $107 million, $106 mil-

lion and $118 million for the years ended December 31, 2003,

2002 and 2001, respectively. The costs of the non-qualified

plan are reflected in Cost of other defined benefit plans on

page 112.

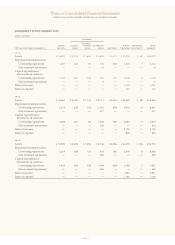

The funded status reconciliation for the qualified plan is

on page 113. The benefit obligation of the non-qualified plan

was $1,068 million and $940 million at December 31, 2003

and 2002, respectively, and the amounts included in

Retirement and nonpension postretirement benefit obliga-

tions in the Consolidated Statement of Financial Position at

December 31, 2003 and 2002, were liabilities of $901 million

and $798 million, respectively.