IBM 2003 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2003 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

While OEM revenue, representing three percent of the

company’s revenue, declined, such decline was smaller than

the prior year decline. The year-to-year percent change in

revenue reflects, in large part, the company’s exit from its

interconnect products business in 2002, as well as sluggish

demand from certain OEM clients.

The increase in Global Services revenue was driven by

SO, as a result of new signings, as well as BCS, as a result of

the acquisition of PwCC in the fourth quarter of 2002. For

Hardware, Systems Group revenue increased as pSeries

servers, xSeries servers, zSeries servers and Storage System

revenue increased in 2003 versus 2002. pSeries server revenue

increased due to increased demand for both low-end servers

and high-end servers. xSeries server revenue increased due

to continued success in the company’s new blade server

offerings. Storage revenue increased due to increased

demand for external disk and tape products. zSeries server

revenue increased as total deliveries of computing power as

measured in MIPS (millions of instructions per second)

increased more than 28 percent in 2003 versus 2002. This

increase was offset by lower average price per MIPS in 2003

versus 2002. Personal Systems Group revenue increased.

Increases in mobile personal computer revenue were offset

by lower revenue for desktop personal computers reflecting

industry-wide price pressures. The decline in Technology

Group revenue in 2003 was primarily due to divestitures in

the Technology Group in 2002 as well as sluggish demand

from certain OEM clients. With respect to Software,

improved demand helped to drive middleware revenue

increases. The WebSphere family of products, Data

Management DB2database software, and Tivoli security and

storage software were middleware software categories with

revenue growth. Operating system software increased due to

the favorable impact of currencies. Offsetting these

increases were lower demand for DB2tools, Lotus advanced

collaboration software and other middleware. Overall, the

increase in total Software revenue was mainly due to the

acquisition of Rational in the first quarter of 2003. The

decline in Global Financing revenue in 2003 versus 2002 was

primarily a result of lower interest rates and the decline in

the average asset balance primarily driven by lower origina-

tions in prior years. See pages 69 to 73 for additional infor-

mation regarding Global Financing results.

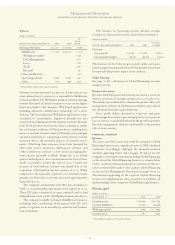

The following table presents each segment’s revenue as a

percentage of the company’s total.

FOR THE YEAR ENDED DECEMBER 31: 2003 2002

Global Services 47.8% 44.8%

Hardware 31.7 33.8

Software 16.1 16.1

Global Financing 3.2 4.0

Enterprise Investments/Other 1.2 1.3

Total 100.0% 100.0%

Gross Profit

YR. TO YR.

FOR THE YEAR ENDED DECEMBER 31: 2003 2002 CHANGE

Gross Profit Margin:

Global Services 25.2% 26.3% (1.1) pts.

Hardware 27.8 27.1 0.7

Software 86.5 84.4 2.1

Global Financing 55.8 56.2 (0.4)

Enterprise Investments/

Other 43.4 42.6 0.8

Total 37.0% 37.3% (0.3) pts.

The decline in Global Services margin was due to invest-

ment costs during the early stages of an SO contract and the

company’s changing mix of revenue toward BCS. These

decreases were partially offset by an increase in gross margin

for Maintenance due to lower labor and parts costs and

benefits from the 2002 productivity actions.

The increase in Hardware margin was achieved by cost

improvements in zSeries and pSeries primarily due to the new

product announcement of the z990 server and increased

demand associated with the pSeries high-end servers. xSeries

servers also increased as a result of cost improvements and

the success of the company’s blade strategy. In addition,

Technology Group margin increased primarily due to the

productivity and cost savings resulting from the 2002

Microelectronics actions taken in the second quarter of 2002.

The Software margin increased due to growth in Software

revenue principally as a result of currency translation.

The decrease in the Global Financing margin was driven

by a mix change toward lower margin remarketing sales and

away from financing income, partially offset by lower bor-

rowing costs related to the current interest rate environment.

The cost savings generated by IBM’s supply chain initiatives

also contributed to the company’s overall margin improvement,

but as discussed on pages 49 and 50, the company will and has

passed a portion of the savings to clients to improve competi-

tive leadership and gain market share in key industry sectors.

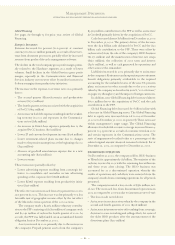

Expense

(dollars in millions)

FOR THE YEAR YR. TO YR.

ENDED DECEMBER 31: 2003 2002 CHANGE

Total expense and

other income $«22,144 $«22,760 (2.7) %

E/R 24.8% 28.0% (3.2) pts.

The Total expense and other income expense-to-revenue ratio

declined 3.2 percentage points to 24.8 percent in 2003 versus

2002. This decline was a result of revenue increasing by 9.8 per-

cent in 2003 versus 2002, while Total expense and other income

declined 2.7 percent in 2003 versus 2002 due primarily to pro-

ductivity and efficiency initiatives, and the 2002 actions par-

tially offset by an increase in retirement-related plan costs. For

additional information regarding the decline in Total expense

and other income, see the following analyses by category.

Management Discussion

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

52