IBM 2003 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2003 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In connection with various acquisition transactions, there

are an additional 3.5 million options outstanding at

December 31, 2003, as a result of the company’s assumption

of options granted by the acquired entities. The weighted-

average exercise price of these options is $90.

IBM EMPLOYEES STOCK PURCHASE PLAN

In July 2003, the IBM 2003 ESPP became effective and 50

million additional shares of authorized common stock were

reserved and approved for issuance. The ESPP enables sub-

stantially all regular employees to purchase full or fractional

shares of IBM common stock through payroll deductions of

up to 10 percent of eligible compensation. The 2003 ESPP

provides for semi-annual offerings commencing July 1,

2003, and continuing as long as shares remain available

under the ESPP, unless terminated earlier at the discretion

of the Board of Directors. The share price paid by an employee

equals the lesser of 85 percent of the average market price

on the first business day of each offering period or 85 per-

cent of the average market price on the last business day of

each pay period. Individual ESPP participants are restricted

from purchasing more than $25,000 of common stock in

one calendar year or 1,000 shares in an offering period.

Approximately 44.2 million, 4.6 million and 16.5 million

reserved unissued shares were available for purchase under

the 2003 ESPP (or a predecessor plan) at December 31, 2003,

2002 and 2001, respectively.

PRO FORMA DISCLOSURE

See “Stock-Based Compensation” on pages 82 and 83, in

note A, “Significant Accounting Policies,” for the pro forma

disclosures of net income and earnings per share required

under SFAS No. 123.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

110

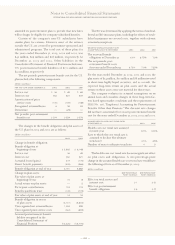

The shares under option at December 31, 2003, were in the following exercise price ranges:

OPTIONS OUTSTANDING OPTIONS CURRENTLY EXERCISABLE

WTD. AVG.

WTD. AVG. NUMBER REMAINING WTD. AVG. NUMBER

EXERCISE OF SHARES CONTRACTUAL EXERCISE OF SHARES

EXERCISE PRICE RANGE PRICE UNDER OPTION LIFE (IN YEARS) PRICE UNDER OPTION

$13 – $60 $««45 58,085,692 5 $««42 46,673,075

$61–$85 77 59,168,633 9 71 7,482,142

$86 –$105 98 58,170,230 7 97 29,229,856

$106 and over 117 69,541,497 7 119 51,350,253

$««86 244,966,052 7 $««85 134,735,326

W

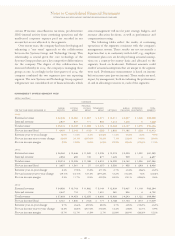

retirement-related benefits

IBM offers defined benefit pension plans, defined contribution pension plans, as well as nonpension postretirement plans

primarily consisting of retiree medical benefits. These benefits form an important part of the company’s total compensation

and benefits program that is designed to attract and retain highly skilled and talented employees. The following table provides

the total retirement-related benefit plans’ impact on income before income taxes.

(dollars in millions)

U.S. NON-U.S. TOTAL

FOR THE YEAR ENDED DECEMBER 31: 2003 2002 2001 2003 2002 2001 2003 2002 2001

Total retirement-related plans—

cost/(income) $««««67 $«(154) $«(256) $«295 $«(17) $«(181) $«362 $«(171) *$«(437) *

Comprise:

Defined benefit and contribution

pension plans—(income)/cost $«(227) $«(478) $«(632) $«254 $«(46) $«(209) $«««27 $«(524) $«(841)

Nonpension postretirement

benefits—cost 294 324 376 41 29 28 335 353 404

*Includes amounts for discontinued operations costs of $77 million and $56 million for 2002 and 2001, respectively.