Cisco 2012 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2012 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company regularly reviews VSOE, TPE, and ESP and maintains internal controls over the establishment and

updates of these estimates. There were no material impacts during the fiscal year, nor does the Company

currently expect a material impact in the near term from changes in VSOE, TPE, or ESP.

The Company’s arrangements with multiple deliverables may have a standalone software deliverable that is

subject to the software revenue recognition guidance. In these cases, revenue for the software is generally

recognized upon shipment or electronic delivery and granting of the license. The revenue for these multiple-

element arrangements is allocated to the software deliverable and the nonsoftware deliverables based on the

relative selling prices of all of the deliverables in the arrangement using the hierarchy in the applicable

accounting guidance. In the limited circumstances where the Company cannot determine VSOE or TPE of the

selling price for all of the deliverables in the arrangement, including the software deliverable, ESP is used for the

purposes of performing this allocation.

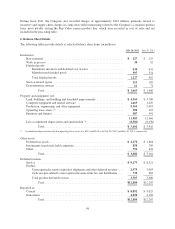

(o) Advertising Costs The Company expenses all advertising costs as incurred. Advertising costs included within

sales and marketing expenses were approximately $218 million, $325 million, and $290 million for fiscal 2012,

2011, and 2010, respectively.

(p) Share-Based Compensation Expense The Company measures and recognizes the compensation expense for

all share-based awards made to employees and directors, including employee stock options, stock grants, stock

units, and employee stock purchases related to the Employee Stock Purchase Plan (“Employee Stock Purchase

Rights”) based on estimated fair values. The fair value of employee stock options is estimated on the date of

grant using a lattice-binomial option-pricing model (“Lattice-Binomial Model”), and for employee stock

purchase rights the Company estimates the fair value using the Black-Scholes model. The fair value for time-

based stock awards and stock awards that are contingent upon the achievement of financial performance metrics

is based on the grant date share price reduced by the present value of the expected dividend yield prior to vesting.

The fair value of market-based stock awards is estimated using an option-pricing model on the date of grant.

Because share-based compensation expense is based on awards ultimately expected to vest, it has been reduced

for forfeitures.

(q) Software Development Costs Software development costs required to be capitalized for software sold, leased,

or otherwise marketed have not been material to date. Software development costs required to be capitalized for

internal use software have also not been material to date.

(r) Income Taxes Income tax expense is based on pretax financial accounting income. Deferred tax assets and

liabilities are recognized for the expected tax consequences of temporary differences between the tax bases of

assets and liabilities and their reported amounts. Valuation allowances are recorded to reduce deferred tax assets

to the amount that will more likely than not be realized.

The Company accounts for uncertainty in income taxes using a two-step approach to recognizing and measuring

uncertain tax positions. The first step is to evaluate the tax position for recognition by determining if the weight

of available evidence indicates that it is more likely than not that the position will be sustained on audit,

including resolution of related appeals or litigation processes, if any. The second step is to measure the tax

benefit as the largest amount that is more than 50% likely of being realized upon settlement. The Company

classifies the liability for unrecognized tax benefits as current to the extent that the Company anticipates payment

(or receipt) of cash within one year. Interest and penalties related to uncertain tax positions are recognized in the

provision for income taxes.

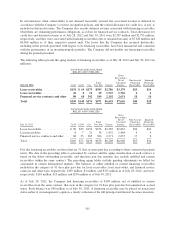

(s) Computation of Net Income per Share Basic net income per share is computed using the weighted-average

number of common shares outstanding during the period. Diluted net income per share is computed using the

weighted-average number of common shares and dilutive potential common shares outstanding during the

period. Diluted shares outstanding include the dilutive effect of in-the-money options, unvested restricted stock,

and restricted stock units. The dilutive effect of such equity awards is calculated based on the average share price

91