Cisco 2012 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2012 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

audits for returns covering tax years through fiscal 2000 and state and local income tax audits for returns

covering tax years through fiscal 1997.

During fiscal 2010, the Ninth Circuit withdrew its prior holding and reaffirmed the 2005 U.S. Tax Court ruling in

Xilinx, Inc. v. Commissioner. As a result of this final decision in fiscal 2010, the Company decreased the amount

of gross unrecognized tax benefits by approximately $220 million and decreased the amount of accrued interest

by $218 million.

The Company regularly engages in discussions and negotiations with tax authorities regarding tax matters in

various jurisdictions. The Company believes it is reasonably possible that certain federal, foreign, and state tax

matters may be concluded in the next 12 months. Specific positions that may be resolved include issues involving

transfer pricing and various other matters. The Company estimates that the unrecognized tax benefits at July 28,

2012 could be reduced by approximately $1.1 billion in the next 12 months.

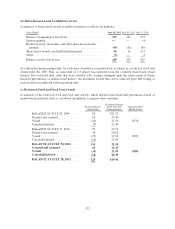

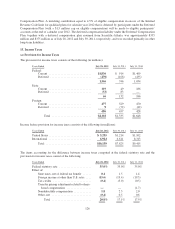

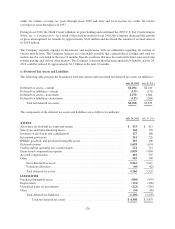

(c) Deferred Tax Assets and Liabilities

The following table presents the breakdown between current and noncurrent net deferred tax assets (in millions):

July 28, 2012 July 30, 2011

Deferred tax assets—current .............................................. $2,294 $2,410

Deferred tax liabilities—current ........................................... (123) (131)

Deferred tax assets—noncurrent ........................................... 2,270 1,864

Deferred tax liabilities—noncurrent ........................................ (133) (264)

Total net deferred tax assets ........................................... $4,308 $3,879

The components of the deferred tax assets and liabilities are as follows (in millions):

July 28, 2012 July 30, 2011

ASSETS

Allowance for doubtful accounts and returns ................................. $ 433 $ 413

Sales-type and direct-financing leases ....................................... 162 178

Inventory write-downs and capitalization .................................... 127 160

Investment provisions ................................................... 261 226

IPR&D, goodwill, and purchased intangible assets ............................. 119 106

Deferred revenue ....................................................... 1,618 1,634

Credits and net operating loss carryforwards .................................. 721 713

Share-based compensation expense ......................................... 1,059 1,084

Accrued compensation ................................................... 481 507

Other ................................................................. 583 590

Gross deferred tax assets ............................................. 5,564 5,611

Valuation allowance ................................................. (60) (82)

Total deferred tax assets .............................................. 5,504 5,529

LIABILITIES

Purchased intangible assets ............................................... (809) (997)

Depreciation ........................................................... (131) (298)

Unrealized gains on investments ........................................... (222) (265)

Other ................................................................. (34) (90)

Total deferred tax liabilities ........................................... (1,196) (1,650)

Total net deferred tax assets ....................................... $ 4,308 $ 3,879

128