Cisco 2012 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2012 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

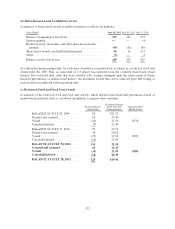

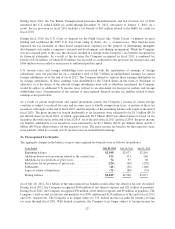

17. Net Income per Share

The following table presents the calculation of basic and diluted net income per share (in millions, except

per-share amounts):

Years Ended July 28, 2012 July 30, 2011 July 31, 2010

Net income ..................................... $8,041 $6,490 $7,767

Weighted-average shares—basic .................... 5,370 5,529 5,732

Effect of dilutive potential common shares ............ 34 34 116

Weighted-average shares—diluted ................... 5,404 5,563 5,848

Net income per share—basic ....................... $ 1.50 $ 1.17 $ 1.36

Net income per share—diluted ...................... $ 1.49 $ 1.17 $ 1.33

Antidilutive employee share-based awards, excluded .... 591 379 344

Employee equity share options, unvested shares, and similar equity instruments granted by the Company are

treated as potential common shares outstanding in computing diluted earnings per share. Diluted shares

outstanding include the dilutive effect of in-the-money options, unvested restricted stock, and restricted stock

units. The dilutive effect of such equity awards is calculated based on the average share price for each fiscal

period using the treasury stock method. Under the treasury stock method, the amount the employee must pay for

exercising stock options, the amount of compensation cost for future service that the Company has not yet

recognized, and the amount of tax benefits that would be recorded in additional paid-in capital when the award

becomes deductible are collectively assumed to be used to repurchase shares.

131