Cisco 2012 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2012 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

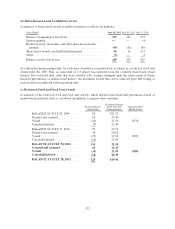

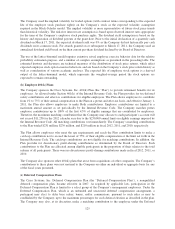

As of July 28, 2012, the Company’s federal, state, and foreign net operating loss carryforwards for income tax

purposes were $321 million, $1.5 billion, and $240 million, respectively. A significant amount of the federal net

operating loss carryforwards relate to acquisitions and, as a result, is limited in the amount that can be recognized

in any one year. If not utilized, the federal net operating loss will begin to expire in fiscal 2019 and the foreign

and state net operating loss carryforwards will begin to expire in fiscal 2013. The Company has provided a

valuation allowance of $55 million for deferred tax assets related to foreign net operating losses that are not

expected to be realized.

As of July 28, 2012, the Company’s federal, state and foreign tax credit carryforwards for income tax purposes

were approximately $6 million, $562 million and $4 million, respectively. The federal and foreign tax credit

carryforwards will begin to expire in fiscal 2019 and 2027, respectively. The majority of state tax credits can be

carried forward indefinitely.

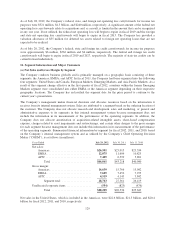

16. Segment Information and Major Customers

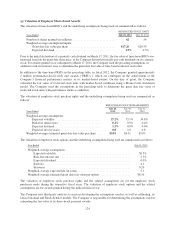

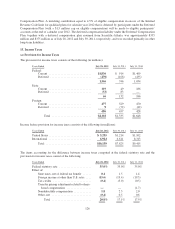

(a) Net Sales and Gross Margin by Segment

The Company conducts business globally and is primarily managed on a geographic basis consisting of three

segments: the Americas; EMEA; and APJC. In fiscal 2011, the Company had been organized into the following

four segments: United States and Canada, European Markets, Emerging Markets, and Asia Pacific Markets. As a

result of this segment change effective in the first quarter of fiscal 2012, countries within the former Emerging

Markets segment were consolidated into either EMEA or the Americas segment depending on their respective

geographic locations. The Company has reclassified the segment data for the prior period to conform to the

current year’s presentation.

The Company’s management makes financial decisions and allocates resources based on the information it

receives from its internal management system. Sales are attributed to a segment based on the ordering location of

the customer. The Company does not allocate research and development, sales and marketing, or general and

administrative expenses to its segments in this internal management system because management does not

include the information in its measurement of the performance of the operating segments. In addition, the

Company does not allocate amortization of acquisition-related intangible assets, share-based compensation

expense, charges related to asset impairments and restructurings, and certain other charges to the gross margin

for each segment because management does not include this information in its measurement of the performance

of the operating segments. Summarized financial information by segment for fiscal 2012, 2011, and 2010, based

on the Company’s internal management system and as utilized by the Company’s Chief Operating Decision

Maker (“CODM”), is as follows (in millions):

Years Ended July 28, 2012 July 30, 2011 July 31, 2010

Net sales:

Americas ............................ $26,501 $25,015 $23,334

EMEA .............................. 12,075 11,604 10,825

APJC ............................... 7,485 6,599 5,881

Total ........................... $46,061 $43,218 $40,040

Gross margin:

Americas ............................ 16,639 15,766 15,042

EMEA .............................. 7,605 7,452 7,235

APJC ............................... 4,519 4,143 3,842

Segment total .................... 28,763 27,361 26,119

Unallocated corporate items ................. (554) (825) (476)

Total ........................... $28,209 $26,536 $25,643

Net sales in the United States, which is included in the Americas, were $22.6 billion, $21.5 billion, and $20.4

billion for fiscal 2012, 2011, and 2010, respectively.

129