Cisco 2012 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2012 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

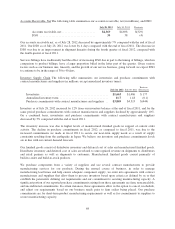

Deferred Revenue Related to Financing Receivables and Guarantees The majority of the deferred revenue in the

preceding table is related to financed service contracts. The majority of the revenue related to financed service

contracts, which primarily relates to technical support services, is deferred as the revenue related to financed

service contracts is recognized ratably over the period during which the related services are to be performed. A

portion of the revenue related to lease and loan receivables is also deferred and included in deferred product

revenue based on revenue recognition criteria not currently having been met.

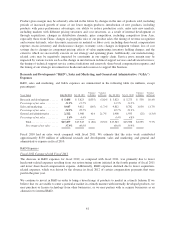

Borrowings

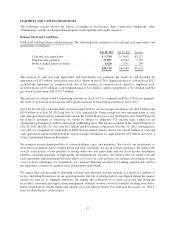

Senior Notes The following table summarizes the principal amount of our senior notes (in millions):

July 28, 2012 July 30, 2011

Senior notes:

Floating-rate notes, due 2014 ........................ $ 1,250 $ 1,250

1.625% fixed-rate notes, due 2014 .................... 2,000 2,000

2.90% fixed-rate notes, due 2014 ..................... 500 500

5.50% fixed-rate notes, due 2016 ..................... 3,000 3,000

3.15% fixed-rate notes, due 2017 ..................... 750 750

4.95% fixed-rate notes, due 2019 ..................... 2,000 2,000

4.45% fixed-rate notes, due 2020 ..................... 2,500 2,500

5.90% fixed-rate notes, due 2039 ..................... 2,000 2,000

5.50% fixed-rate notes, due 2040 ..................... 2,000 2,000

Total ....................................... $16,000 $16,000

Interest is payable semiannually on each class of the senior fixed-rate notes, each of which is redeemable by us at

any time, subject to a make-whole premium. Interest is payable quarterly on the floating-rate notes. We were in

compliance with all debt covenants as of July 28, 2012.

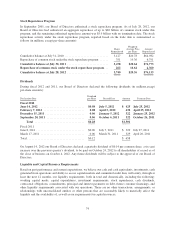

Commercial Paper In fiscal 2011 we established a short-term debt financing program of up to $3.0 billion

through the issuance of commercial paper notes. As of July 28, 2012, we had no commercial paper outstanding

under this program. As of July 30, 2011, we had commercial paper notes of $500 million outstanding under this

program.

Other Notes and Borrowings Other notes and borrowings include notes and credit facilities with a number of

financial institutions that are available to certain of our foreign subsidiaries. The amount of borrowings

outstanding under these arrangements was $31 million and $88 million as of July 28, 2012 and July 30, 2011,

respectively.

Credit Facility On February 17, 2012, we terminated our then-existing credit facility and entered into a credit

agreement with certain institutional lenders that provides for a $3.0 billion unsecured revolving credit facility that

is scheduled to expire on February 17, 2017. Any advances under the credit agreement will accrue interest at

rates that are equal to, based on certain conditions, either (i) the higher of the Federal Funds rate plus 0.50%,

Bank of America’s “prime rate” as announced from time to time or one-month LIBOR plus 1.00%, or (ii) LIBOR

plus a margin that is based on our senior debt credit ratings as published by Standard & Poor’s Financial

Services, LLC and Moody’s Investors Service, Inc. The credit agreement requires that we comply with certain

covenants, including that we maintain an interest coverage ratio as defined in the agreement. As of July 28, 2012,

we were in compliance with the required interest coverage ratio and the other covenants and we had not

borrowed any funds under the credit facility.

We may also, upon the agreement of either the then-existing lenders or additional lenders not currently parties to

the agreement, increase the commitments under the credit facility by up to an additional $2.0 billion and/or

extend the expiration date of the credit facility up to February 17, 2019.

70