Cisco 2012 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2012 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

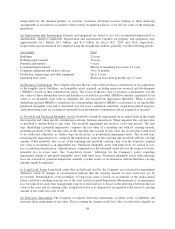

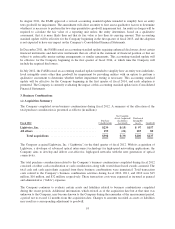

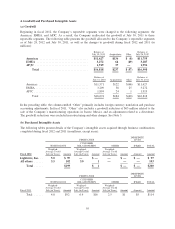

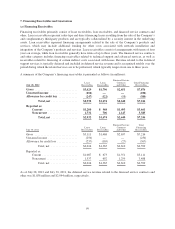

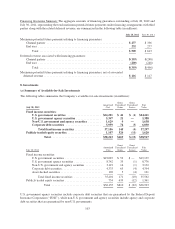

The estimated future amortization expense of purchased intangible assets with finite lives as of July 28, 2012 is

as follows (in millions):

Fiscal Year Amount

2013 .............................................. $ 706

2014 .............................................. 523

2015 .............................................. 444

2016 .............................................. 217

2017 .............................................. 69

Total .......................................... $1,959

5. Restructuring and Other Charges

In fiscal 2011, the Company initiated a number of key targeted actions to address several areas in its business

model. These actions were intended to simplify and focus the Company’s organization and operating model,

align the Company’s cost structure given transitions in the marketplace, divest or exit underperforming

operations, and deliver value to the Company’s shareholders. The Company is taking these actions to align its

business based on its five foundational priorities: leadership in its core business (routing, switching, and

associated services), which includes comprehensive security and mobility solutions; collaboration; data center

virtualization and cloud; video; and architectures for business transformation.

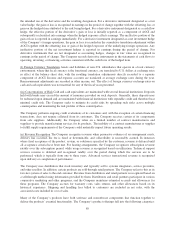

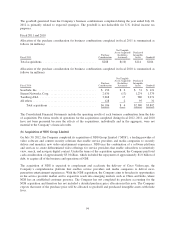

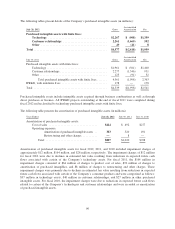

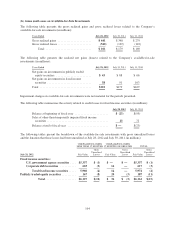

Pursuant to the restructuring that the Company announced in July 2011, the Company has incurred cumulative

charges of approximately $1.0 billion (included as part of the charges discussed below). The Company expects

that the total pretax charges pursuant to these restructuring actions will be approximately $1.1 billion, and it

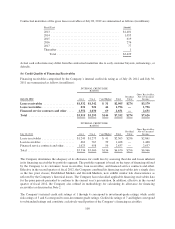

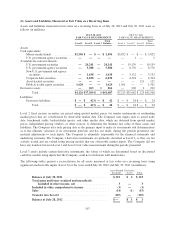

expects the remaining charges to be incurred primarily in the first quarter of fiscal 2013. The following table

summarizes the activities related to the restructuring and other charges pursuant to the Company’s July 2011

announcement related to the realignment and restructuring of the Company’s business as well as certain

consumer product lines as announced during April 2011 (in millions):

Voluntary Early

Retirement Program

Employee

Severance

Goodwill and

Intangible Assets Other Total

Gross charges in fiscal 2011 ....................... $453 $247 $ 71 $ 28 $799

Cash payments ................................. (436) (13) — — (449)

Non-cash items ................................. — — (71) (17) (88)

Balance as of July 30, 2011 ....................... 17 234 — 11 262

Gross charges in fiscal 2012 ...................... — 299 — 54 353

Change in estimate related to fiscal 2011 charges .... — (49) — — (49)

Cash payments ................................ (17) (401) — (18) (436)

Non-cash items ................................ — — — (20) (20)

Balance as of July 28, 2012 ....................... $ — $ 83 $ — $ 27 $ 110

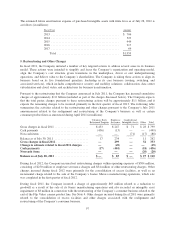

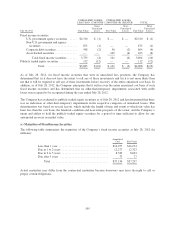

During fiscal 2012, the Company incurred net restructuring charges within operating expenses of $304 million,

consisting of $250 million of employee severance charges and $54 million of other restructuring charges. Other

charges incurred during fiscal 2012 were primarily for the consolidation of excess facilities, as well as an

incremental charge related to the sale of the Company’s Juarez, Mexico manufacturing operations, which sale

was completed in the first quarter of fiscal 2012.

During fiscal 2011, the Company incurred a charge of approximately $63 million related to a reduction to

goodwill as a result of the sale of its Juarez manufacturing operations and also recorded an intangible asset

impairment of $8 million in connection with the restructuring of the Company’s consumer business related to the

exit of the Flip Video camera product line. See Note 4. Other charges incurred during fiscal 2011 were primarily

related to the consolidation of excess facilities and other charges associated with the realignment and

restructuring of the Company’s consumer business.

97