Cisco 2012 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2012 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

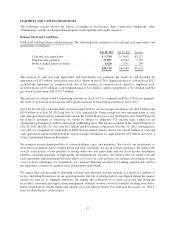

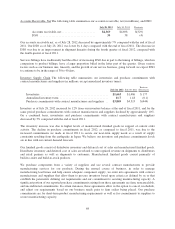

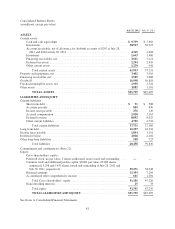

Deferred Revenue The following table presents the breakdown of deferred revenue (in millions):

July 28, 2012 July 30, 2011

Increase

(Decrease)

Service ................................... $ 9,173 $ 8,521 $ 652

Product ................................... 3,707 3,686 21

Total ............................. $12,880 $12,207 $ 673

Reported as:

Current ............................... $ 8,852 $ 8,025 $ 827

Noncurrent ............................ 4,028 4,182 (154)

Total ............................. $12,880 $12,207 $ 673

The 8% increase in deferred service revenue in fiscal 2012 reflects the impact of new contract initiations and

renewals, partially offset by the ongoing amortization of deferred service revenue. The slight increase in deferred

product revenue was due to increased deferrals related to subscription revenue arrangements and, to a lesser

extent, higher two-tier deferred revenue which was due to improved shipment linearity to two-tier partners during

the fourth quarter of fiscal 2012. This increase was partially offset by decreased deferred revenue related to our

financing arrangements.

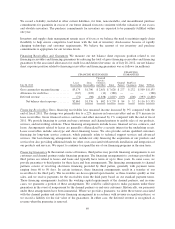

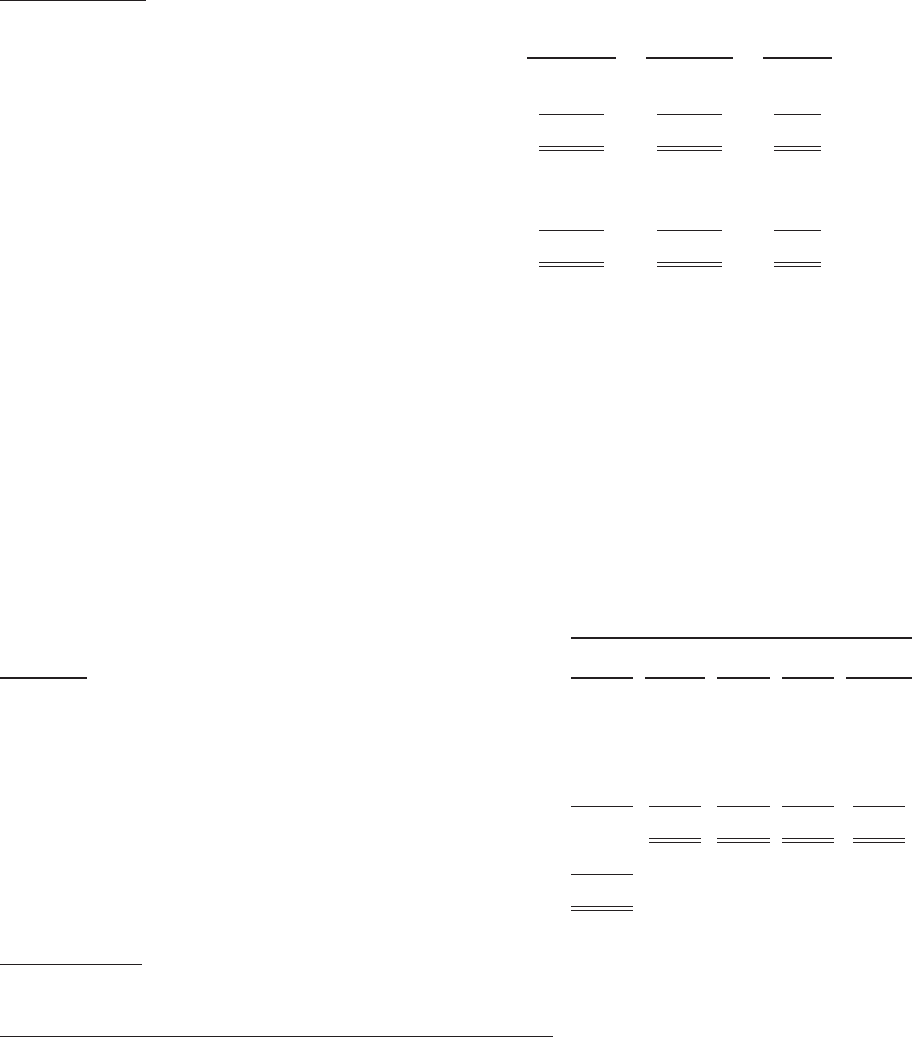

Contractual Obligations

The impact of contractual obligations on our liquidity and capital resources in future periods should be analyzed

in conjunction with the factors that impact our cash flows from operations discussed previously. In addition, we

plan for and measure our liquidity and capital resources through an annual budgeting process. The following

table summarizes our contractual obligations at July 28, 2012 (in millions):

PAYMENTS DUE BY PERIOD

July 28, 2012 Total

Less than

1 Year

1to3

Years

3to5

Years

More than

5 Years

Operating leases ............................................. $ 1,139 $ 328 $ 442 $ 167 $ 202

Purchase commitments with contract manufacturers and suppliers ...... 3,869 3,869 — — —

Other purchase obligations ..................................... 1,460 501 808 151 —

Long-term debt .............................................. 16,010 — 3,760 3,750 8,500

Other long-term liabilities ..................................... 425 — 88 40 297

Total by period .......................................... $22,903 $4,698 $5,098 $4,108 $8,999

Other long-term liabilities (uncertainty in the timing of future payments) . . . 1,977

Total .............................................. $24,880

Operating Leases For more information on our operating leases, see Note 12 to the Consolidated Financial

Statements.

Purchase Commitments with Contract Manufacturers and Suppliers We purchase components from a variety of

suppliers and use several contract manufacturers to provide manufacturing services for our products. A

significant portion of our reported estimated purchase commitments arising from these agreements are firm,

noncancelable, and unconditional commitments. We record a liability for firm, noncancelable, and unconditional

purchase commitments for quantities in excess of our future demand forecasts consistent with the valuation of

our excess and obsolete inventory. See further discussion in “Inventory Supply Chain.” As of July 28, 2012, the

liability for these purchase commitments was $193 million and is recorded in other current liabilities and is not

included in the preceding table.

71