Cisco 2012 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2012 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

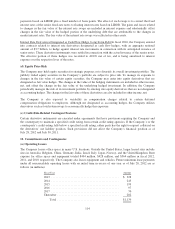

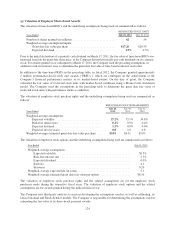

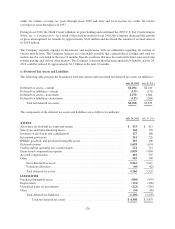

(g) Valuation of Employee Share-Based Awards

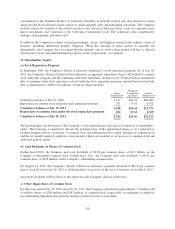

The valuation of time-based RSU’s and the underlying assumptions being used are summarized as follows:

RESTRICTED STOCK UNITS

Years Ended July 28, 2012 July 30, 2011

Number of shares granted (in millions) ............................ 62 54

Weighted-average assumptions/inputs:

Grant date fair value per share ............................... $17.26 $20.59

Expected dividend ........................................ 1.5% 0.3%

Prior to the initial declaration of a quarterly cash dividend on March 17, 2011, the fair value of time-based RSUs was

measured based on the grant date share price, as the Company did not historically pay cash dividends on its common

stock. For awards granted on or subsequent to March 17, 2011, the Company used the preceding assumptions, in

addition to risk-free interest rates, to determine the grant date fair value of time-based restricted stock units.

In addition to the time-based RSUs in the preceding table, in fiscal 2012, the Company granted approximately

2 million performance-based stock unit awards (“PRSUs”), which are contingent on the achievement of the

Company’s financial performance metrics or its market-based returns. On the date of grant, the Company

estimated the fair value of restricted stock units with market-based conditions using a Monte Carlo simulation

model. The Company used the assumptions in the preceding table to determine the grant date fair value of

restricted stock units with performance metrics conditions.

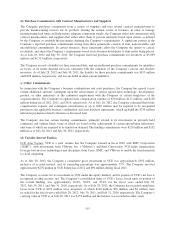

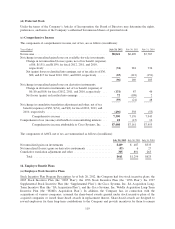

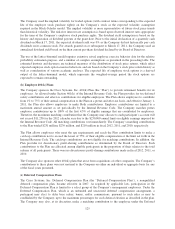

The valuation of employee stock purchase rights and the underlying assumptions being used are summarized as

follows:

EMPLOYEE STOCK PURCHASE RIGHTS

Years Ended

July 28,

2012

July 30,

2011

July 31,

2010

Weighted-average assumptions:

Expected volatility ............................... 27.2% 35.1% 34.8%

Risk-free interest rate ............................. 0.2% 0.9% 0.4%

Expected dividend ................................ 1.5% 0.0% 0.0%

Expected life (in years) ............................ 0.8 1.8 0.8

Weighted-average estimated grant date fair value per share . . . $3.81 $6.31 $5.03

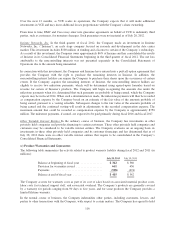

The valuation of employee stock options and the underlying assumptions being used are summarized as follows:

Year Ended July 31, 2010

Weighted-average assumptions:

Expected volatility .................................................. 30.5%

Risk-free interest rate ................................................ 2.3%

Expected dividend .................................................. 0.0%

Kurtosis .......................................................... 4.1

Skewness ......................................................... 0.20

Weighted-average expected life (in years) ................................... 5.1

Weighted-average estimated grant date fair value per option ..................... $6.50

The valuation of employee stock purchase rights and the related assumptions are for the employee stock

purchases made during the respective fiscal years. The valuation of employee stock options and the related

assumptions are for awards granted during the indicated fiscal year.

The Company uses third-party analyses to assist in developing the assumptions used in, as well as calibrating, its

lattice-binomial and Black-Scholes models. The Company is responsible for determining the assumptions used in

estimating the fair value of its share-based payment awards.

124