Cisco 2012 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2012 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

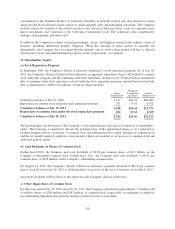

Compensation Plan. A matching contribution equal to 4.5% of eligible compensation in excess of the Internal

Revenue Code limit for qualified plans for calendar year 2012 that is deferred by participants under the Deferred

Compensation Plan (with a $1.5 million cap on eligible compensation) will be made to eligible participants’

accounts at the end of calendar year 2012. The deferred compensation liability under the Deferred Compensation

Plan, together with a deferred compensation plan assumed from Scientific-Atlanta, was approximately $355

million and $375 million as of July 28, 2012 and July 30, 2011, respectively, and was recorded primarily in other

long-term liabilities.

15. Income Taxes

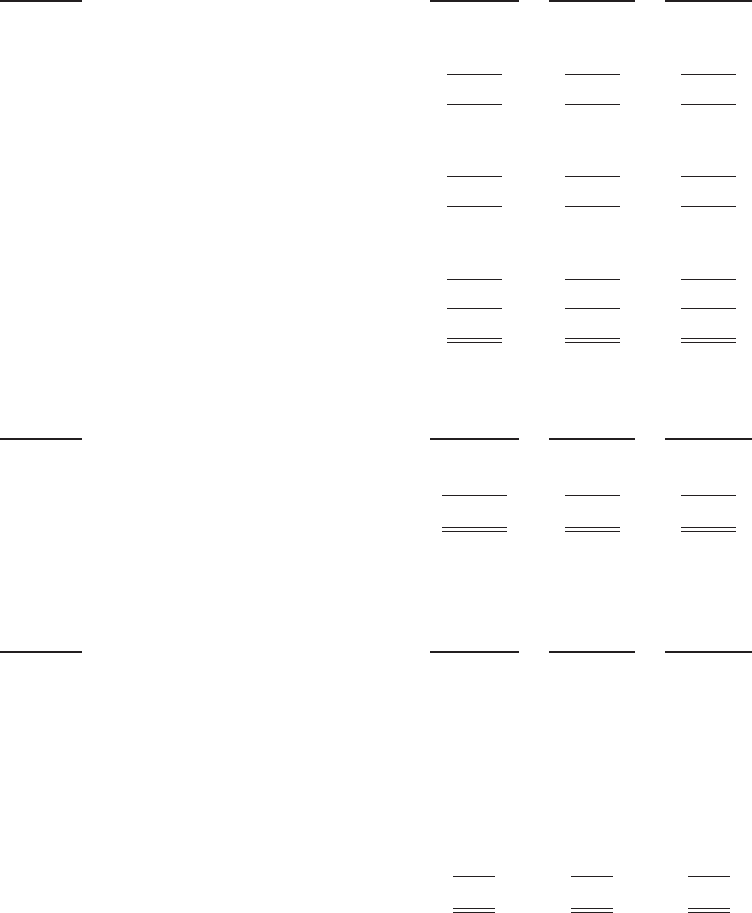

(a) Provision for Income Taxes

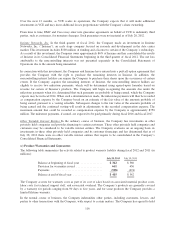

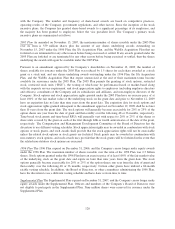

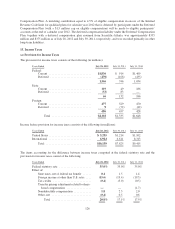

The provision for income taxes consists of the following (in millions):

Years Ended July 28, 2012 July 30, 2011 July 31, 2010

Federal:

Current ............................. $1,836 $ 914 $1,469

Deferred ............................ (270) (168) (435)

1,566 746 1,034

State:

Current ............................. 119 49 186

Deferred ............................ (53) 83 —

66 132 186

Foreign:

Current ............................. 477 529 470

Deferred ............................ 9(72) (42)

486 457 428

Total ........................... $2,118 $1,335 $1,648

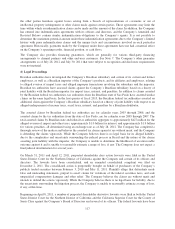

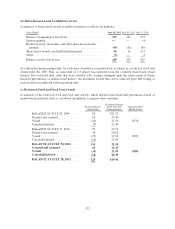

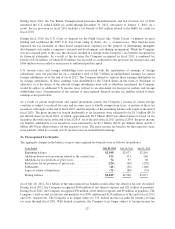

Income before provision for income taxes consists of the following (in millions):

Years Ended July 28, 2012 July 30, 2011 July 31, 2010

United States ............................. $ 3,235 $1,214 $1,102

International ............................. 6,924 6,611 8,313

Total ............................... $10,159 $7,825 $9,415

The items accounting for the difference between income taxes computed at the federal statutory rate and the

provision for income taxes consist of the following:

Years Ended July 28, 2012 July 30, 2011 July 31, 2010

Federal statutory rate ...................... 35.0% 35.0% 35.0%

Effect of:

State taxes, net of federal tax benefit ...... 0.4 1.5 1.4

Foreign income at other than U.S. rates .... (15.6) (19.4) (19.3)

Tax credits .......................... (0.4) (3.0) (0.5)

Transfer pricing adjustment related to share-

based compensation ................. —— (1.7)

Nondeductible compensation ............ 1.8 2.5 2.0

Other, net ........................... (0.4) 0.5 0.6

Total ........................... 20.8% 17.1% 17.5%

126