Cisco 2012 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2012 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

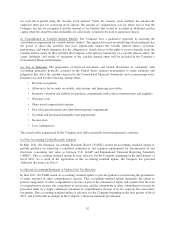

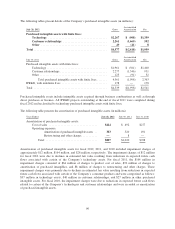

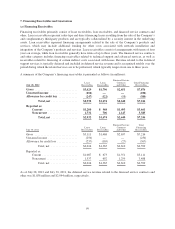

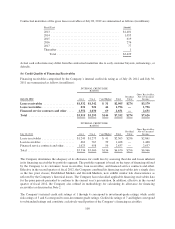

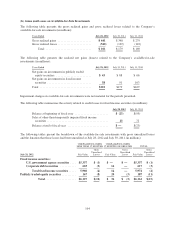

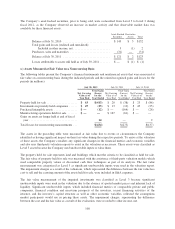

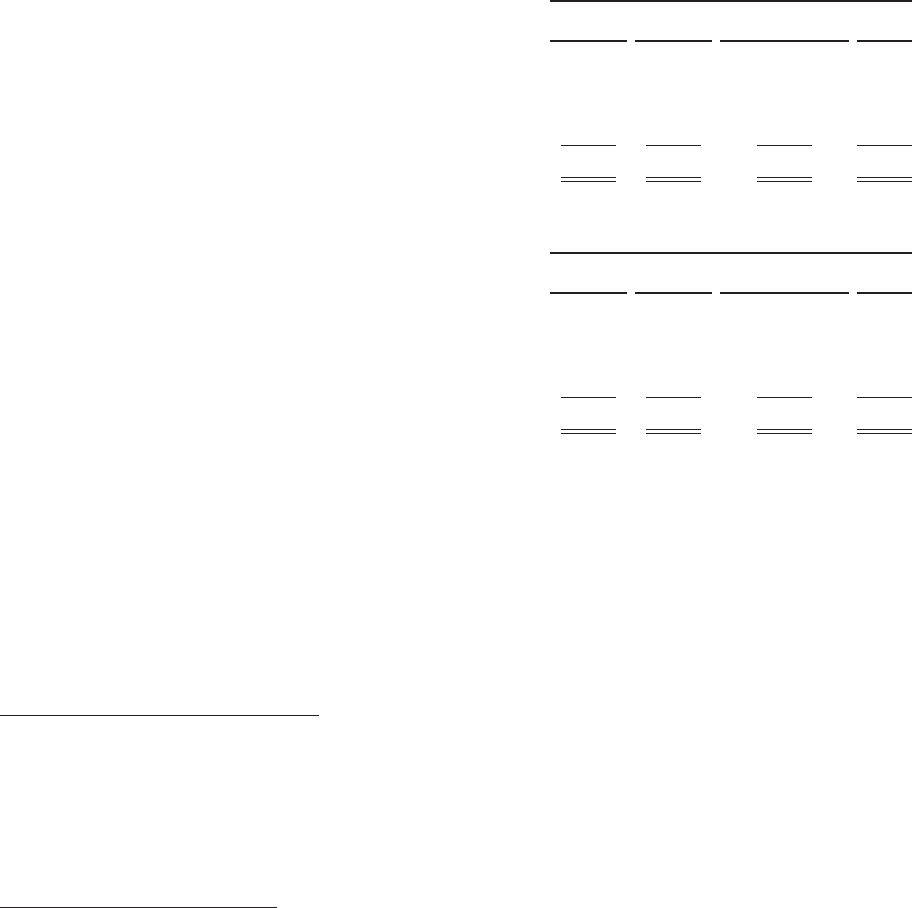

(c) Allowance for Credit Loss Rollforward

The allowances for credit loss and the related financing receivables are summarized as follows (in millions):

CREDIT LOSS ALLOWANCES

Lease

Receivables

Loan

Receivables

Financed Service

Contracts and Other Total

Allowance for credit loss as of July 30, 2011 ................ $ 237 $ 103 $ 27 $ 367

Provisions ............................................. 22 22 (13) 31

Write-offs net of recoveries .............................. (2) — (1) (3)

Foreign exchange and other .............................. (10) (3) (2) (15)

Allowance for credit loss as of July 28, 2012 ................ $ 247 $ 122 $ 11 $ 380

Gross receivables as of July 28, 2012, net of unearned income .. $3,179 $1,796 $2,651 $7,626

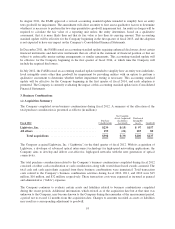

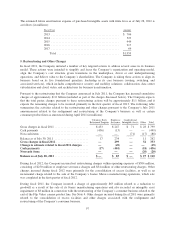

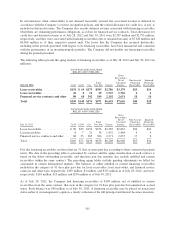

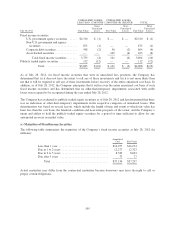

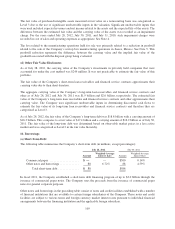

CREDIT LOSS ALLOWANCES

Lease

Receivables

Loan

Receivables

Financed Service

Contracts and Other Total

Allowance for credit loss as of July 31, 2010 .................. $ 207 $ 73 $ 21 $ 301

Provisions ............................................. 31 43 8 82

Write-offs net of recoveries ............................... (13) (18) (2) (33)

Foreign exchange and other ............................... 12 5 — 17

Allowance for credit loss as of July 30, 2011 .................. $ 237 $ 103 $ 27 $ 367

Gross receivables as of July 30, 2011, net of unearned income .... $2,861 $1,468 $2,637 $6,966

Financing receivables that were individually evaluated for impairment during the fiscal years presented were not

material and therefore are not presented separately in the preceding table.

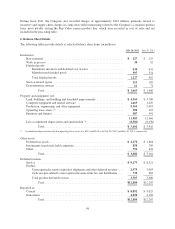

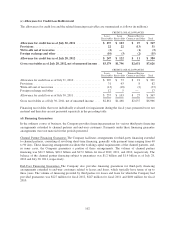

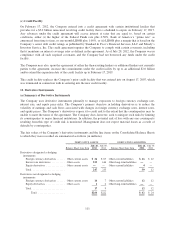

(d) Financing Guarantees

In the ordinary course of business, the Company provides financing guarantees for various third-party financing

arrangements extended to channel partners and end-user customers. Payments under these financing guarantee

arrangements were not material for the periods presented.

Channel Partner Financing Guarantees The Company facilitates arrangements for third-party financing extended

to channel partners, consisting of revolving short-term financing, generally with payment terms ranging from 60

to 90 days. These financing arrangements facilitate the working capital requirements of the channel partners, and,

in some cases, the Company guarantees a portion of these arrangements. The volume of channel partner

financing was $21.3 billion, $18.2 billion and $17.2 billion for fiscal 2012, 2011, and 2010, respectively. The

balance of the channel partner financing subject to guarantees was $1.2 billion and $1.4 billion as of July 28,

2012 and July 30, 2011, respectively.

End-User Financing Guarantees The Company also provides financing guarantees for third-party financing

arrangements extended to end-user customers related to leases and loans, which typically have terms of up to

three years. The volume of financing provided by third parties for leases and loans for which the Company had

provided guarantees was $227 million for fiscal 2012, $247 million for fiscal 2011 and $180 million for fiscal

2010.

102