Cisco 2012 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2012 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Fiscal 2011 Compared with Fiscal 2010

For fiscal 2011, as compared with fiscal 2010, net sales increased by 8%. Within total net sales growth, net

product sales increased by 6%, while service revenue increased by 14%. Our product and service revenue totals

each reflected sales growth across each of our geographic segments. The sales increase was due to customer

acceptance of the new product transitions taking place in our core switching and routing businesses, sales growth

in our Collaboration, Data Center, Wireless, and Service Provider Video product categories and the strong

performance of our services solutions.

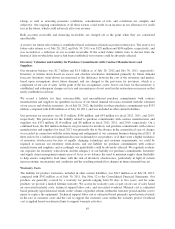

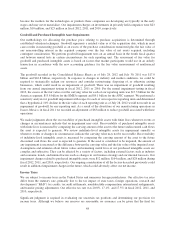

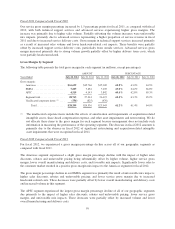

Net Product Sales by Segment

The following table presents the breakdown of net product sales by segment (in millions, except percentages):

Years Ended July 28, 2012 July 30, 2011

Variance

in Dollars

Variance

in Percent July 30, 2011 July 31, 2010

Variance

in Dollars

Variance

in Percent

Net product sales:

Americas .................... $20,168 $19,292 $ 876 4.5% $19,292 $18,240 $1,052 5.8%

Percentage of net product sales ... 55.5% 55.9% 55.9% 56.3%

EMEA ...................... 10,024 9,788 236 2.4% 9,788 9,223 565 6.1%

Percentage of net product sales ... 27.6% 28.3% 28.3% 28.4%

APJC ....................... 6,134 5,446 688 12.6% 5,446 4,957 489 9.9%

Percentage of net product sales ... 16.9% 15.8% 15.8% 15.3%

Total .................. $36,326 $34,526 $1,800 5.2% $34,526 $32,420 $2,106 6.5%

Americas

Fiscal 2012 Compared with Fiscal 2011

For fiscal 2012, as compared with fiscal 2011, net product sales in the Americas segment increased by 5%. The

increase in net product sales was across most of our customer markets in the Americas segment, led by growth in

the enterprise, service provider and commercial markets. We experienced a net product sales decline in the public

sector market for the fiscal year. Within the Americas segment, net product sales to the U.S. public sector were

flat, as lower net product sales to the U.S. federal government were offset by higher net product sales to state and

local government. From a country perspective, net product sales increased by 4% in the United States, 10% in

Canada, 21% in Mexico, and 14% in Brazil.

Fiscal 2011 Compared with Fiscal 2010

For fiscal 2011, as compared with fiscal 2010, net product sales in the Americas segment increased by 6%. Net

product sales increased 3% in the United States, 31% in Canada, 20% in Brazil, and 8% in Mexico. The increase

in net product sales was across all of our customer markets in the Americas segment, led by the net product sales

growth in our commercial market, followed by smaller increases in net product sales growth in the service

provider, enterprise, and public sector markets. Net product sales to the U.S. public sector decreased due to a

decrease in sales to the U.S. federal government, while sales to the state and local government market were flat.

EMEA

Fiscal 2012 Compared with Fiscal 2011

For fiscal 2012, as compared with fiscal 2011, net product sales in the EMEA segment increased by 2%. The

increase in net product sales was across most of our customer markets in the EMEA segment, led by growth in

the commercial, enterprise and public sector markets. We experienced a slight decline in net product sales in the

service provider customer market during the fiscal year driven by lower revenue from this customer market in

several of the large countries in the region. From a country perspective, net product sales increased by 11% in the

United Kingdom, 15% in Russia, and 9% in the Netherlands. These increases were partially offset by net product

sales declines of 23% in Italy, 21% in Spain, 2% in Germany, and 1% in France.

51