Cisco 2012 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2012 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

Our financial position is exposed to a variety of risks, including interest rate risk, equity price risk, and foreign

currency exchange risk.

Interest Rate Risk

Fixed Income Securities We maintain an investment portfolio of various holdings, types, and maturities. Our

primary objective for holding fixed income securities is to achieve an appropriate investment return consistent

with preserving principal and managing risk. At any time, a sharp rise in market interest rates could have a

material adverse impact on the fair value of our fixed income investment portfolio. Conversely, declines in

interest rates, including the impact from lower credit spreads, could have a material adverse impact on interest

income for our investment portfolio. We may utilize derivative instruments designated as hedging instruments to

achieve our investment objectives. We had no outstanding hedging instruments for our fixed income securities as

of July 28, 2012. Our fixed income investments are held for purposes other than trading. Our fixed income

investments are not leveraged as of July 28, 2012. We monitor our interest rate and credit risks, including our

credit exposures to specific rating categories and to individual issuers. As of July 28, 2012, approximately 80%

of our fixed income securities balance consists of U.S. government and U.S. government agency securities. We

believe the overall credit quality of our portfolio is strong.

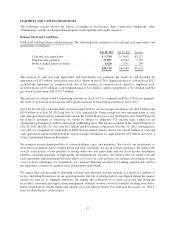

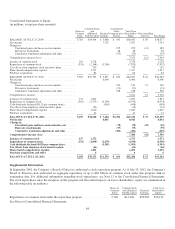

The following tables present the hypothetical fair values of our fixed income securities, including the hedging

effects when applicable, as a result of selected potential market decreases and increases in interest rates. The

market changes reflect immediate hypothetical parallel shifts in the yield curve of plus or minus 50 basis points

(“BPS”), plus 100 BPS, and plus 150 BPS. Due to the low interest rate environment at the end of each of fiscal

2012 and fiscal 2011, we did not believe a parallel shift of minus 100 BPS or minus 150 BPS was relevant. The

hypothetical fair values as of July 28, 2012 and July 30, 2011 are as follows (in millions):

VALUATION OF SECURITIES

GIVEN AN INTEREST RATE

DECREASE OF X BASIS POINTS

FAIR VALUE

AS OF

JULY 28,

2012

VALUATION OF SECURITIES

GIVEN AN INTEREST RATE

INCREASE OF X BASIS POINTS

(150 BPS) (100 BPS) (50 BPS) 50 BPS 100 BPS 150 BPS

Fixed income securities ........ N/A N/A $37,483 $37,297 $37,111 $36,924 $36,737

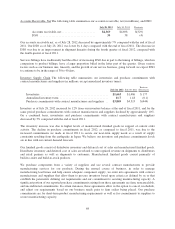

VALUATION OF SECURITIES

GIVEN AN INTEREST RATE

DECREASE OF X BASIS POINTS FAIR VALUE

AS OF

JULY 30, 2011

VALUATION OF SECURITIES

GIVEN AN INTEREST RATE

INCREASE OF X BASIS POINTS

(150 BPS) (100 BPS) (50 BPS) 50 BPS 100 BPS 150 BPS

Fixed income securities ........ N/A N/A $35,740 $35,562 $35,384 $35,206 $35,029

Impairment charges on our investments in fixed income securities were not material for fiscal 2012, 2011, or

2010.

Debt As of July 28, 2012, we had $16.0 billion in principal amount of senior notes outstanding, which consisted

of $1.25 billion floating-rate notes and $14.75 billion fixed-rate notes. The carrying amount of the senior notes

was $16.3 billion, and the related fair value was $18.8 billion, which fair value is based on market prices. As of

July 28, 2012, a hypothetical 50 BPS increase or decrease in market interest rates would change the fair value of

the fixed-rate debt, excluding the $4.25 billion of hedged debt, by a decrease or increase of $0.6 billion,

respectively. However, this hypothetical change in interest rates would not impact the interest expense on the

fixed-rate debt, which is not hedged.

75