Cisco 2012 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2012 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Equity Price Risk

The fair value of our equity investments in publicly traded companies is subject to market price volatility. We

may hold equity securities for strategic purposes or to diversify our overall investment portfolio. Our equity

portfolio consists of securities with characteristics that most closely match the Standard & Poor’s 500 Index or

NASDAQ Composite Index. These equity securities are held for purposes other than trading. To manage our

exposure to changes in the fair value of certain equity securities, we may enter into equity derivatives designated

as hedging instruments.

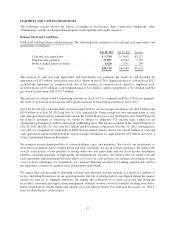

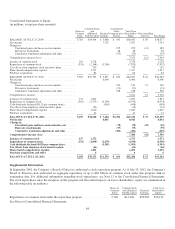

Publicly Traded Equity Securities The following tables present the hypothetical fair values of publicly traded

equity securities as a result of selected potential decreases and increases in the price of each equity security in the

portfolio, excluding hedged equity securities, if any. Potential fluctuations in the price of each equity security in

the portfolio of plus or minus 10%, 20%, and 30% were selected based on potential near-term changes in those

security prices. The hypothetical fair values as of July 28, 2012 and July 30, 2011 are as follows (in millions):

VALUATION OF

SECURITIES

GIVEN AN X%

DECREASE IN

EACH STOCK’S PRICE

FAIR VALUE

AS OF

JULY 28,

2012

VALUATION OF

SECURITIES

GIVEN AN X%

INCREASE IN

EACH STOCK’S PRICE

(30)% (20)% (10)% 10% 20% 30%

Publicly traded equity securities ......... $944 $1,078 $1,213 $1,348 $1,483 $1,618 $1,752

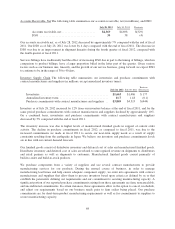

VALUATION OF

SECURITIES

GIVEN AN X%

DECREASE IN

EACH STOCK’S PRICE

FAIR VALUE

AS OF

JULY 30,

2011

VALUATION OF

SECURITIES

GIVEN AN X%

INCREASE IN

EACH STOCK’S PRICE

(30)% (20)% (10)% 10% 20% 30%

Publicly traded equity securities ......... $953 $1,089 $1,225 $1,361 $1,497 $1,633 $1,769

Impairment charges on our investments in publicly traded equity securities were not material during the fiscal

years presented.

Investments in Privately Held Companies We have also invested in privately held companies. These investments

are recorded in other assets in our Consolidated Balance Sheets and are accounted for using primarily either the

cost or the equity method. As of July 28, 2012, the total carrying amount of our investments in privately held

companies was $858 million, compared with $796 million at July 30, 2011. Some of the privately held

companies in which we invested are in the startup or development stages. These investments are inherently risky

because the markets for the technologies or products these companies are developing are typically in the early

stages and may never materialize. We could lose our entire investment in these companies. Our evaluation of

investments in privately held companies is based on the fundamentals of the businesses invested in, including,

among other factors, the nature of their technologies and potential for financial return. Our impairment charges

on investments in privately held companies were $23 million, $10 million, and $25 million for fiscal 2012, 2011,

and 2010, respectively.

76