Cisco 2012 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2012 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

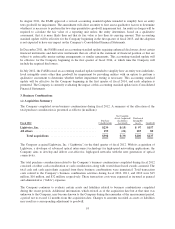

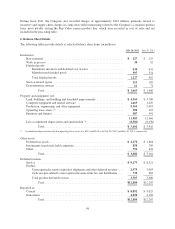

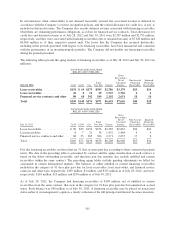

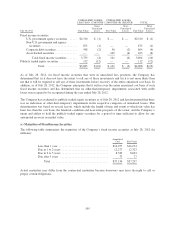

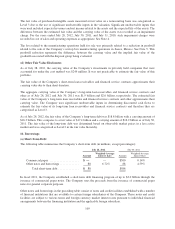

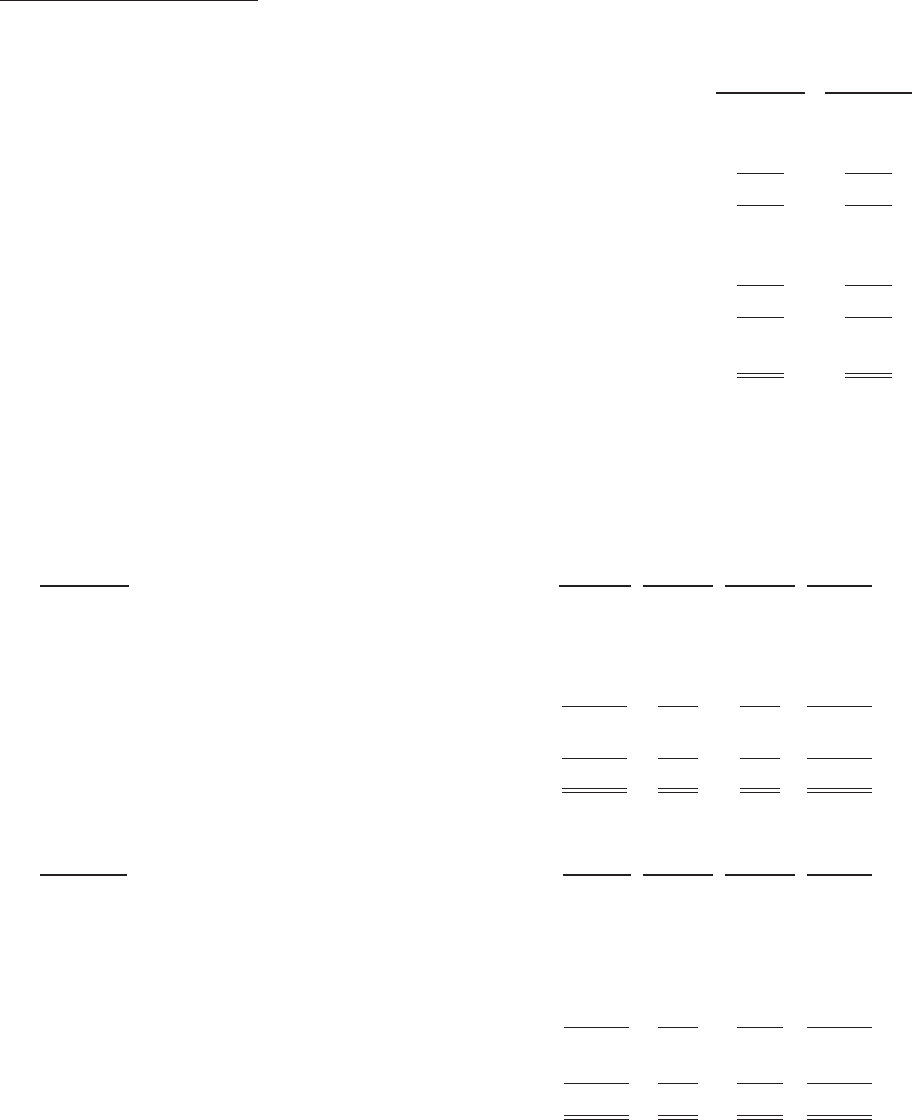

Financing Guarantee Summary The aggregate amounts of financing guarantees outstanding at July 28, 2012 and

July 30, 2011, representing the total maximum potential future payments under financing arrangements with third

parties along with the related deferred revenue, are summarized in the following table (in millions):

July 28, 2012 July 30, 2011

Maximum potential future payments relating to financing guarantees:

Channel partner .................................................... $ 277 $ 336

End user .......................................................... 232 277

Total ......................................................... $ 509 $ 613

Deferred revenue associated with financing guarantees:

Channel partner .................................................... $(193) $(248)

End user .......................................................... (200) (248)

Total ......................................................... $(393) $(496)

Maximum potential future payments relating to financing guarantees, net of associated

deferred revenue ...................................................... $ 116 $ 117

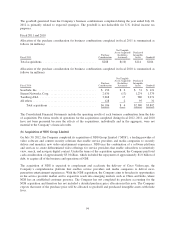

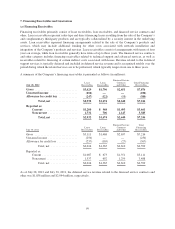

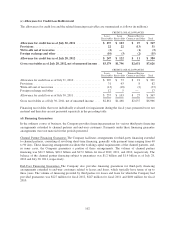

8. Investments

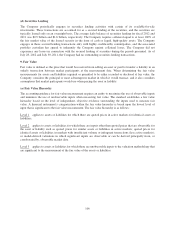

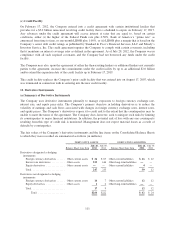

(a) Summary of Available-for-Sale Investments

The following tables summarize the Company’s available-for-sale investments (in millions):

July 28, 2012

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Fair

Value

Fixed income securities:

U.S. government securities ....................... $24,201 $ 41 $ (1) $24,241

U.S. government agency securities ................. 5,367 21 — 5,388

Non-U.S. government and agency securities ......... 1,629 9 — 1,638

Corporate debt securities ........................ 5,959 74 (3) 6,030

Total fixed income securities .................. 37,156 145 (4) 37,297

Publicly traded equity securities ....................... 1,107 524 (11) 1,620

Total .................................. $38,263 $669 $ (15) $38,917

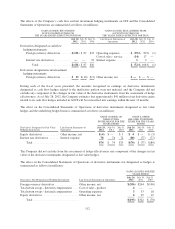

July 30, 2011

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Fair

Value

Fixed income securities:

U.S. government securities ......................... $19,087 $ 52 $ — $19,139

U.S. government agency securities ................... 8,742 35 (1) 8,776

Non-U.S. government and agency securities ........... 3,119 14 (1) 3,132

Corporate debt securities ........................... 4,333 65 (4) 4,394

Asset-backed securities ............................ 120 5 (4) 121

Total fixed income securities ................... 35,401 171 (10) 35,562

Publicly traded equity securities ......................... 734 639 (12) 1,361

Total .................................. $36,135 $810 $ (22) $36,923

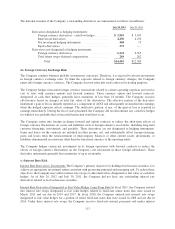

U.S. government agency securities include corporate debt securities that are guaranteed by the Federal Deposit

Insurance Corporation (“FDIC”), while non-U.S. government and agency securities include agency and corporate

debt securities that are guaranteed by non-U.S. governments.

103