Cisco 2012 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2012 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

consolidated in the Northern District of California. Plaintiffs in both the federal and state derivative actions

allege that the Board allowed certain officers to make allegedly false and misleading statements. The complaint

includes claims for violation of the federal securities laws, breach of fiduciary duties, waste of corporate assets,

unjust enrichment, and violations of the California Corporations Code. The complaint seeks compensatory

damages, disgorgement, and other relief.

In addition, the Company is subject to legal proceedings, claims, and litigation arising in the ordinary course of

business, including intellectual property litigation. While the outcome of these matters is currently not

determinable, the Company does not expect that the ultimate costs to resolve these matters will have a material

adverse effect on its consolidated financial position, results of operations, or cash flows.

13. Shareholders’ Equity

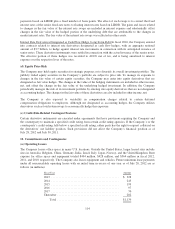

(a) Stock Repurchase Program

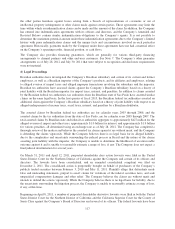

In September 2001, the Company’s Board of Directors authorized a stock repurchase program. As of July 28,

2012, the Company’s Board of Directors had authorized an aggregate repurchase of up to $82 billion of common

stock under this program, and the remaining authorized repurchase amount was $5.9 billion with no termination

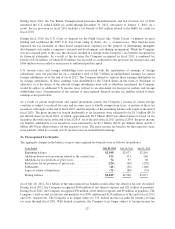

date. A summary of the stock repurchase activity under the stock repurchase program, reported based on the trade

date, is summarized as follows (in millions, except per-share amounts):

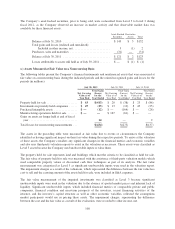

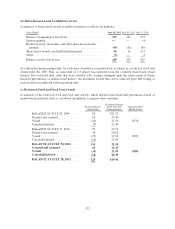

Shares

Repurchased

Weighted-

Average Price

per Share

Amount

Repurchased

Cumulative balance at July 31, 2010 .............................. 3,127 $20.78 $64,982

Repurchase of common stock under the stock repurchase program ...... 351 19.36 6,791

Cumulative balance at July 30, 2011 ............................ 3,478 $20.64 $71,773

Repurchase of common stock under the stock repurchase program .. 262 16.64 4,360

Cumulative balance at July 28, 2012 ............................ 3,740 $20.36 $76,133

The purchase price for the shares of the Company’s stock repurchased is reflected as a reduction to shareholders’

equity. The Company is required to allocate the purchase price of the repurchased shares as (i) a reduction to

retained earnings and (ii) a reduction of common stock and additional paid-in capital. Issuance of common stock

and the tax benefit related to employee stock incentive plans are recorded as an increase to common stock and

additional paid-in capital.

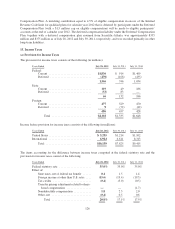

(b) Cash Dividends on Shares of Common Stock

During fiscal 2012, the Company paid cash dividends of $0.28 per common share, or $1.5 billion, on the

Company’s outstanding common stock. During fiscal 2011, the Company paid cash dividends of $0.12 per

common share, or $658 million, on the Company’s outstanding common stock.

On August 14, 2012, the Company’s Board of Directors declared a quarterly dividend of $0.14 per common

share to be paid on October 24, 2012 to all shareholders of record as of the close of business on October 4, 2012.

Any future dividends will be subject to the approval of the Company’s Board of Directors.

(c) Other Repurchases of Common Stock

For the years ended July 28, 2012 and July 30, 2011, the Company repurchased approximately 12 million and

10 million shares, or $200 million and $183 million, of common stock, respectively, in settlement of employee

tax withholding obligations due upon the vesting of restricted stock or stock units.

118