Cisco 2012 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2012 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

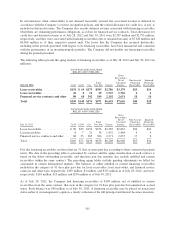

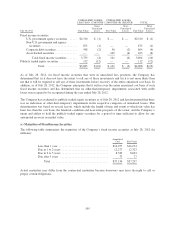

In circumstances when collectability is not deemed reasonably assured, the associated revenue is deferred in

accordance with the Company’s revenue recognition policies, and the related allowance for credit loss, if any, is

included in deferred revenue. The Company also records deferred revenue associated with financing receivables

when there are remaining performance obligations, as it does for financed service contracts. Total allowances for

credit loss and deferred revenue as of July 28, 2012 and July 30, 2011 were $2,387 million and $2,793 million,

respectively, and they were associated with financing receivables (net of unearned income) of $7,626 million and

$6,966 million as of their respective period ends. The losses that the Company has incurred historically,

including in the periods presented with respect to its financing receivables, have been immaterial and consistent

with the performance of an investment-grade portfolio. The Company did not modify any financing receivables

during the periods presented.

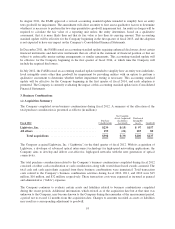

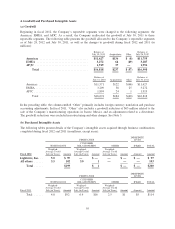

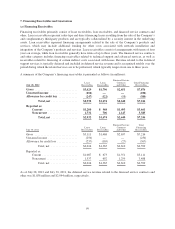

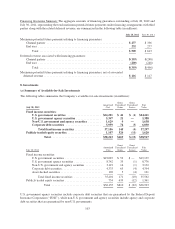

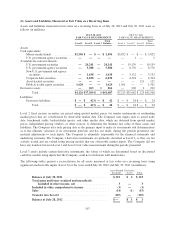

The following tables present the aging analysis of financing receivables as of July 28, 2012 and July 30, 2011 (in

millions):

DAYS PAST DUE (INCLUDES

BILLED AND UNBILLED)

July 28, 2012 31-60 61-90 91+

Total

Past Due Current

Gross

Receivables,

Net of

Unearned

Income

Non-Accrual

Financing

Receivables

Impaired

Financing

Receivables

Lease receivables ................. $151 $ 69 $173 $393 $2,786 $3,179 $23 $14

Loan receivables .................. 10 8 11 29 1,767 1,796 4 4

Financed service contracts and other 89 68 392 549 2,102 2,651 18 10

Total $250 $145 $576 $971 $6,655 $7,626 $45 $28

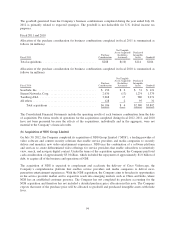

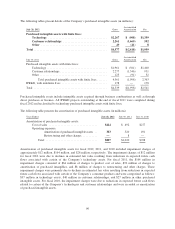

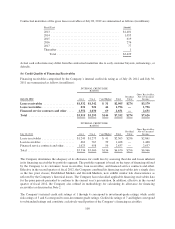

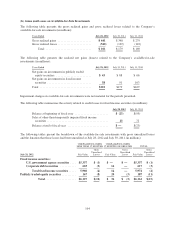

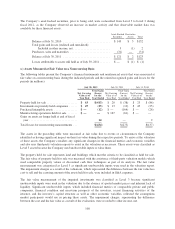

DAYS PAST DUE (INCLUDES

BILLED AND UNBILLED)

July 30, 2011 31-60 61-90 91+

Total

Past Due Current

Gross

Receivables,

Net of

Unearned

Income

Non-Accrual

Financing

Receivables

Impaired

Financing

Receivables

Lease receivables .................. $ 89 $35 $152 $276 $2,585 $2,861 $34 $24

Loan receivables .................. 8 7 21 36 1,432 1,468 4 4

Financed service contracts and other . . . 68 33 265 366 2,271 2,637 17 6

Total ............................ $165 $75 $438 $678 $6,288 $6,966 $55 $34

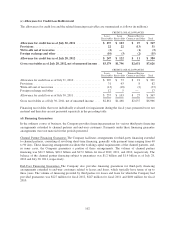

Past due financing receivables are those that are 31 days or more past due according to their contractual payment

terms. The data in the preceding tables is presented by contract and the aging classification of each contract is

based on the oldest outstanding receivable, and therefore past due amounts also include unbilled and current

receivables within the same contract. The preceding aging tables exclude pending adjustments on billed tax

assessment in certain international markets. The balances of either unbilled or current financing receivables

included in the category of 91 days plus past due for lease receivables, loan receivables, and financed service

contracts and other were, respectively, $139 million, $3 million, and $313 million as of July 28, 2012; and were,

respectively, $116 million, $15 million, and $230 million as of July 30, 2011.

As of July 28, 2012, the Company had financing receivables of $109 million, net of unbilled or current

receivables from the same contract, that were in the category for 91 days plus past due but remained on accrual

status. Such balance was $50 million as of July 30, 2011. A financing receivable may be placed on nonaccrual

status earlier if, in management’s opinion, a timely collection of the full principal and interest becomes uncertain.

101