Cisco 2012 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2012 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In August 2011, the FASB approved a revised accounting standard update intended to simplify how an entity

tests goodwill for impairment. The amendment will allow an entity to first assess qualitative factors to determine

whether it is necessary to perform the two-step quantitative goodwill impairment test. An entity no longer will be

required to calculate the fair value of a reporting unit unless the entity determines, based on a qualitative

assessment, that it is more likely than not that its fair value is less than its carrying amount. This accounting

standard update will be effective for the Company beginning in the first quarter of fiscal 2013, and the adoption

is not expected to have any impact on the Company’s Consolidated Financial Statements.

In December 2011, the FASB issued an accounting standard update requiring enhanced disclosures about certain

financial instruments and derivative instruments that are offset in the statement of financial position or that are

subject to enforceable master netting arrangements or similar agreements. This accounting standard update will

be effective for the Company beginning in the first quarter of fiscal 2014, at which time the Company will

include the required disclosures.

In July 2012, the FASB issued an accounting standard update intended to simplify how an entity tests indefinite-

lived intangible assets other than goodwill for impairment by providing entities with an option to perform a

qualitative assessment to determine whether further impairment testing is necessary. This accounting standard

update will be effective for the Company beginning in the first quarter of fiscal 2014, and early adoption is

permitted. The Company is currently evaluating the impact of this accounting standard update in its Consolidated

Financial Statements.

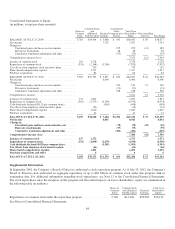

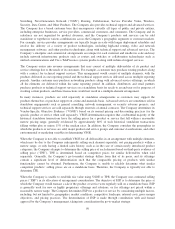

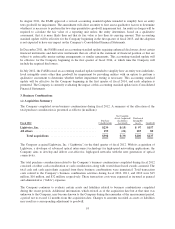

3. Business Combinations

(a) Acquisition Summary

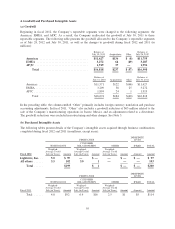

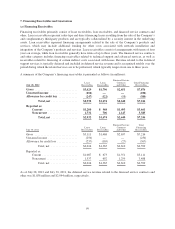

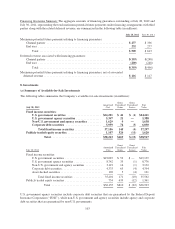

The Company completed seven business combinations during fiscal 2012. A summary of the allocation of the

total purchase consideration is presented as follows (in millions):

Fiscal 2012

Purchase

Consideration

Net Tangible

Assets Acquired/

(Liabilities

Assumed)

Purchased

Intangible

Assets Goodwill

Lightwire, Inc. ...................................... $239 $(15) $ 97 $157

All others .......................................... 159 (24) 103 80

Total acquisitions ............................... $398 $(39) $200 $237

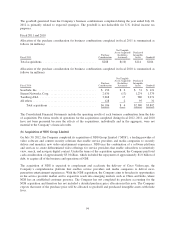

The Company acquired Lightwire, Inc. (“Lightwire”) in the third quarter of fiscal 2012. With its acquisition of

Lightwire, a developer of advanced optical interconnect technology for high-speed networking applications, the

Company aims to develop and deliver cost-effective, high-speed networks with the next generation of optical

connectivity.

The total purchase consideration related to the Company’s business combinations completed during fiscal 2012

consisted of either cash consideration or cash consideration along with vested share-based awards assumed. The

total cash and cash equivalents acquired from these business combinations were immaterial. Total transaction

costs related to the Company’s business combination activities during fiscal 2012, 2011, and 2010 were $15

million, $10 million, and $32 million, respectively. These transaction costs were expensed as incurred as general

and administrative (“G&A”) expenses.

The Company continues to evaluate certain assets and liabilities related to business combinations completed

during the recent periods. Additional information, which existed as of the acquisition date but at that time was

unknown to the Company, may become known to the Company during the remainder of the measurement period,

a period not to exceed 12 months from the acquisition date. Changes to amounts recorded as assets or liabilities

may result in a corresponding adjustment to goodwill.

93