Cisco 2012 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2012 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

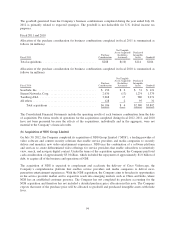

The goodwill generated from the Company’s business combinations completed during the year ended July 28,

2012 is primarily related to expected synergies. The goodwill is not deductible for U.S. federal income tax

purposes.

Fiscal 2011 and 2010

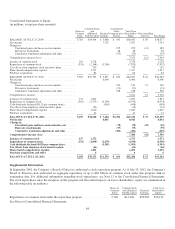

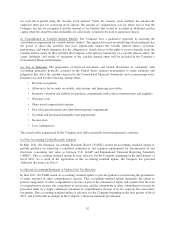

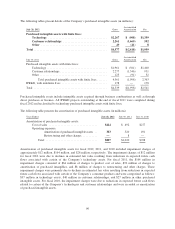

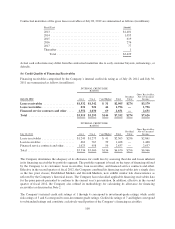

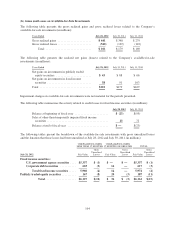

Allocation of the purchase consideration for business combinations completed in fiscal 2011 is summarized as

follows (in millions):

Fiscal 2011

Purchase

Consideration

Net Tangible

Assets Acquired/

(Liabilities

Assumed)

Purchased

Intangible

Assets Goodwill

Total acquisitions .................................... $288 $(10) $114 $184

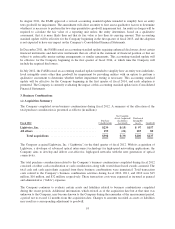

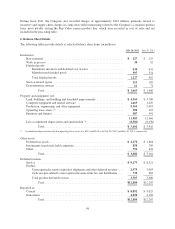

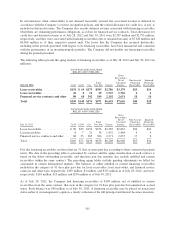

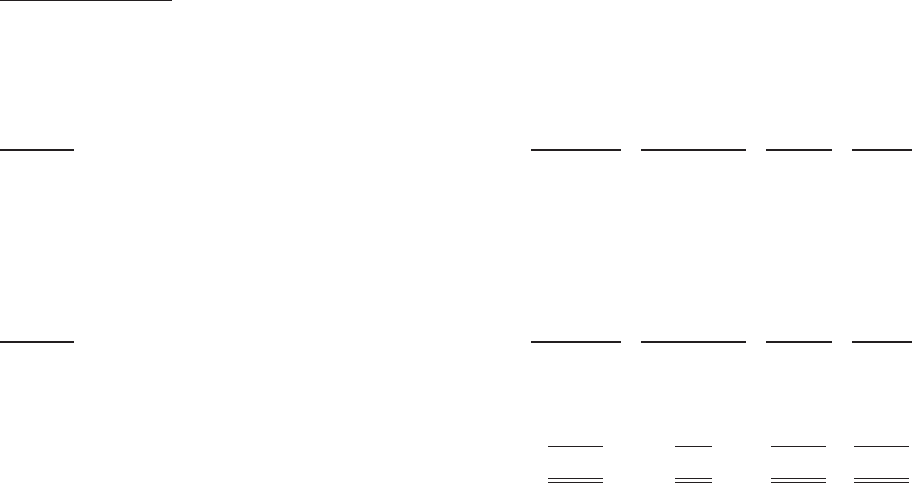

Allocation of the purchase consideration for business combinations completed in fiscal 2010 is summarized as

follows (in millions):

Fiscal 2010

Purchase

Consideration

Net Tangible

Assets Acquired/

(Liabilities

Assumed)

Purchased

Intangible

Assets Goodwill

ScanSafe, Inc. ....................................... $ 154 $ 2 $ 31 $ 121

Starent Networks, Corp. ............................... 2,636 (17) 1,274 1,379

Tandberg ASA ...................................... 3,268 17 980 2,271

All others ........................................... 128 2 95 31

Total acquisitions ................................ $6,186 $ 4 $2,380 $3,802

The Consolidated Financial Statements include the operating results of each business combination from the date

of acquisition. Pro forma results of operations for the acquisitions completed during fiscal 2012, 2011, and 2010

have not been presented because the effects of the acquisitions, individually and in the aggregate, were not

material to the Company’s financial results.

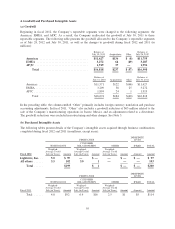

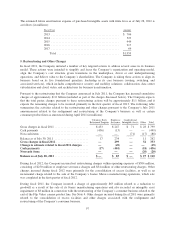

(b) Acquisition of NDS Group Limited

On July 30, 2012, the Company completed its acquisition of NDS Group Limited (“NDS”), a leading provider of

video software and content security solutions that enable service providers and media companies to securely

deliver and monetize new video entertainment experiences. NDS uses the combination of a software platform

and services to create differentiated video offerings for service providers that enable subscribers to intuitively

view, search, and navigate digital content. Under the terms of the acquisition agreement, the Company paid total

cash consideration of approximately $5.0 billion, which included the repayment of approximately $1.0 billion of

debt, to acquire all of the business and operations of NDS.

The acquisition of NDS is expected to complement and accelerate the delivery of Cisco Videoscape, the

Company’s comprehensive platform that enables service providers and media companies to deliver next-

generation entertainment experiences. With the NDS acquisition, the Company aims to broaden its opportunities

in the service provider market and to expand its reach into emerging markets such as China and India, where

NDS has an established customer presence. The Company has not completed its purchase accounting for the

NDS acquisition and therefore has not included a detailed purchase price allocation in this note. The Company

expects that most of the purchase price will be allocated to goodwill and purchased intangible assets with finite

lives.

94