Cisco 2012 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2012 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

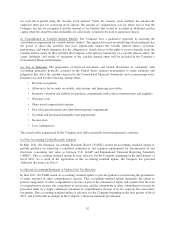

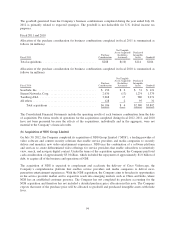

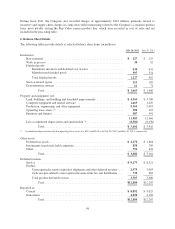

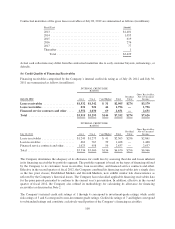

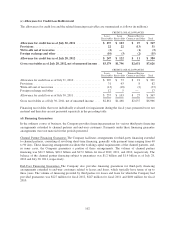

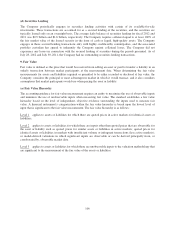

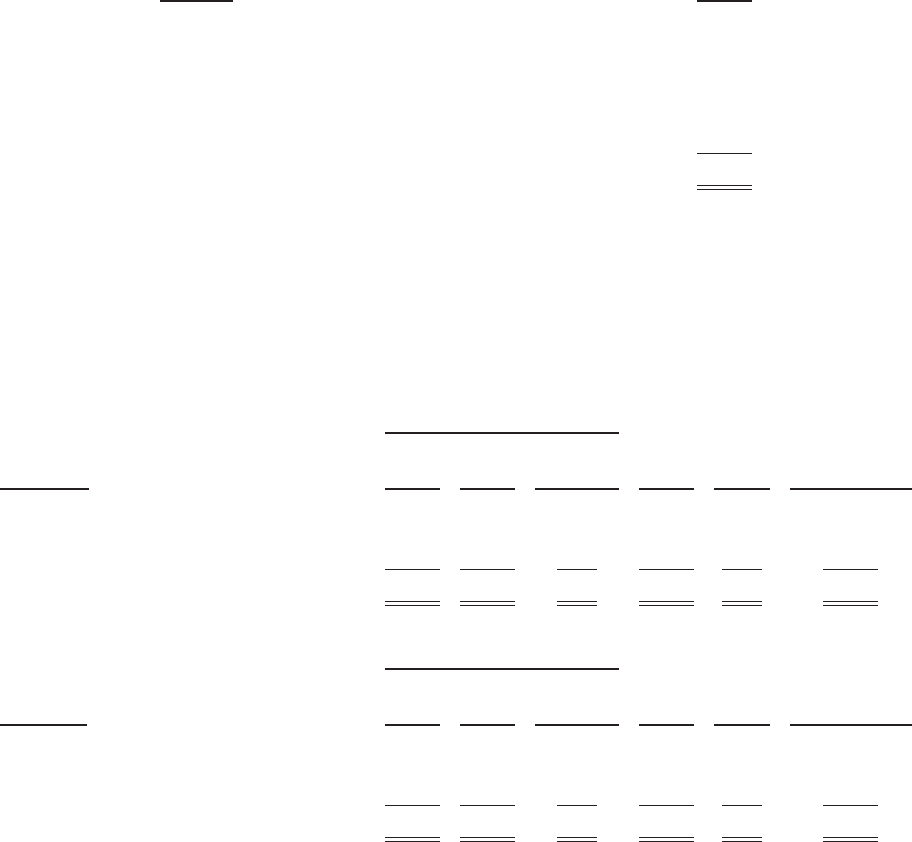

Contractual maturities of the gross lease receivables at July 28, 2012 are summarized as follows (in millions):

Fiscal Year Amount

2013 .............................................. $1,401

2014 .............................................. 1,055

2015 .............................................. 619

2016 .............................................. 276

2017 .............................................. 77

Thereafter .......................................... 1

Total .......................................... $3,429

Actual cash collections may differ from the contractual maturities due to early customer buyouts, refinancings, or

defaults.

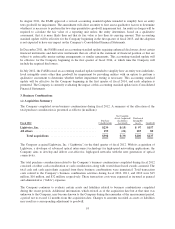

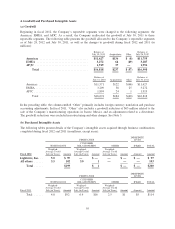

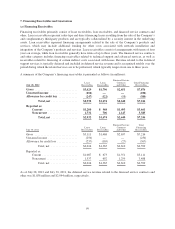

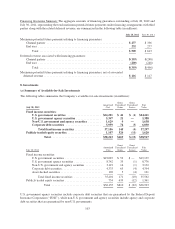

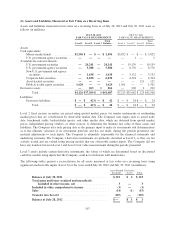

(b) Credit Quality of Financing Receivables

Financing receivables categorized by the Company’s internal credit risk rating as of July 28, 2012 and July 30,

2011 are summarized as follows (in millions):

INTERNAL CREDIT RISK

RATING

July 28, 2012 1to4 5to6 7 and Higher Total

Residual

Value

Gross Receivables,

Net of Unearned

Income

Lease receivables ..................... $1,532 $1,342 $ 31 $2,905 $274 $3,179

Loan receivables ...................... 831 921 44 1,796 — 1,796

Financed service contracts and other ..... 1,552 1,030 69 2,651 — 2,651

Total ............................... $3,915 $3,293 $144 $7,352 $274 $7,626

INTERNAL CREDIT RISK

RATING

July 30, 2011 1to4 5to6 7 and Higher Total

Residual

Value

Gross Receivables,

Net of Unearned

Income

Lease receivables ...................... $1,249 $1,275 $ 41 $2,565 $296 $2,861

Loan receivables ...................... 662 767 39 1,468 — 1,468

Financed service contracts and other ....... 1,623 958 56 2,637 — 2,637

Total ................................ $3,534 $3,000 $136 $6,670 $296 $6,966

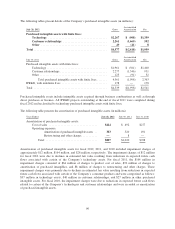

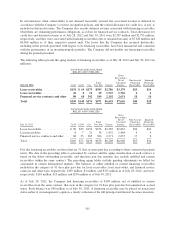

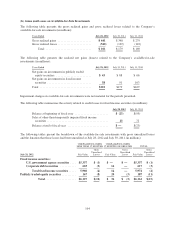

The Company determines the adequacy of its allowance for credit loss by assessing the risks and losses inherent

in its financing receivables by portfolio segment. The portfolio segment is based on the types of financing offered

by the Company to its customers: lease receivables, loan receivables, and financed service contracts and other.

Effective in the second quarter of fiscal 2012, the Company combined its financing receivables into a single class

as the two prior classes, Established Markets and Growth Markets, now exhibit similar risk characteristics as

reflected by the Company’s historical losses. The Company has reclassified applicable financing receivables data

for the prior periods presented to conform to the current year’s presentation. In addition, effective in the second

quarter of fiscal 2012, the Company also refined its methodology for calculating its allowance for financing

receivables as discussed in Note 2.

The Company’s internal credit risk ratings of 1 through 4 correspond to investment-grade ratings, while credit

risk ratings of 5 and 6 correspond to non-investment grade ratings. Credit risk ratings of 7 and higher correspond

to substandard ratings and constitute a relatively small portion of the Company’s financing receivables.

100