Cisco 2012 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2012 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

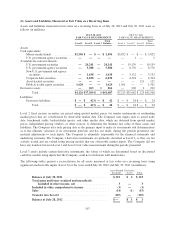

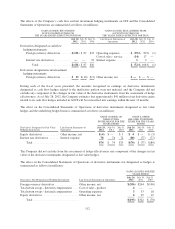

As of July 28, 2012 and July 30, 2011, the estimated fair value of the short-term debt approximates its carrying

value due to the short maturities.

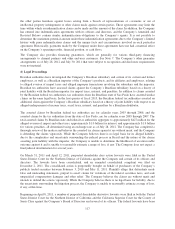

(b) Long-Term Debt

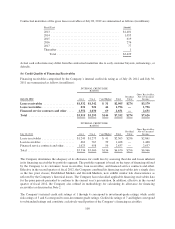

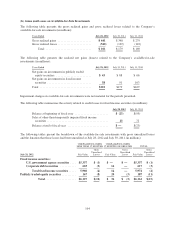

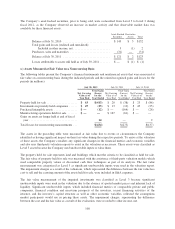

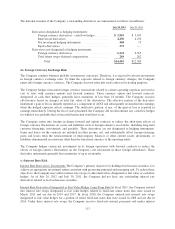

The following table summarizes the Company’s long-term debt (in millions, except percentages):

July 28, 2012 July 30, 2011

Amount Effective Rate Amount Effective Rate

Senior Notes:

Floating-rate notes, due 2014 ........... $ 1,250 0.81% $ 1,250 0.60%

1.625% fixed-rate notes, due 2014 ....... 2,000 0.84% 2,000 0.58%

2.90% fixed-rate notes, due 2014 ........ 500 3.11% 500 3.11%

5.50% fixed-rate notes, due 2016 ........ 3,000 3.16% 3,000 3.06%

3.15% fixed-rate notes, due 2017 ........ 750 1.03% 750 0.81%

4.95% fixed-rate notes, due 2019 ........ 2,000 5.08% 2,000 5.08%

4.45% fixed-rate notes, due 2020 ........ 2,500 4.50% 2,500 4.50%

5.90% fixed-rate notes, due 2039 ........ 2,000 6.11% 2,000 6.11%

5.50% fixed-rate notes, due 2040 ........ 2,000 5.67% 2,000 5.67%

Total ........................... 16,000 16,000

Other long-term debt ...................... 10 0.19% —

Unaccreted discount ...................... (70) (73)

Hedge accounting fair value adjustments ...... 357 307

Total long-term debt .............. $16,297 $16,234

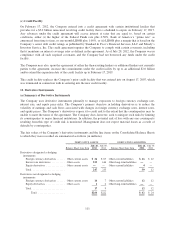

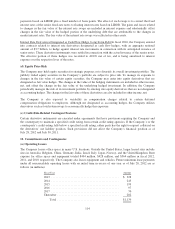

To achieve its interest rate risk management objectives, the Company entered into interest rate swaps with an

aggregate notional amount of $4.25 billion designated as fair value hedges of certain fixed-rate senior notes. In

effect, these swaps convert the fixed interest rates of the fixed-rate notes to floating interest rates based on the

London InterBank Offered Rate (“LIBOR”). The gains and losses related to changes in the fair value of the

interest rate swaps substantially offset changes in the fair value of the hedged portion of the underlying debt that

are attributable to the changes in market interest rates. See Note 11.

The effective rates for the fixed-rate debt include the interest on the notes, the accretion of the discount, and, if

applicable, adjustments related to hedging. Interest is payable semiannually on each class of the senior fixed-rate

notes and payable quarterly on the floating-rate notes. Each of the senior fixed-rate notes is redeemable by the

Company at any time, subject to a make-whole premium.

The senior notes rank at par with the issued commercial paper notes, as well as any other commercial paper notes

that may be issued in the future pursuant to the short-term debt financing program, as discussed earlier under

“Short-Term Debt.” As of July 28, 2012, the Company was in compliance with all debt covenants.

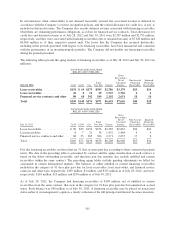

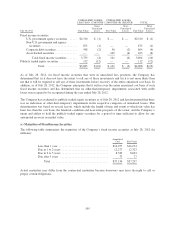

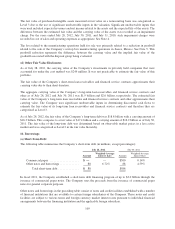

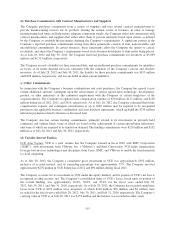

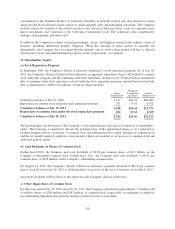

Future principal payments for long-term debt as of July 28, 2012 are summarized as follows (in millions):

Fiscal Year Amount

2013 ............................................. $ —

2014 ............................................. 3,260

2015 ............................................. 500

2016 ............................................. 3,000

2017 ............................................. 750

Thereafter ......................................... 8,500

Total ......................................... $16,010

110