Cisco 2012 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2012 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

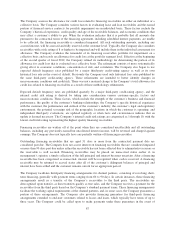

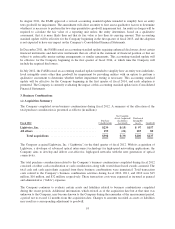

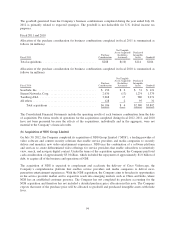

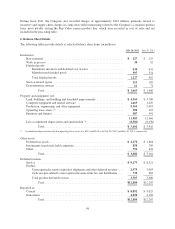

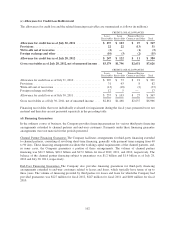

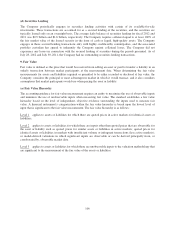

The following tables present details of the Company’s purchased intangible assets (in millions):

July 28, 2012 Gross

Accumulated

Amortization Net

Purchased intangible assets with finite lives:

Technology ........................................ $2,267 $ (908) $1,359

Customer relationships .............................. 2,261 (1,669) 592

Other ............................................. 49 (41) 8

Total .................................................. $4,577 $(2,618) $1,959

July 30, 2011 Gross

Accumulated

Amortization Net

Purchased intangible assets with finite lives:

Technology ......................................... $1,961 $ (561) $1,400

Customer relationships ................................ 2,277 (1,346) 931

Other .............................................. 123 (91) 32

Total purchased intangible assets with finite lives ....... 4,361 (1,998) 2,363

IPR&D, with indefinite lives ............................... 178 — 178

Total .................................................. $4,539 $(1,998) $2,541

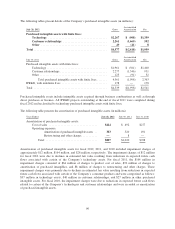

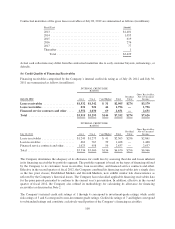

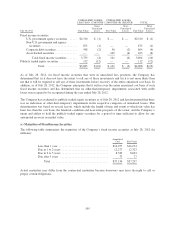

Purchased intangible assets include intangible assets acquired through business combinations as well as through

direct purchases or licenses. All IPR&D projects outstanding at the end of fiscal 2011 were completed during

fiscal 2012 and reclassified to technology purchased intangible assets with finite lives.

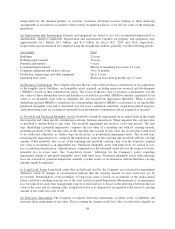

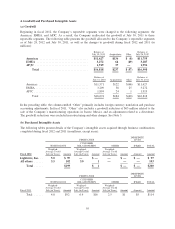

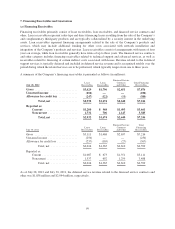

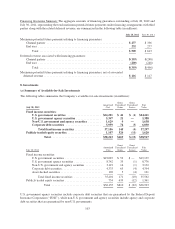

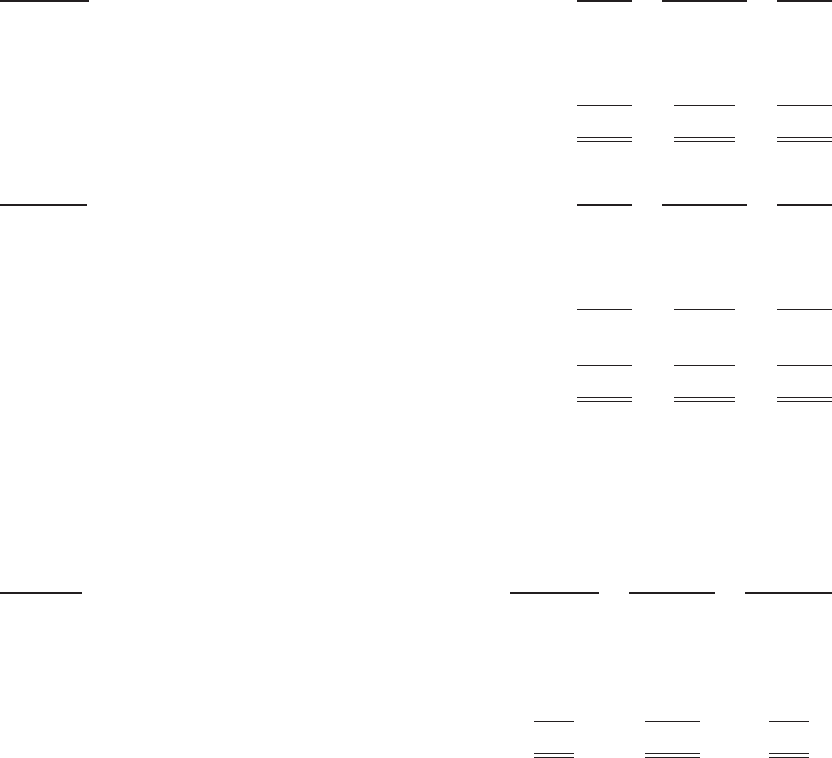

The following table presents the amortization of purchased intangible assets (in millions):

Years Ended July 28, 2012 July 30, 2011 July 31, 2010

Amortization of purchased intangible assets:

Cost of sales ................................. $424 $ 492 $277

Operating expenses:

Amortization of purchased intangible assets . .

383 520 491

Restructuring and other charges .......... —8—

Total ................................... $807 $1,020 $768

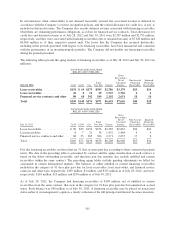

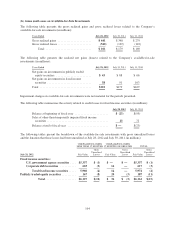

Amortization of purchased intangible assets for fiscal 2012, 2011, and 2010 included impairment charges of

approximately $12 million, $164 million, and $28 million, respectively. The impairment charges of $12 million

for fiscal 2012 were due to declines in estimated fair value resulting from reductions in expected future cash

flows associated with certain of the Company’s technology assets. For fiscal 2011, the $164 million in

impairment charges consisted of $64 million of charges to product cost of sales, $92 million of charges to

amortization of purchased intangibles, and $8 million of charges to restructuring and other charges. These

impairment charges were primarily due to declines in estimated fair value resulting from reductions in expected

future cash flows associated with certain of the Company’s consumer products and were categorized as follows:

$97 million in technology assets, $40 million in customer relationships, and $27 million in other purchased

intangible assets. For fiscal 2010, the impairment charges were due to reductions in expected future cash flows

related to certain of the Company’s technologies and customer relationships and were recorded as amortization

of purchased intangible assets.

96