Cisco 2012 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2012 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

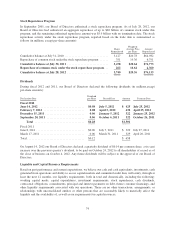

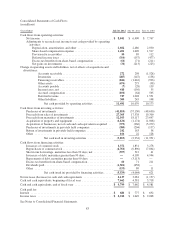

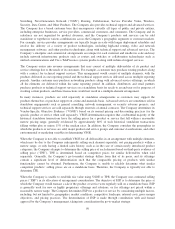

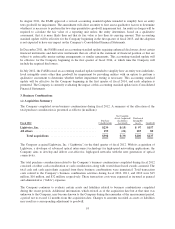

Consolidated Statements of Cash Flows

(in millions)

Years Ended July 28, 2012 July 30, 2011 July 31, 2010

Cash flows from operating activities:

Net income ................................................. $ 8,041 $ 6,490 $ 7,767

Adjustments to reconcile net income to net cash provided by operating

activities:

Depreciation, amortization, and other ........................ 2,602 2,486 2,030

Share-based compensation expense .......................... 1,401 1,620 1,517

Provision for receivables .................................. 50 89 112

Deferred income taxes .................................... (314) (157) (477)

Excess tax benefits from share-based compensation ............. (60) (71) (211)

Net gains on investments .................................. (31) (213) (223)

Change in operating assets and liabilities, net of effects of acquisitions and

divestitures:

Accounts receivable .................................. 272 298 (1,528)

Inventories ......................................... (287) (147) (158)

Financing receivables ................................. (846) (1,616) (996)

Other assets ........................................ (674) 275 (98)

Accounts payable .................................... (7) (28) 139

Income taxes, net .................................... 418 (156) 55

Accrued compensation ................................ (101) (64) 565

Deferred revenue .................................... 727 1,028 1,531

Other liabilities ...................................... 300 245 148

Net cash provided by operating activities ............. 11,491 10,079 10,173

Cash flows from investing activities:

Purchases of investments ...................................... (41,810) (37,130) (48,690)

Proceeds from sales of investments .............................. 27,365 17,538 19,300

Proceeds from maturities of investments .......................... 12,103 18,117 23,697

Acquisition of property and equipment ........................... (1,126) (1,174) (1,008)

Acquisition of businesses, net of cash and cash equivalents acquired . . . (375) (266) (5,279)

Purchases of investments in privately held companies ............... (380) (204) (137)

Return of investments in privately held companies .................. 242 163 58

Other ..................................................... 166 22 128

Net cash used in investing activities ................. (3,815) (2,934) (11,931)

Cash flows from financing activities:

Issuances of common stock .................................... 1,372 1,831 3,278

Repurchases of common stock .................................. (4,760) (6,896) (7,864)

Short-term borrowings, maturities less than 90 days, net ............. (557) 512 41

Issuances of debt, maturities greater than 90 days ................... —4,109 4,944

Repayments of debt, maturities greater than 90 days ................ —(3,113) —

Excess tax benefits from share-based compensation ................. 60 71 211

Dividends paid .............................................. (1,501) (658) —

Other ..................................................... (153) 80 11

Net cash (used in) provided by financing activities ...... (5,539) (4,064) 621

Net increase (decrease) in cash and cash equivalents .................... 2,137 3,081 (1,137)

Cash and cash equivalents, beginning of fiscal year ..................... 7,662 4,581 5,718

Cash and cash equivalents, end of fiscal year .......................... $ 9,799 $ 7,662 $ 4,581

Cash paid for:

Interest ........................................................ $ 681 $ 777 $ 692

Income taxes ................................................... $ 2,014 $ 1,649 $ 2,068

See Notes to Consolidated Financial Statements.

83