Cisco 2012 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2012 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(d) Preferred Stock

Under the terms of the Company’s Articles of Incorporation, the Board of Directors may determine the rights,

preferences, and terms of the Company’s authorized but unissued shares of preferred stock.

(e) Comprehensive Income

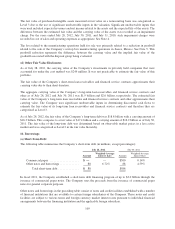

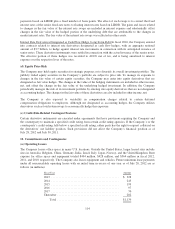

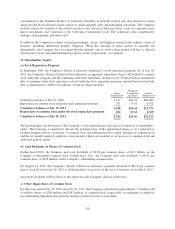

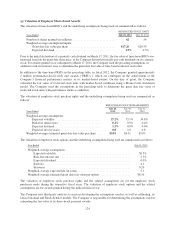

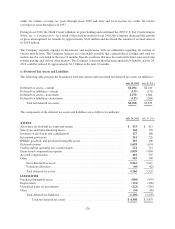

The components of comprehensive income, net of tax, are as follows (in millions):

Years Ended July 28, 2012 July 30, 2011 July 31, 2010

Net income ................................................. $8,041 $6,490 $7,767

Net change in unrealized gains/losses on available-for-sale investments:

Change in net unrealized (losses) gains, net of tax benefit (expense)

of $6, $(151), and $(199) for fiscal 2012, 2011, and 2010,

respectively .......................................... (31) 281 334

Net (gains) losses reclassified into earnings, net of tax effects of $36,

$68, and $17 for fiscal 2012, 2011, and 2010, respectively ...... (65) (112) (151)

(96) 169 183

Net change in unrealized gains/losses on derivative instruments:

Change in derivative instruments, net of tax benefit (expense) of

$0, $0 and $(9) for fiscal 2012, 2011, and 2010, respectively . . . (131) 87 46

Net losses (gains) reclassified into earnings ................... 72 (108) 2

(59) (21) 48

Net change in cumulative translation adjustment and other, net of tax

benefit (expense) of $36, $(34), and $(9) for fiscal 2012, 2011, and

2010, respectively ......................................... (496) 538 (55)

Comprehensive income ............................... 7,390 7,176 7,943

Comprehensive loss (income) attributable to noncontrolling interests . . . 18 (15) 12

Comprehensive income attributable to Cisco Systems, Inc. . . . $7,408 $7,161 $7,955

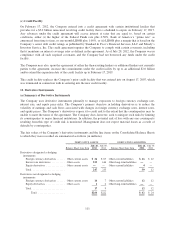

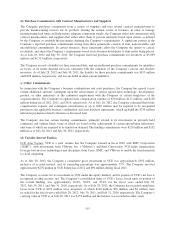

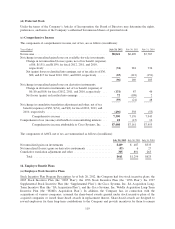

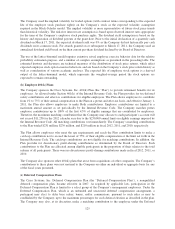

The components of AOCI, net of tax, are summarized as follows (in millions):

July 28, 2012 July 30, 2011 July 31, 2010

Net unrealized gains on investments ................................ $409 $ 487 $333

Net unrealized (losses) gains on derivative instruments ................. (53) 627

Cumulative translation adjustment and other .......................... 305 801 263

Total ..................................................... $661 $1,294 $623

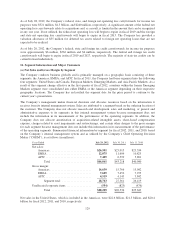

14. Employee Benefit Plans

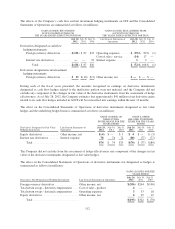

(a) Employee Stock Incentive Plans

Stock Incentive Plan Program Description As of July 28, 2012, the Company had five stock incentive plans: the

2005 Stock Incentive Plan (the “2005 Plan”); the 1996 Stock Incentive Plan (the “1996 Plan”); the 1997

Supplemental Stock Incentive Plan (the “Supplemental Plan”); the Cisco Systems, Inc. SA Acquisition Long-

Term Incentive Plan (the “SA Acquisition Plan”); and the Cisco Systems, Inc. WebEx Acquisition Long-Term

Incentive Plan (the “WebEx Acquisition Plan”). In addition, the Company has, in connection with the

acquisitions of various companies, assumed the share-based awards granted under stock incentive plans of the

acquired companies or issued share-based awards in replacement thereof. Share-based awards are designed to

reward employees for their long-term contributions to the Company and provide incentives for them to remain

119