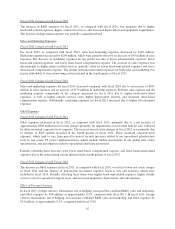

Cisco 2012 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2012 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

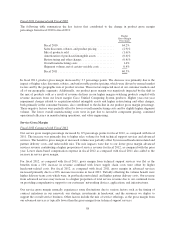

We believe that the slower growth we experienced in EMEA was a result of weak macroeconomic conditions

attributable in large part to the austerity measures taking place in parts of the region. In particular, we

experienced weakness in this segment during the second half of fiscal 2012, with a year-over-year decline in net

product sales in this segment during the fourth quarter.

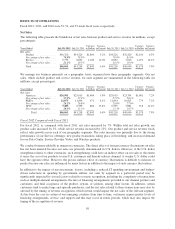

Fiscal 2011 Compared with Fiscal 2010

For fiscal 2011, as compared with fiscal 2010, net product sales in the EMEA segment increased by 6%. The

increase in net product sales in the European Markets segment was primarily due to growth in the enterprise and

service provider markets and to a lesser extent sales growth in the commercial market. For fiscal 2011, as

compared with fiscal 2010, sales to the public sector market were flat. From a country perspective, for fiscal

2011 as compared with fiscal 2010, net product sales increased by approximately 17% in France, 13% in the

Netherlands, 2% in Germany, 1% in the United Kingdom, and 63% in Russia and were flat in Italy.

APJC

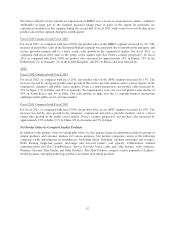

Fiscal 2012 Compared with Fiscal 2011

For fiscal 2012, as compared with fiscal 2011, net product sales in the APJC segment increased by 13%. The

increase was led by strong net product sales growth in the service provider market, and to a lesser degree, in the

commercial, enterprise and public sector markets. From a country perspective, net product sales increased by

27% in Japan, 17% in China, and 12% in Australia. We experienced a year-over-year net product sales decline of

19% in South Korea, and 4% in India. Our sales decline in India was due to ongoing business momentum

challenges in the public sector customer market.

Fiscal 2011 Compared with Fiscal 2010

For fiscal 2011, as compared with fiscal 2010, net product sales in our APJC segment increased by 10%. The

increase was led by sales growth in the enterprise, commercial and service provider markets, and to a lesser

extent sales growth in the public sector market. From a country perspective, net product sales increased by

approximately 13% in India, 11% in China, 8% in Australia, and 7% in Japan.

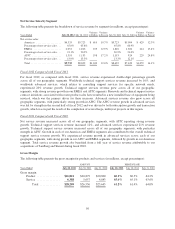

Net Product Sales by Groups of Similar Products

In addition to the primary view on a geographic basis, we also prepare financial information related to groups of

similar products and customer markets for various purposes. Our product categories consist of the following

categories (with subcategories in parentheses): Switching (fixed switching, modular switching, and storage);

NGN Routing (high-end routers, mid-range and low-end routers, and optical); Collaboration (unified

communications and Cisco TelePresence); Service Provider Video (cable and cable modem, video systems);

Wireless; Security; Data Center; and Other Products. The Other Products category consists primarily of Linksys-

related products, emerging technology products, and other networking products.

52