Cisco 2012 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2012 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

challenges in fiscal 2013. In particular, we expect to be impacted by continued weakness in the European

economy, lower global public sector spending especially with regard to the U.S. federal government and

European governments, and a continued conservative approach to IT-related capital spending as our customers

respond to this difficult macroeconomic environment.

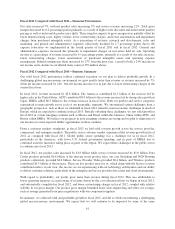

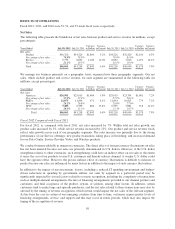

Fourth Quarter Snapshot

For the fourth quarter of fiscal 2012, as compared with the corresponding period in fiscal 2011, net sales

increased by 4%, with net product sales increasing by 3% and service revenue increasing by 12%. With regard to

our geographic segment performance, on a year-over-year basis, net sales increased by 7% in the Americas,

decreased by 5% in EMEA, and increased by 9% in APJC. Total gross margin decreased by 0.7 percentage

points, primarily as a result of higher sales discounts and unfavorable product pricing as well as unfavorable

product mix shifts, partially offset by lower manufacturing costs and higher volume. As a percentage of revenue,

research and development, sales and marketing, and general and administrative expenses collectively declined by

1.6 percentage points. For the fourth quarter of fiscal 2012, general and administrative expenses include $202

million of real estate charges, primarily related to impairment charges on real estate held for sale. Operating

income as a percentage of revenue increased by 7.3 percentage points, primarily as a result of lower restructuring

and other charges in the fourth quarter of fiscal 2012 and our sales increase. Diluted earnings per share increased

by 64% from the prior year period, primarily as a result of a 56% increase in net income and also, to a lesser

degree, from a decline of 142 million in our diluted share count.

Strategy and Focus Areas

We began in fiscal 2011, and had largely completed by the end of fiscal 2012, realigning our sales, services and

engineering organizations in order to simplify our operating model, drive faster innovation, and focus on our five

foundational priorities:

• Leadership in our core business (routing, switching, and associated services) which includes

comprehensive security and mobility solutions

• Collaboration

• Data center virtualization and cloud

• Video

• Architectures for business transformation

We believe that focusing on these priorities best positions us to continue to expand our share of our customers’

information technology spending. For a full discussion of our strategy and focus areas, see Item 1. Business.

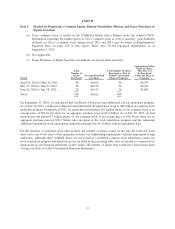

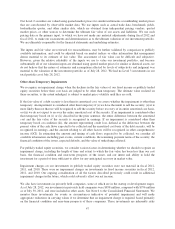

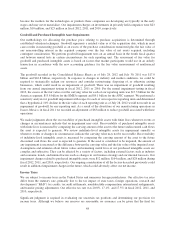

Other Key Financial Measures

The following is a summary of our other key financial measures for fiscal 2012 compared with fiscal 2011 (in

millions, except days sales outstanding in accounts receivable (“DSO”) and annualized inventory turns):

Fiscal

2012

Fiscal

2011

Cash and cash equivalents and investments ............................. $48,716 $44,585

Cash provided by operating activities .................................. $11,491 $10,079

Deferred revenue .................................................. $12,880 $12,207

Repurchases of common stock--stock repurchase program ................. $ 4,360 $ 6,791

Dividends ....................................................... $ 1,501 $ 658

DSO............................................................ 34 days 38 days

Inventories ....................................................... $ 1,663 $ 1,486

Annualized inventory turns .......................................... 11.7 11.8

Our product backlog at the end of fiscal 2012 was $5.0 billion, or 11% of fiscal 2012 net sales, compared with

$4.5 billion at the end of fiscal 2011, or 10% of fiscal 2011 net sales.

42