Cisco 2012 Annual Report Download - page 133

Download and view the complete annual report

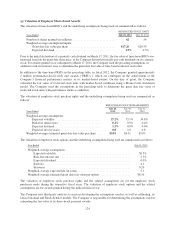

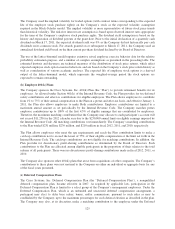

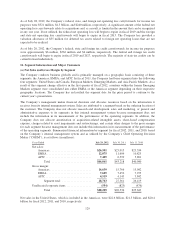

Please find page 133 of the 2012 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Company used the implied volatility for traded options (with contract terms corresponding to the expected

life of the employee stock purchase rights) on the Company’s stock as the expected volatility assumption

required in the Black-Scholes model. The implied volatility is more representative of future stock price trends

than historical volatility. The risk-free interest rate assumption is based upon observed interest rates appropriate

for the term of the Company’s employee stock purchase rights. The dividend yield assumption is based on the

history and expectation of dividend payouts at the grant date. Prior to the initial declaration of a quarterly cash

dividend on March 17, 2011, the expected dividend yield was 0% as the Company did not historically pay cash

dividends on its common stock. For awards granted on or subsequent to March 17, 2011, the Company used an

annualized dividend yield based on the then current per-share dividend declared by its Board of Directors.

The use of the lattice-binomial model requires extensive actual employee exercise behavior data for the relative

probability estimation purpose, and a number of complex assumptions as presented in the preceding table. The

estimated kurtosis and skewness are technical measures of the distribution of stock price returns, which affect

expected employee stock option exercise behaviors, and are based on the Company’s stock price return history as

well as consideration of various academic analyses. The expected life of employee stock options is a derived

output of the lattice-binomial model, which represents the weighted-average period the stock options are

expected to remain outstanding.

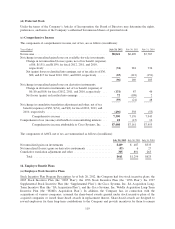

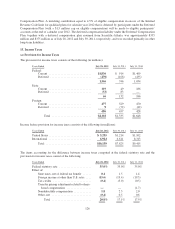

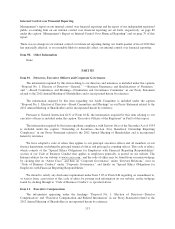

(h) Employee 401(k) Plans

The Company sponsors the Cisco Systems, Inc. 401(k) Plan (the “Plan”) to provide retirement benefits for its

employees. As allowed under Section 401(k) of the Internal Revenue Code, the Plan provides for tax-deferred

salary contributions and after-tax contributions for eligible employees. The Plan allows employees to contribute

from 1% to 75% of their annual compensation to the Plan on a pretax and after-tax basis, and effective January 1,

2011, the Plan also allows employees to make Roth contributions. Employee contributions are limited to a

maximum annual amount as set periodically by the Internal Revenue Code. The Company matches pretax

employee contributions up to 100% of the first 4.5% of eligible earnings that are contributed by employees.

Therefore, the maximum matching contribution that the Company may allocate to each participant’s account will

not exceed $11,250 for the 2012 calendar year due to the $250,000 annual limit on eligible earnings imposed by

the Internal Revenue Code. All matching contributions vest immediately. The Company’s matching contributions

to the Plan totaled $231 million, $239 million, and $210 million in fiscal 2012, 2011, and 2010, respectively.

The Plan allows employees who meet the age requirements and reach the Plan contribution limits to make a

catch-up contribution not to exceed the lesser of 75% of their eligible compensation or the limit set forth in the

Internal Revenue Code. The catch-up contributions are not eligible for matching contributions. In addition, the

Plan provides for discretionary profit-sharing contributions as determined by the Board of Directors. Such

contributions to the Plan are allocated among eligible participants in the proportion of their salaries to the total

salaries of all participants. There were no discretionary profit-sharing contributions made in fiscal 2012, 2011, or

2010.

The Company also sponsors other 401(k) plans that arose from acquisitions of other companies. The Company’s

contributions to these plans were not material to the Company on either an individual or aggregate basis for any

of the fiscal years presented.

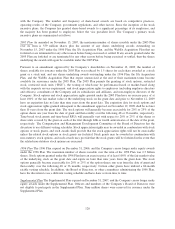

(i) Deferred Compensation Plans

The Cisco Systems, Inc. Deferred Compensation Plan (the “Deferred Compensation Plan”), a nonqualified

deferred compensation plan, became effective in 2007. As required by applicable law, participation in the

Deferred Compensation Plan is limited to a select group of the Company’s management employees. Under the

Deferred Compensation Plan, which is an unfunded and unsecured deferred compensation arrangement, a

participant may elect to defer base salary, bonus, and/or commissions, pursuant to such rules as may be

established by the Company, up to the maximum percentages for each deferral election as described in the plan.

The Company may also, at its discretion, make a matching contribution to the employee under the Deferred

125