Cisco 2012 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2012 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

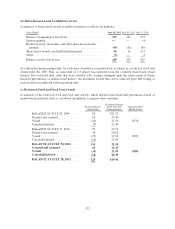

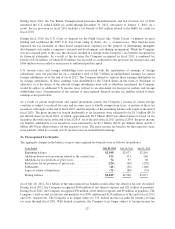

Supplementary Financial Data (Unaudited)

(in millions, except per-share amounts)

Quarters Ended July 28, 2012 April 28, 2012 January 28, 2012 October 29, 2011

Net sales ................................ $11,690 $11,588 $11,527 $11,256

Gross margin ............................ $ 7,085 $ 7,169 $ 7,065 $ 6,890

Operating income ........................ $ 2,371 $ 2,750 $ 2,734 $ 2,210

Net income .............................. $ 1,917 $ 2,165 $ 2,182 $ 1,777

Net income per share—basic ............... $ 0.36 $ 0.40 $ 0.41 $ 0.33

Net income per share—diluted .............. $ 0.36 $ 0.40 $ 0.40 $ 0.33

Cash dividends declared per common share ... $ 0.08 $ 0.08 $ 0.06 $ 0.06

Cash and cash equivalents and investments ... $48,716 $48,412 $46,742 $44,388

Quarters Ended July 30, 2011(1) April 30, 2011 January 29, 2011 October 30, 2010

Net sales ................................. $11,195 $10,866 $10,407 $10,750

Gross margin ............................. $ 6,861 $ 6,659 $ 6,261 $ 6,755

Operating income ......................... $ 1,456 $ 2,183 $ 1,684 $ 2,351

Net income ............................... $ 1,232 $ 1,807 $ 1,521 $ 1,930

Net income per share—basic ................. $ 0.22 $ 0.33 $ 0.27 $ 0.34

Net income per share—diluted ............... $ 0.22 $ 0.33 $ 0.27 $ 0.34

Cash dividends declared per common share(2) .... $ 0.06 $ 0.06 $ — $ —

Cash and cash equivalents and investments ..... $44,585 $43,367 $40,229 $38,925

(1) With regard to items which significantly impact the comparability of the above data, for the quarter ended July 30, 2011, operating

income included restructuring and other charges of $772 million and net income for the quarter ended July 30, 2011 included such

charges of $602 million, net of tax.

(2) The Company first declared a quarterly cash dividend on March 17, 2011.

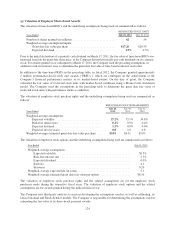

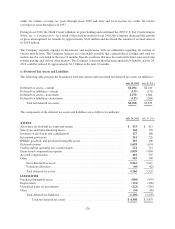

Stock Market Information

Cisco common stock is traded on the NASDAQ Global Select Market under the symbol CSCO. The following

table lists the high and low sales prices for each period indicated:

FISCAL 2012 FISCAL 2011

Fiscal High Low High Low

First quarter ................................................... $18.60 $13.30 $24.87 $19.82

Second quarter ................................................. $20.07 $17.22 $24.60 $19.00

Third quarter .................................................. $21.30 $19.27 $22.34 $16.52

Fourth quarter ................................................. $20.17 $14.96 $17.99 $14.78

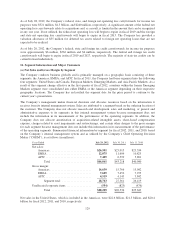

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosures

None.

Item 9A. Controls and Procedures

Evaluation of Disclosure Controls and Procedures

Based on our management’s evaluation (with the participation of our principal executive officer and principal

financial officer), as of the end of the period covered by this report, our principal executive officer and principal

financial officer have concluded that our disclosure controls and procedures (as defined in Rules 13a-15(e) and

15d-15(e) under the Securities Exchange Act of 1934, as amended, (the “Exchange Act”)) are effective to ensure

that information required to be disclosed by us in reports that we file or submit under the Exchange Act is

recorded, processed, summarized and reported within the time periods specified in Securities and Exchange

Commission rules and forms and is accumulated and communicated to our management, including our principal

executive officer and principal financial officer, as appropriate to allow timely decisions regarding required

disclosure.

132