Cisco 2012 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2012 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

nonpayment by the channel partners or end-user customers. Deferred revenue relating to these financing

arrangements is recorded in accordance with revenue recognition policies or for the fair value of the financing

guarantees.

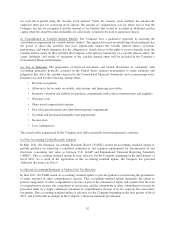

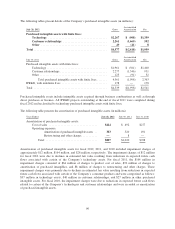

(g) Depreciation and Amortization Property and equipment are stated at cost, less accumulated depreciation or

amortization, whenever applicable. Depreciation and amortization expenses for property and equipment were

approximately $1.1 billion, $1.1 billion, and $1.0 billion for fiscal 2012, 2011 and 2010, respectively.

Depreciation and amortization are computed using the straight-line method, generally over the following periods:

Asset category Period

Buildings 25 years

Building improvements 10 years

Furniture and fixtures 5 years

Leasehold improvements Shorter of remaining lease term or 5 years

Computer equipment and related software 30 to 36 months

Production, engineering, and other equipment Up to 5 years

Operating lease assets Based on lease term generally up to 3 years

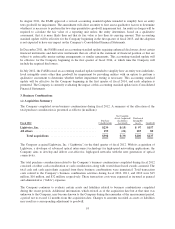

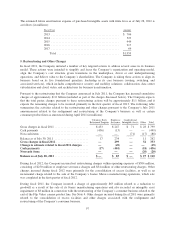

(h) Business Combinations The Company allocates the fair value of the purchase consideration of its acquisitions

to the tangible assets, liabilities, and intangible assets acquired, including in-process research and development

(“IPR&D”), based on their estimated fair values. The excess of the fair value of purchase consideration over the

fair values of these identifiable assets and liabilities is recorded as goodwill. IPR&D is initially capitalized at fair

value as an intangible asset with an indefinite life and assessed for impairment thereafter. When a project

underlying reported IPR&D is completed, the corresponding amount of IPR&D is reclassified as an amortizable

purchased intangible asset and is amortized over the asset’s estimated useful life. Acquisition-related expenses

and restructuring costs are recognized separately from the business combination and are expensed as incurred.

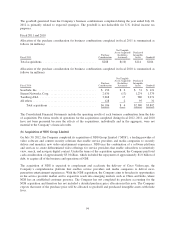

(i) Goodwill and Purchased Intangible Assets Goodwill is tested for impairment on an annual basis in the fourth

fiscal quarter and, when specific circumstances dictate, between annual tests. When impaired, the carrying value

of goodwill is written down to fair value. The goodwill impairment test involves a two-step process. The first

step, identifying a potential impairment, compares the fair value of a reporting unit with its carrying amount,

including goodwill. If the carrying value of the reporting unit exceeds its fair value, the second step would need

to be conducted; otherwise, no further steps are necessary as no potential impairment exists. The second step,

measuring the impairment loss, compares the implied fair value of the reporting unit goodwill with the carrying

amount of that goodwill. Any excess of the reporting unit goodwill carrying value over the respective implied

fair value is recognized as an impairment loss. Purchased intangible assets with finite lives are carried at cost,

less accumulated amortization. Amortization is computed over the estimated useful lives of the respective assets,

generally two to seven years. See “Long-Lived Assets,” following, for the Company’s policy regarding

impairment testing of purchased intangible assets with finite lives. Purchased intangible assets with indefinite

lives are assessed for potential impairment annually or when events or circumstances indicate that their carrying

amounts might be impaired.

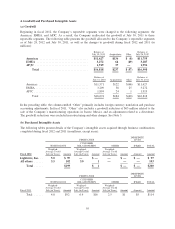

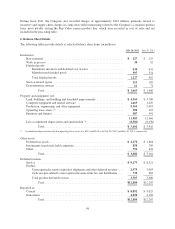

(j) Long-Lived Assets Long-lived assets that are held and used by the Company are reviewed for impairment

whenever events or changes in circumstances indicate that the carrying amount of such assets may not be

recoverable. Determination of recoverability of long-lived assets is based on an estimate of the undiscounted

future cash flows resulting from the use of the asset and its eventual disposition. Measurement of an impairment

loss for long-lived assets that management expects to hold and use is based on the difference between the fair

value of the asset and its carrying value. Long-lived assets to be disposed of are reported at the lower of carrying

amount or fair value less costs to sell.

(k) Derivative Instruments The Company recognizes derivative instruments as either assets or liabilities and

measures those instruments at fair value. The accounting for changes in the fair value of a derivative depends on

88