Cisco 2012 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2012 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

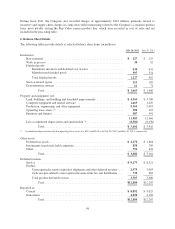

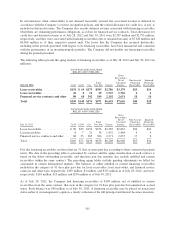

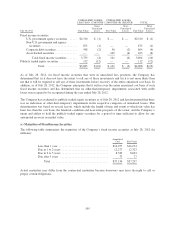

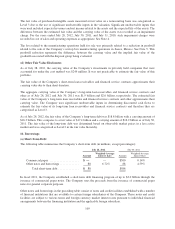

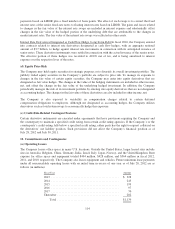

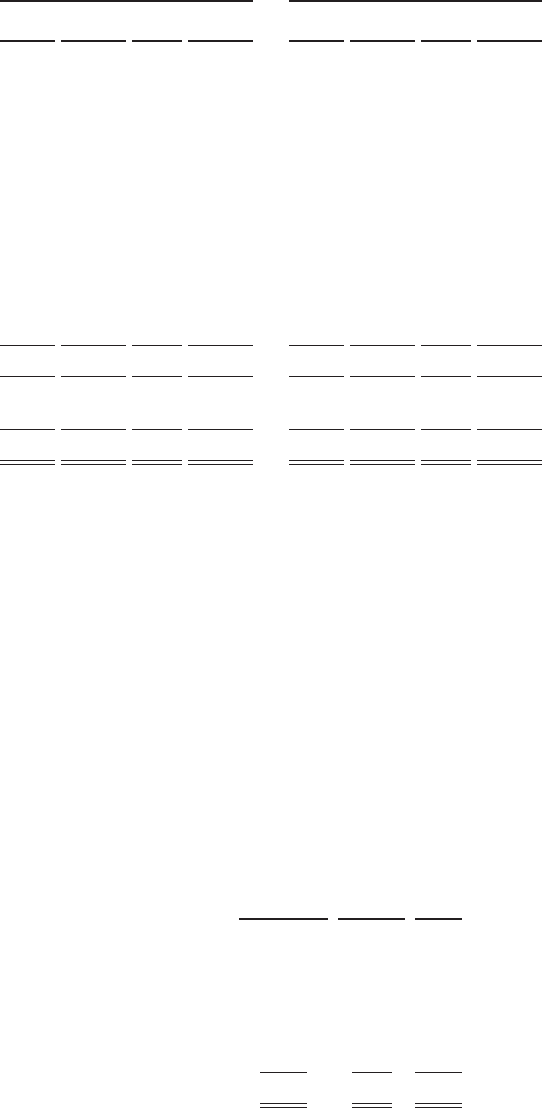

(b) Assets and Liabilities Measured at Fair Value on a Recurring Basis

Assets and liabilities measured at fair value on a recurring basis as of July 28, 2012 and July 30, 2011 were as

follows (in millions):

JULY 28, 2012

FAIR VALUE MEASUREMENTS

JULY 30, 2011

FAIR VALUE MEASUREMENTS

Level 1 Level 2 Level 3

Total

Balance Level 1 Level 2 Level 3

Total

Balance

Assets

Cash equivalents:

Money market funds ...............$2,506 $ — $ — $ 2,506 $5,852 $ — $ — $ 5,852

U.S. government agency securities .... ———— —1—1

Available-for-sale investments:

U.S. government securities .......... — 24,241 — 24,241 — 19,139 — 19,139

U.S. government agency securities .... — 5,388 — 5,388 — 8,776 — 8,776

Non-U.S. government and agency

securities ...................... — 1,638 — 1,638 — 3,132 — 3,132

Corporate debt securities ............ — 6,030 — 6,030 — 4,394 — 4,394

Asset-backed securities ............. ———— — — 121 121

Publicly traded equity securities ...... 1,620 — — 1,620 1,361 — — 1,361

Derivative assets ...................... — 263 1 264 — 220 2 222

Total ........................$4,126 $37,560 $ 1 $41,687 $7,213 $35,662 $ 123 $42,998

Liabilities:

Derivative liabilities ...............$—$ 42$—$ 42 $—$ 24$—$ 24

Total ........................$—$ 42$—$ 42 $—$ 24$—$ 24

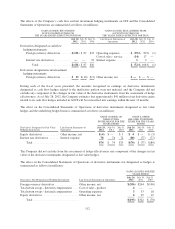

Level 2 fixed income securities are priced using quoted market prices for similar instruments or nonbinding

market prices that are corroborated by observable market data. The Company uses inputs such as actual trade

data, benchmark yields, broker/dealer quotes, and other similar data, which are obtained from quoted market

prices, independent pricing vendors, or other sources, to determine the ultimate fair value of these assets and

liabilities. The Company uses such pricing data as the primary input to make its assessments and determinations

as to the ultimate valuation of its investment portfolio and has not made, during the periods presented, any

material adjustments to such inputs. The Company is ultimately responsible for the financial statements and

underlying estimates. The Company’s derivative instruments are primarily classified as Level 2, as they are not

actively traded and are valued using pricing models that use observable market inputs. The Company did not

have any transfers between Level 1 and Level 2 fair value measurements during the periods presented.

Level 3 assets include certain derivative instruments, the values of which are determined based on discounted

cash flow models using inputs that the Company could not corroborate with market data.

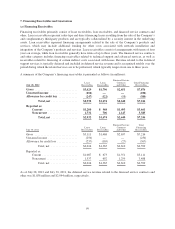

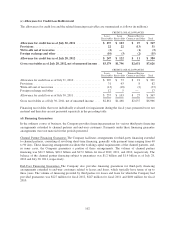

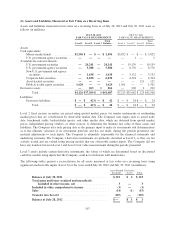

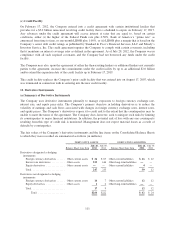

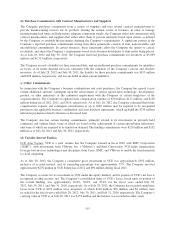

The following tables present a reconciliation for all assets measured at fair value on a recurring basis using

significant unobservable inputs (Level 3) for the years ended July 28, 2012 and July 30, 2011 (in millions):

Asset-Backed

Securities

Derivative

Assets Total

Balance at July 30, 2011 ............................... $ 121 $ 2 $ 123

Total gains and losses (realized and unrealized):

Included in other income, net ...................... 3— 3

Included in other comprehensive income ................. (3) — (3)

Sales ............................................... (14) (1) (15)

Transfer into Level 2 ................................. (107) — (107)

Balance at July 28, 2012 ............................... $— $ 1 $ 1

107