Cisco 2012 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2012 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

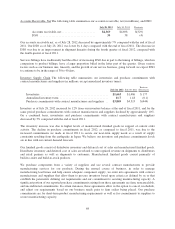

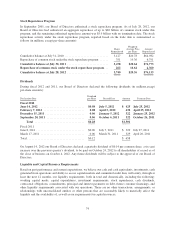

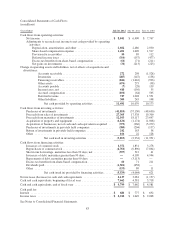

Stock Repurchase Program

In September 2001, our Board of Directors authorized a stock repurchase program. As of July 28, 2012, our

Board of Directors had authorized an aggregate repurchase of up to $82 billion of common stock under this

program, and the remaining authorized repurchase amount was $5.9 billion with no termination date. The stock

repurchase activity under the stock repurchase program, reported based on the trade date is summarized as

follows (in millions, except per-share amounts):

Shares

Repurchased

Weighted-

Average Price

per Share

Amount

Repurchased

Cumulative balance at July 31, 2010 .............................. 3,127 $20.78 $64,982

Repurchase of common stock under the stock repurchase program ...... 351 19.36 6,791

Cumulative balance at July 30, 2011 ............................ 3,478 $20.64 $71,773

Repurchase of common stock under the stock repurchase program .. 262 16.64 4,360

Cumulative balance at July 28, 2012 ............................ 3,740 $20.36 $76,133

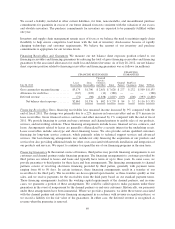

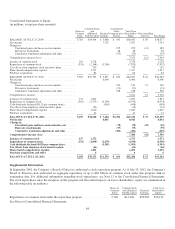

Dividends

During fiscal 2012 and 2011, our Board of Directors declared the following dividends (in millions,except

per-share amounts):

Declaration Date

Dividend

per Share Record Date Amount Payment Date

Fiscal 2012

June 14, 2012 ............................... $0.08 July 5, 2012 $ 425 July 25, 2012

February 7, 2012 ............................ 0.08 April 5, 2012 432 April 25, 2012

December 15, 2011 ........................... 0.06 January 5, 2012 322 January 25, 2012

September 20, 2011 .......................... 0.06 October 6, 2011 322 October 26, 2011

Total .................................. $0.28 $1,501

Fiscal 2011

June 8, 2011 ................................. $0.06 July 7, 2011 $ 329 July 27, 2011

March 17, 2011 .............................. 0.06 March 31, 2011 329 April 20, 2011

Total ....................................... $0.12 $ 658

On August 14, 2012 our Board of Directors declared a quarterly dividend of $0.14 per common share, a six-cent

increase over the previous quarter’s dividend, to be paid on October 24, 2012 to all shareholders of record as of

the close of business on October 4, 2012. Any future dividends will be subject to the approval of our Board of

Directors.

Liquidity and Capital Resource Requirements

Based on past performance and current expectations, we believe our cash and cash equivalents, investments, cash

generated from operations and ability to access capital markets and committed credit lines will satisfy, through at

least the next 12 months, our liquidity requirements, both in total and domestically, including the following:

working capital needs, capital expenditures, investment requirements, stock repurchases, cash dividends,

contractual obligations, commitments, principal and interest payments on debt, future customer financings, and

other liquidity requirements associated with our operations. There are no other transactions, arrangements, or

relationships with unconsolidated entities or other persons that are reasonably likely to materially affect the

liquidity and the availability of, as well as our requirements for capital resources.

74