Cisco 2012 Annual Report Download - page 56

Download and view the complete annual report

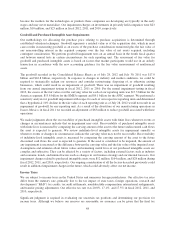

Please find page 56 of the 2012 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.because the markets for the technologies or products these companies are developing are typically in the early

stages and may never materialize. Our impairment charges on investments in privately held companies were $23

million, $10 million, and $25 million in fiscal 2012, 2011, and 2010, respectively.

Goodwill and Purchased Intangible Asset Impairments

Our methodology for allocating the purchase price relating to purchase acquisitions is determined through

established valuation techniques. Goodwill represents a residual value as of the acquisition date, which in most

cases results in measuring goodwill as an excess of the purchase consideration transferred plus the fair value of

any noncontrolling interest in the acquired company over the fair value of net assets acquired, including

contingent consideration. We perform goodwill impairment tests on an annual basis in the fourth fiscal quarter

and between annual tests in certain circumstances for each reporting unit. The assessment of fair value for

goodwill and purchased intangible assets is based on factors that market participants would use in an orderly

transaction in accordance with the new accounting guidance for the fair value measurement of nonfinancial

assets.

The goodwill recorded in the Consolidated Balance Sheets as of July 28, 2012 and July 30, 2011 was $17.0

billion and $16.8 billion, respectively. In response to changes in industry and market conditions, we could be

required to strategically realign our resources and consider restructuring, disposing of, or otherwise exiting

businesses, which could result in an impairment of goodwill. There was no impairment of goodwill resulting

from our annual impairment testing in fiscal 2012, 2011 or 2010. For the annual impairment testing in fiscal

2012, the excess of the fair value over the carrying value for each of our reporting units was $17.3 billion for the

Americas segment, $13.8 billion for the EMEA segment and $9.1 billion for the APJC segment. We performed a

sensitivity analysis for goodwill impairment with respect to each of our respective reporting units and determined

that a hypothetical 10% decline in the fair value of each reporting unit as of July 28, 2012 would not result in an

impairment of goodwill for any reporting unit. As a result of the divestiture of our manufacturing operations in

Juarez, Mexico, in fiscal 2011 we recorded an adjustment of $63 million to reduce goodwill associated with these

operations.

We make judgments about the recoverability of purchased intangible assets with finite lives whenever events or

changes in circumstances indicate that an impairment may exist. Recoverability of purchased intangible assets

with finite lives is measured by comparing the carrying amount of the asset to the future undiscounted cash flows

the asset is expected to generate. We review indefinite-lived intangible assets for impairment annually or

whenever events or changes in circumstances indicate the carrying value may not be recoverable. Recoverability

of indefinite-lived intangible assets is measured by comparing the carrying amount of the asset to the future

discounted cash flows the asset is expected to generate. If the asset is considered to be impaired, the amount of

any impairment is measured as the difference between the carrying value and the fair value of the impaired asset.

Assumptions and estimates about future values and remaining useful lives of our purchased intangible assets are

complex and subjective. They can be affected by a variety of factors, including external factors such as industry

and economic trends, and internal factors such as changes in our business strategy and our internal forecasts. Our

impairment charges related to purchased intangible assets were $12 million, $164 million, and $28 million during

fiscal 2012, 2011, and 2010, respectively. Our ongoing consideration of all the factors described previously could

result in additional impairment charges in the future, which could adversely affect our net income.

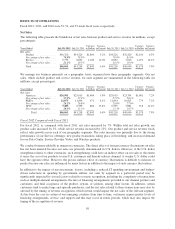

Income Taxes

We are subject to income taxes in the United States and numerous foreign jurisdictions. Our effective tax rates

differ from the statutory rate, primarily due to the tax impact of state taxes, foreign operations, research and

development (“R&D”) tax credits, tax audit settlements, nondeductible compensation, international realignments,

and transfer pricing adjustments. Our effective tax rate was 20.8%, 17.1%, and 17.5% in fiscal 2012, 2011, and

2010, respectively.

Significant judgment is required in evaluating our uncertain tax positions and determining our provision for

income taxes. Although we believe our reserves are reasonable, no assurance can be given that the final tax

48