Cisco 2012 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2012 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

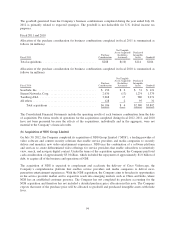

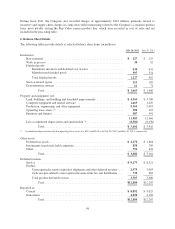

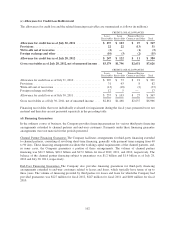

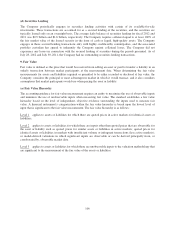

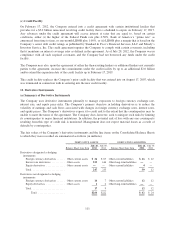

(b) Gains and Losses on Available-for-Sale Investments

The following table presents the gross realized gains and gross realized losses related to the Company’s

available-for-sale investments (in millions):

Years Ended July 28, 2012 July 30, 2011 July 31, 2010

Gross realized gains ....................... $ 641 $ 348 $ 279

Gross realized losses ....................... (540) (169) (110)

Total ............................... $ 101 $ 179 $ 169

The following table presents the realized net gains (losses) related to the Company’s available-for-sale

investments (in millions):

Years Ended July 28, 2012 July 30, 2011 July 31, 2010

Net gains on investments in publicly traded

equity securities ........................ $43 $88 $66

Net gains on investments in fixed income

securities .............................. 58 91 103

Total ................................... $101 $179 $169

Impairment charges on available-for-sale investments were not material for the periods presented.

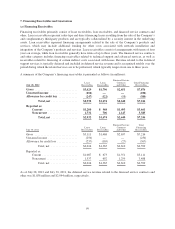

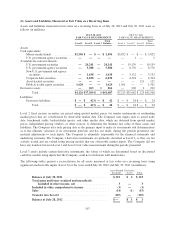

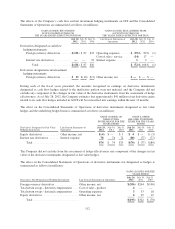

The following table summarizes the activity related to credit losses for fixed income securities (in millions):

July 28, 2012 July 30, 2011

Balance at beginning of fiscal year ....................... $ (23) $(95)

Sales of other-than-temporarily impaired fixed income

securities .......................................... 23 72

Balance at end of fiscal year ............................ $— $(23)

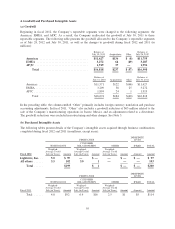

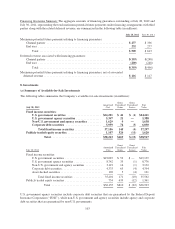

The following tables present the breakdown of the available-for-sale investments with gross unrealized losses

and the duration that those losses had been unrealized at July 28, 2012 and July 30, 2011 (in millions):

UNREALIZED LOSSES

LESS THAN 12 MONTHS

UNREALIZED LOSSES

12 MONTHS OR GREATER TOTAL

July 28, 2012 Fair Value

Gross

Unrealized

Losses Fair Value

Gross

Unrealized

Losses Fair Value

Gross

Unrealized

Losses

Fixed income securities:

U.S. government agency securities .... $5,357 $ (1) $ — $ — $5,357 $ (1)

Corporate debt securities ........... 603 (3) 14 — 617 (3)

Total fixed income securities ..... 5,960 (4) 14 — 5,974 (4)

Publicly traded equity securities .......... 167 (8) 20 (3) 187 (11)

Total ..................... $6,127 $(12) $ 34 $ (3) $6,161 $(15)

104